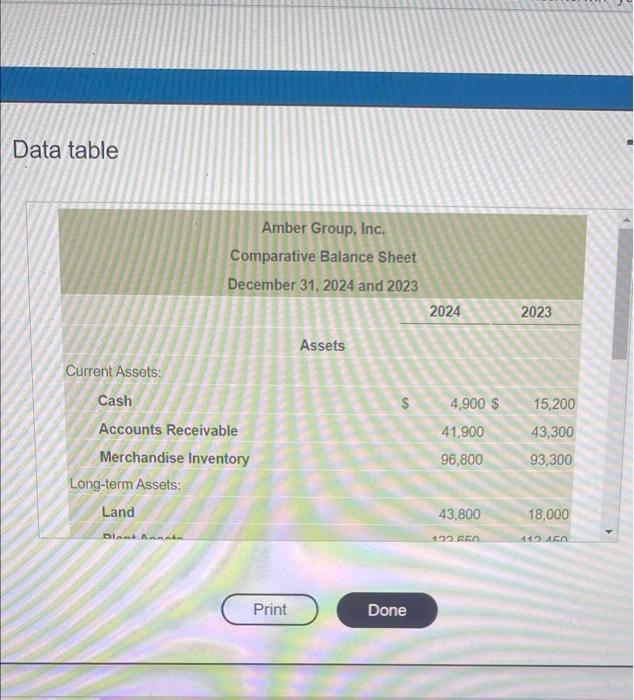

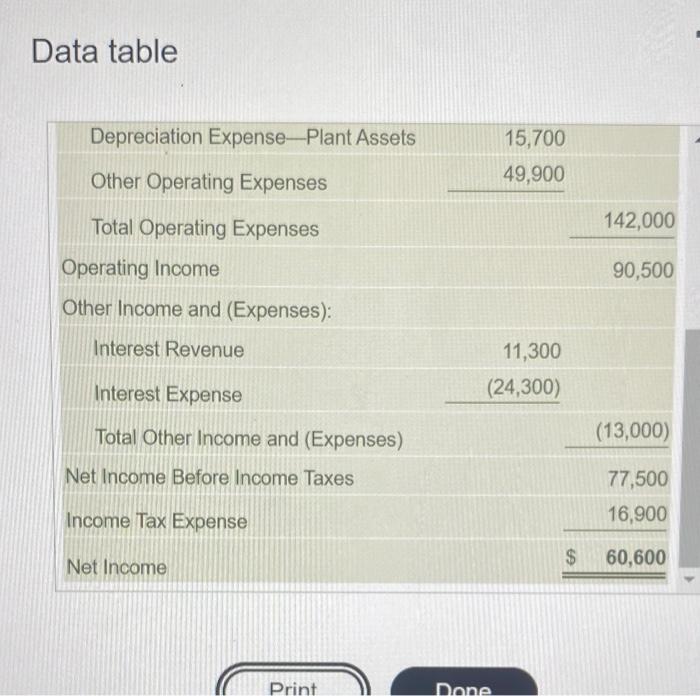

Question: PLEASE HELP FILL IN THE WHITE BOXES Data table Amber Group, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 Assets 4,900 $

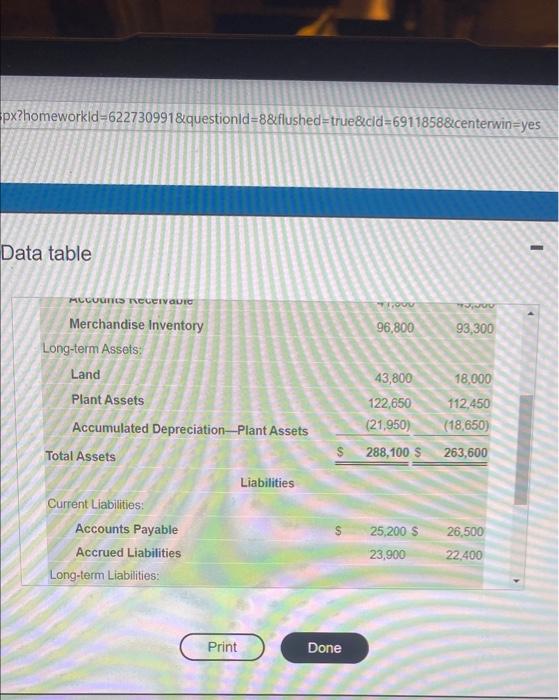

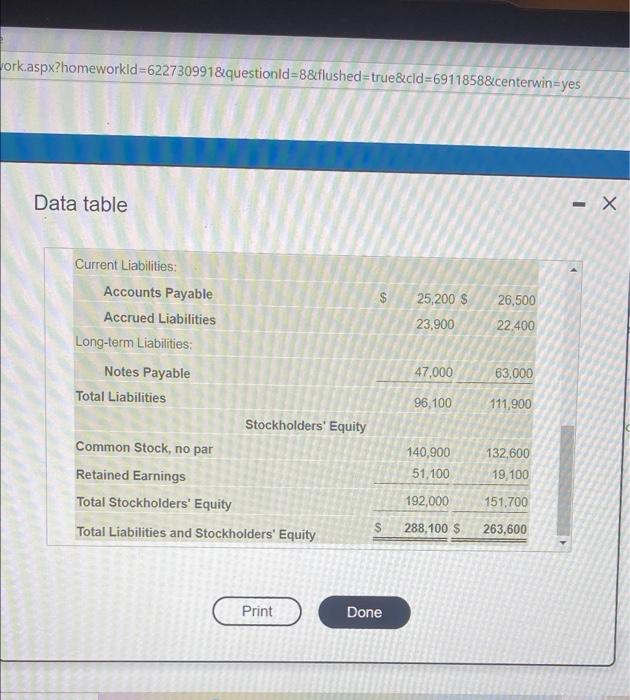

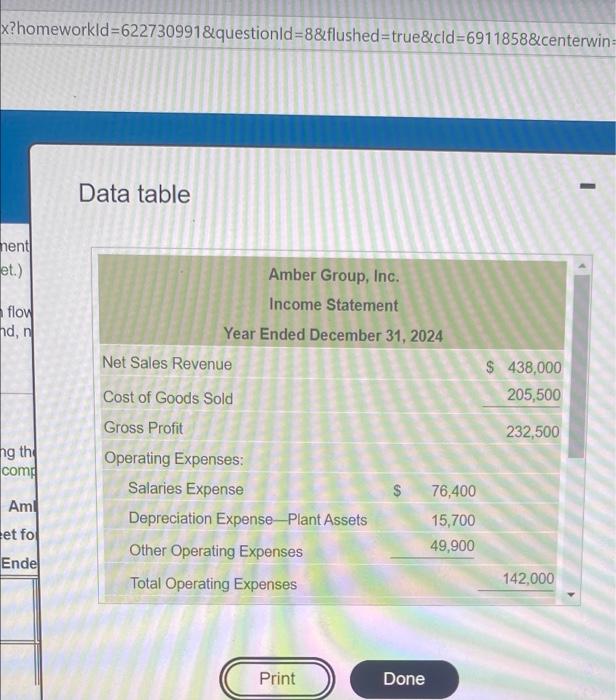

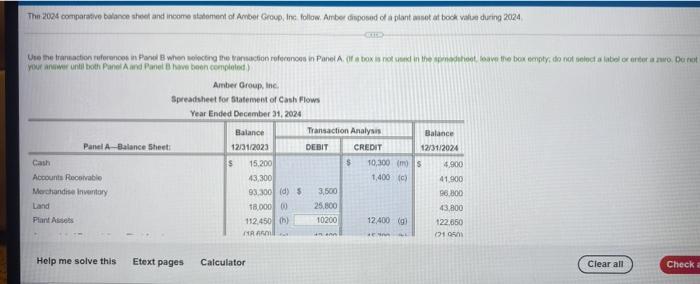

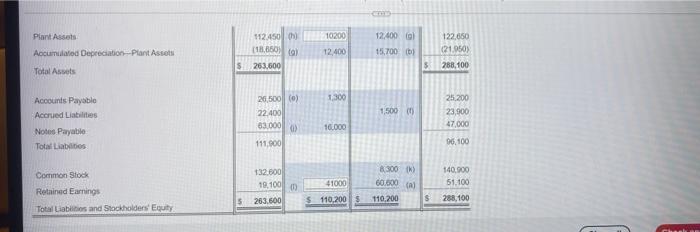

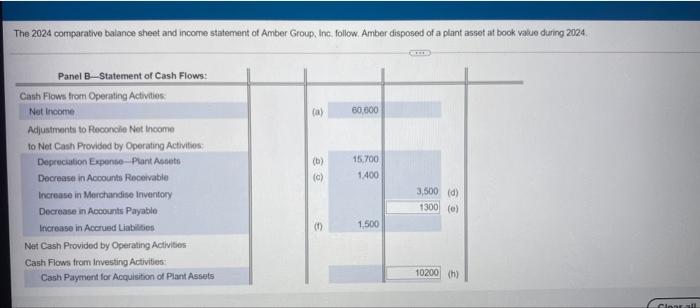

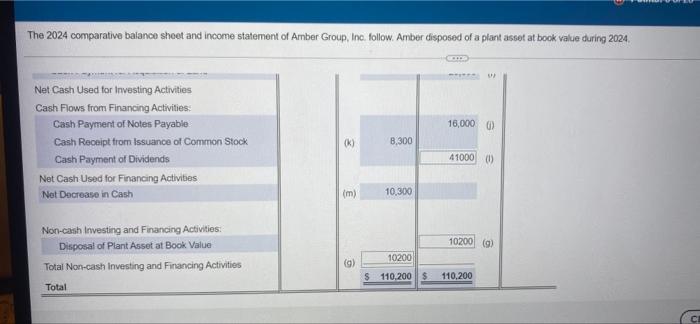

Data table Amber Group, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 Assets 4,900 $ 41,900 Current Assets: Cash Accounts Receivable Merchandise Inventory Long-term Assets: Land 15,200 43,300 93,300 96,800 43,800 18,000 Die Mann RO 142460 Print Done px?homeworkid=622730991&questionid=8&flushed=true&cid=6911858¢erwin=yes Data table MELUUN INCUCIVOLTO Vio 96,800 93,300 43,800 122,650 (21,950) 18,000 112,450 (18,650) Merchandise Inventory Long-term Assets Land Plant Assets Accumulated Depreciation-Plant Assets Total Assets Liabilities Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: $ 288,100 $ 263,600 25,200 $ 26,500 22.400 23,900 Print Done bork.aspx?homeworkld=622730991&questionid=8&flushed=true&cid=6911858¢erwin=yes Data table $ 25,200 $ 23,900 26,500 22,400 63,000 Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 47,000 96,100 111,900 132 600 140,900 51,100 19,100 192,000 151,700 $ 288,100 $ 263,600 Print Done x?homeworkld=622730991&questionid=8&flushed=true&cid=6911858¢erwin= Data table nent let.) flow hd, $ 438,000 205,500 Amber Group, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense $ 76,400 Depreciation Expense-Plant Assets 15,700 49,900 Other Operating Expenses Total Operating Expenses 232,500 ng the come Amil et fo Endel 142.000 Print Done Data table Depreciation Expense-Plant Assets 15,700 Other Operating Expenses 49,900 142,000 Total Operating Expenses Operating Income 90,500 Other Income and (Expenses): Interest Revenue 11,300 (24,300) Interest Expense (13,000) Total Other Income and (Expenses) Net Income Before Income Taxes 77,500 16,900 Income Tax Expense Net Income $ 60,600 Print Done The 2004 comparave balance sheet and income statement of Amber Group, Inc Hollow Amber onponad of a plant annet at booke ville during 2024 Use the traction references in Panel when selecting the transaction references in Panel (box on the most ove the box empty, do not soleda