Question: Please help fill in the table! Required information Problem 9-42 Preparation of Master Budget (LO 9-3, 9-4, 9-5) [The following information applies to the questions

Please help fill in the table!

Please help fill in the table!

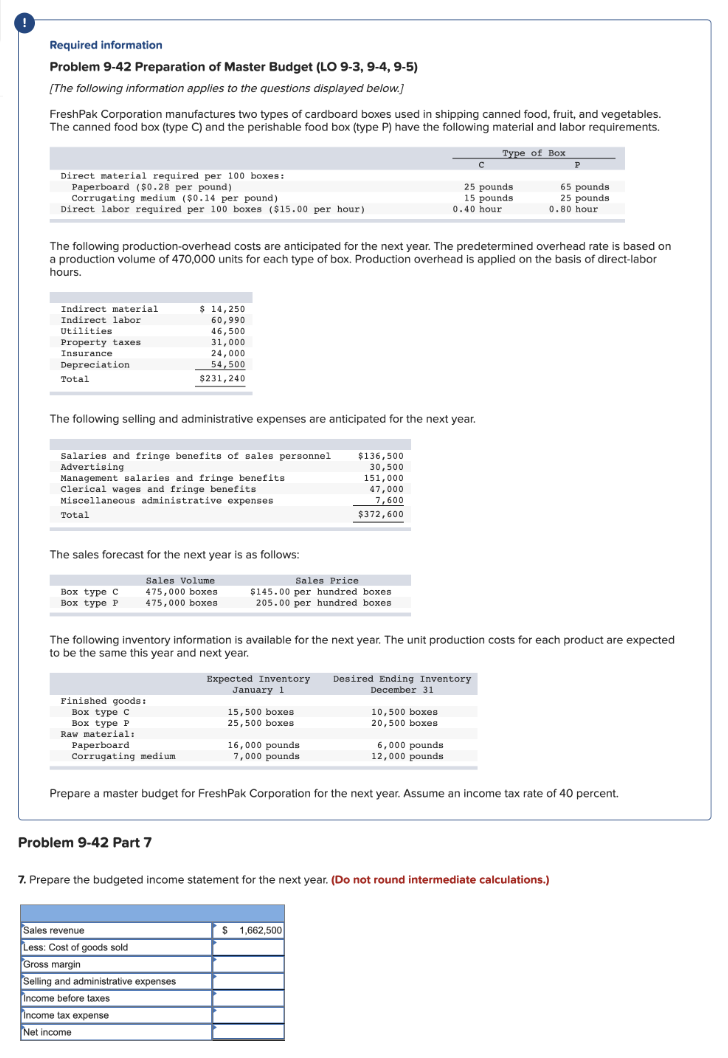

Required information Problem 9-42 Preparation of Master Budget (LO 9-3, 9-4, 9-5) [The following information applies to the questions displayed below.] FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables. The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements. The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on a production volume of 470,000 units for each type of box. Production overhead is applied on the basis of direct-labor hours. The following selling and administrative expenses are anticipated for the next year. The sales forecast for the next year is as follows: The following inventory information is available for the next year. The unit production costs for each product are expected to be the same this year and next year. Prepare a master budget for FreshPak Corporation for the next year. Assume an income tax rate of 40 percent. Problem 942 Part 7 7. Prepare the budgeted income statement for the next year. (Do not round intermediate calculations.) Required information Problem 9-42 Preparation of Master Budget (LO 9-3, 9-4, 9-5) [The following information applies to the questions displayed below.] FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables. The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements. The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on a production volume of 470,000 units for each type of box. Production overhead is applied on the basis of direct-labor hours. The following selling and administrative expenses are anticipated for the next year. The sales forecast for the next year is as follows: The following inventory information is available for the next year. The unit production costs for each product are expected to be the same this year and next year. Prepare a master budget for FreshPak Corporation for the next year. Assume an income tax rate of 40 percent. Problem 942 Part 7 7. Prepare the budgeted income statement for the next year. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts