Question: please help fill out ammorization and cash flow tables Use Assignment 9 Data File. . Use each workshect for amortization table and one for cash

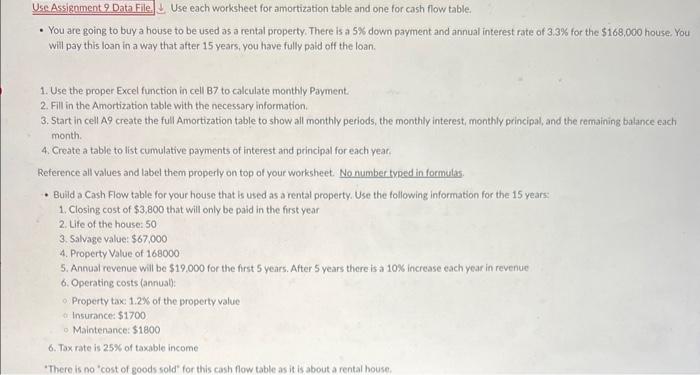

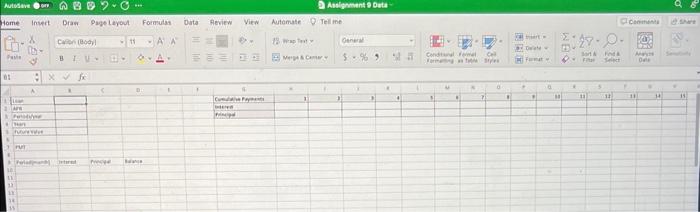

Use Assignment 9 Data File. . Use each workshect for amortization table and one for cash flow table. - You are going to buy a house to be used as a rental property. There is a 5% down payment and annual interest rate of 3.3% for the $168,000 house, You will pay this loan in a way that after 15 years, you have fully paid off the loan. 1. Use the proper Excel function in cell B7 to calculate monthly Payment. 2. Fill in the Amortization table with the necessary information. 3. Start in cell A9 create the full Amortization table to show all monthly periods, the monthly interest, monthly principal, and the remaining balance each month. 4. Create a table to list cumulative payments of interest and principal for each year. Reference all values and label them properly on top of your worksheet. No number typed in formulas. - Build a Cash Flow table for your house that is used as a rental property. Use the following information for the 15 years: 1. Closing cost of $3,800 that will only be paid in the first year 2. Life of the house: 50 3. Salvage value: $67,000 4. Property Value of 168000 5. Annual revenue will be $19,000 for the first 5 years. After 5 years there is a 10% increase each year in revenue 6. Operating costs (annual): Property taxe 1.26 of the property value Insurance: $1700 Maintenance: $1800 6. Tax rate is 25Y of taxable income

Step by Step Solution

There are 3 Steps involved in it

To complete the Excel worksheet follow these steps Amortization Table 1 Calculate Monthly Payment Ce... View full answer

Get step-by-step solutions from verified subject matter experts