Intel corter a wo Durot your answer onth both Panel and Panel have been completed) Amber Group, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2024 Balance Transaction Analysis Balance Panel A-Balance Sheet 12/31/2023 DEBIT CREDIT 12/31/2024 Cash $ 15.200 $ 10.300 ms 4.900 Accounts Receivable 43,300 1,400) 41 900 Merchandise Inventory 93.300 (d) 5 3,500 96.800 Land TB 00000 25,800 43.800 Plant Ass 112.450 10200 12 400g 122.650 HA 1710 Help me solve this Etext pages Calculator Clear all Check Plant Assets 12.450 10200 12/600 l 15,700 122,650 (21.950) Accumulated Depreciation Plant Assets (18.00 12,400 $ 263,600 $ 288,100 Total Assets 1,300 26,500 (0) 22.400 1,500 Accounts Payable Accrued Liabilities Notes Payable Total Liabilities 25.200 23,900 47.000 33.000 16.000 111,000 06.100 Common Stock 132.800 19.1000 8.300) 60.000 (A) 110.200 41000 110,200 $ 140.000 51.100 288,100 Retained Earnings Total Liabilities and Stockholders' Equity $ 5 263.600 The 2024 comparative balance sheet and income statement of Amber Group, Inc. follow. Amber disposed of a plant asset at book value during 2024 (a) 80.000 Panel B-Statement of Cash Flows: Cumsh Flows from Operating Activities Net Income Adjustments to Reconcilio Net Income to Net Cash Provided by Operating Activities: Depreciation Expono Plant Assets Decrease in Accounts Receivable Increase in Merchandise inventory Decrease in Accounts Payable Increase in Accrued Liabilities Net Cash Provided by Operating Activities Cash Flows from Investing Activities Cash Payment for Acquisition of Plant Assets (b) (c) 15.700 1400 3,500 (0) 1300 (ol 1,500 10200 (h) Clear The 2024 comparative balance sheet and income statement of Amber Group, Inc. follow. Amber disposed of a plant asset at book value during 2024 --- 16,0000 Net Cash Used for investing Activities Cash Flows from Financing Activities: Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Used for Financing Activities Net Decrease in Cash k) 8,300 410000 (m) 10,300 10200 (9) Non-cash Investing and Financing Activities. Disposal of Plant Asset at Book Value Total Non-cash Investing and Financing Activities 10200 (9) 9) $ 110,200 $ 110,200 Total CI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts