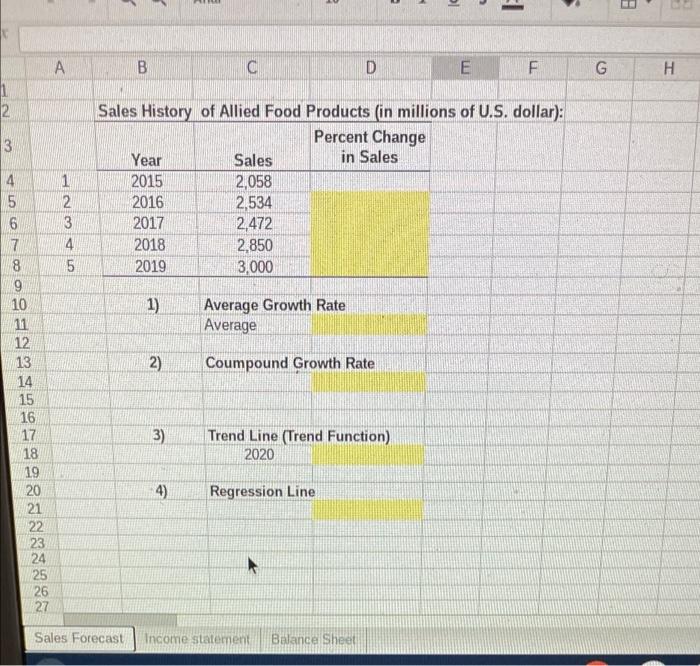

Question: Please help fill in shaded areas *Excel Formulas* u . .. B C D E F F G H 1 2 3 02 Sales History

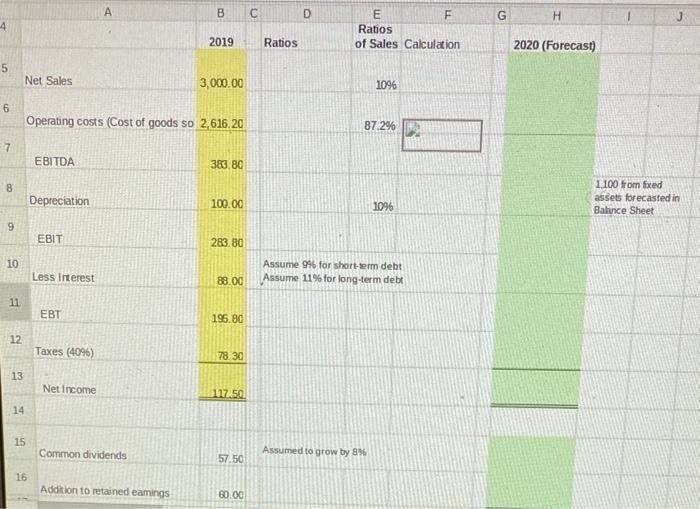

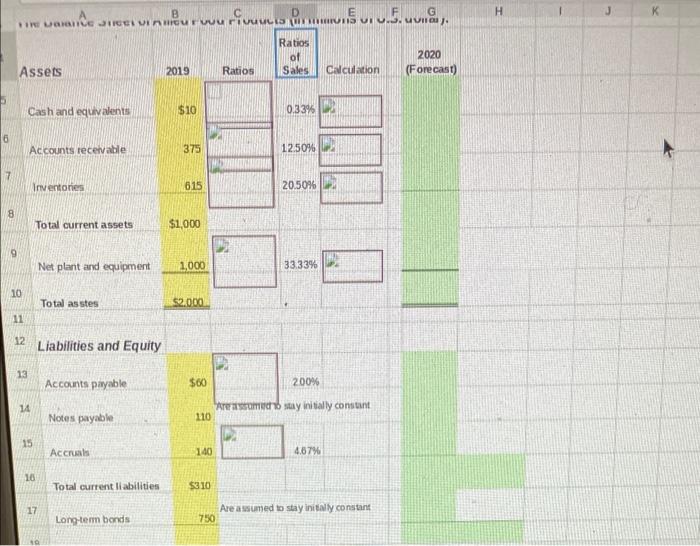

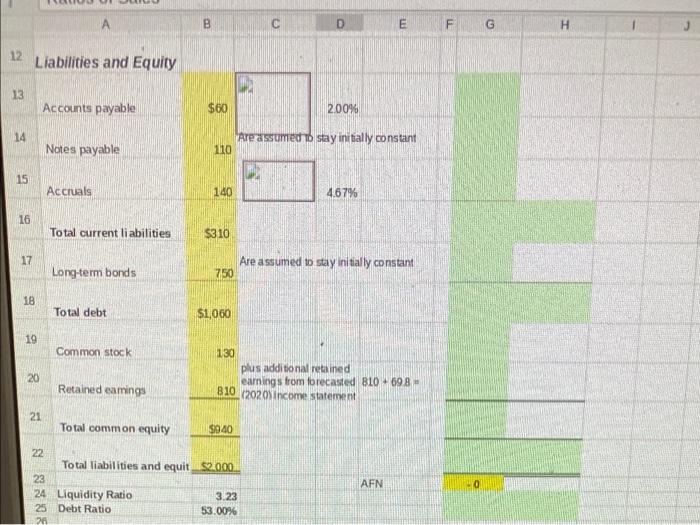

u . .. B C D E F F G H 1 2 3 02 Sales History of Allied Food Products (in millions of U.S. dollar): Percent Change Year Sales in Sales 2015 2,058 2016 2,534 2017 2,472 2018 2,850 2019 3,000 1 2 3 4 5 1) 4 5 6 7 8 9 10 11 12. 13 14 15 16 17 18 19 20 Average Growth Rate Average 2) Coumpound Growth Rate 3) Trend Line (Trend Function) 2020 4) Regression Line 22 23 25 27 Sales Forecast Income statement Balance Sheet B C D G H 4 E F Ratios of Sales Calculation 2019 Ratios 2020 (Forecast) 5 Net Sales 3,000.00 1096 6 Operating costs (Cost of goods so 2,616,20 87 2% 7 EBITDA 383 80 8 Depreciation 100.00 1.100 from fixed assets forecasted in Balance Sheet 1096 9 EBIT 283.80 10 Less interest Assume 996 for short-term debt Assume 11% for long-term debt 88.00 11 EBT 196.80 12 Taxes (409) 78.30 13 Net Income 127.50 14 15 Common dividends Assumed to grow by 8% 57.50 16 Addition to retained eamings 60.00 B G H .. we wienerwu rivula P...S. U.S. u. Ratios of Sales 2020 (Forecast) Assets 2019 Ratios Calculation Cash and equivalents $10 0.33% 16 Accounts receivable 375 12.50% Inventores 615 20.50% 8 Total current assets $1,000 9 Net plant and equipment 1,000 33.33% 10 Total asstes $2.000 11 12 Liabilities and Equity 13 Accounts payable $60 200% 14 Area scumstay initially constant Notes payable 110 15 Accruals 140 4.679 16 Total current liabilities $310 17 Are assumed to stay initially constant Long-term bonds 750 B C D E E F F G H 12 Liabilities and Equity 13 Accounts payable $60 200% 14 Are assumed b stay initially constant Notes payable 110 15 Accruals 140 4.67% 16 Total current liabilities $310 17 Are assumed to stay initially constant Long-term bonds 750 18 Total debt $1,000 19 Common stock 20 130 plus additional retained earnings from forecasted 810 698 810 (2020 income statement Retained eamings 21 Total common equity $940 22 Total liabilities and equit $2.000 23 24 Liquidity Ratio 3.23 25 Debt Ratio 53.00% AFN X ONS u . .. B C D E F F G H 1 2 3 02 Sales History of Allied Food Products (in millions of U.S. dollar): Percent Change Year Sales in Sales 2015 2,058 2016 2,534 2017 2,472 2018 2,850 2019 3,000 1 2 3 4 5 1) 4 5 6 7 8 9 10 11 12. 13 14 15 16 17 18 19 20 Average Growth Rate Average 2) Coumpound Growth Rate 3) Trend Line (Trend Function) 2020 4) Regression Line 22 23 25 27 Sales Forecast Income statement Balance Sheet B C D G H 4 E F Ratios of Sales Calculation 2019 Ratios 2020 (Forecast) 5 Net Sales 3,000.00 1096 6 Operating costs (Cost of goods so 2,616,20 87 2% 7 EBITDA 383 80 8 Depreciation 100.00 1.100 from fixed assets forecasted in Balance Sheet 1096 9 EBIT 283.80 10 Less interest Assume 996 for short-term debt Assume 11% for long-term debt 88.00 11 EBT 196.80 12 Taxes (409) 78.30 13 Net Income 127.50 14 15 Common dividends Assumed to grow by 8% 57.50 16 Addition to retained eamings 60.00 B G H .. we wienerwu rivula P...S. U.S. u. Ratios of Sales 2020 (Forecast) Assets 2019 Ratios Calculation Cash and equivalents $10 0.33% 16 Accounts receivable 375 12.50% Inventores 615 20.50% 8 Total current assets $1,000 9 Net plant and equipment 1,000 33.33% 10 Total asstes $2.000 11 12 Liabilities and Equity 13 Accounts payable $60 200% 14 Area scumstay initially constant Notes payable 110 15 Accruals 140 4.679 16 Total current liabilities $310 17 Are assumed to stay initially constant Long-term bonds 750 B C D E E F F G H 12 Liabilities and Equity 13 Accounts payable $60 200% 14 Are assumed b stay initially constant Notes payable 110 15 Accruals 140 4.67% 16 Total current liabilities $310 17 Are assumed to stay initially constant Long-term bonds 750 18 Total debt $1,000 19 Common stock 20 130 plus additional retained earnings from forecasted 810 698 810 (2020 income statement Retained eamings 21 Total common equity $940 22 Total liabilities and equit $2.000 23 24 Liquidity Ratio 3.23 25 Debt Ratio 53.00% AFN X ONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts