Question: Please help fill out Brady, a US based firm, is considering a 4 year project in Turkey. The following information is available about the project:

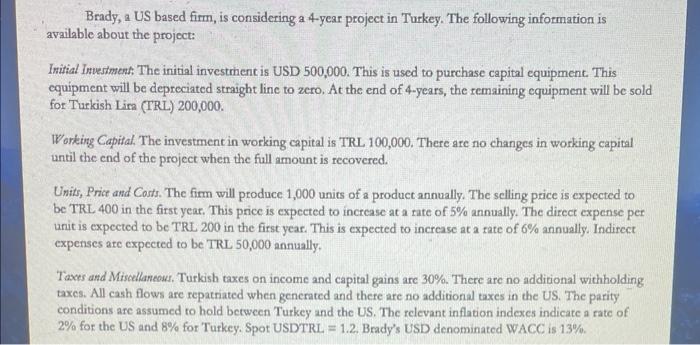

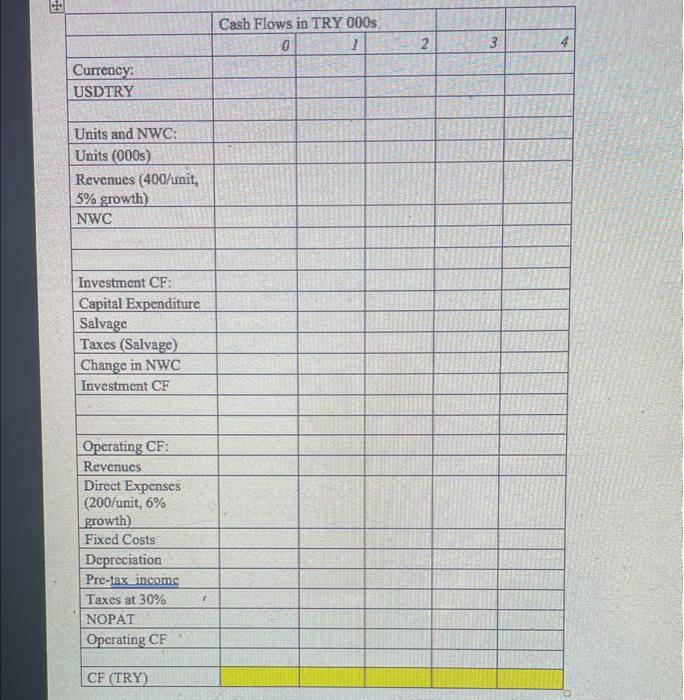

Brady, a US based firm, is considering a 4 year project in Turkey. The following information is available about the project: Initial invesiment. The initial investment is USD 500,000. This is used to purchase capital equipment. This equipment will be depreciated straight line to zero. At the end of 4-years, the remaining equipment will be sold for Turkish Lin (TRL) 200,000. Warking Capital, The investment in working capital is TRL 100,000. There are no changes in working capital until the end of the project when the full amount is recovered. Units, Price and Costs. The firm will produce 1,000 units of a product annually. The selling price is expected to be TRL 400 in the first year. This price is expected to increase at a rate of 5% annually. The direct expense per unit is expected to be TRL 200 in the first year. This is expected to increase at a tate of 6% annually. Indirect expenses are expected to be TRL 50,000 annually. Taxes and Misellaneous. Turkish taxes on income and capital gains arc 30%. There are no additional withholding taxes. All cash flows are repatnated when generated and there are no additional taxes in the US. The parity conditions are assumed to hold between Turkey and the US. The relevant inflation indexes indicate a ratc of 2% for the US and 8% for Turkey. Spot USDTRL =1.2. Brady's USD denominated WACC is 13%. \begin{tabular}{|l|r|r|r|r|} \hline & \multicolumn{2}{|c|}{ Cash Flows in TRY 000s } & \\ \hline & \multicolumn{1}{|c|}{1} & 2 & 3 \\ \hline & & & & \\ \hline Currency: & & & \\ \hline USDTRY & & & \\ \hline & & & \\ \hline Units and NWC: & & & \\ \hline Units (000s) & & & \\ \hline Revenues (400/unit, & & & \\ \hline 5% growth) & & & \\ \hline NWC & & & \\ \hline & & & \\ \hline & & & \\ \hline Investment CF: & & & \\ \hline Capital Expenditure & & & \\ \hline Salvage & & & \\ \hline Taxes (Salvage) & & & \\ \hline Change in NWC & & & \\ \hline Investment CF & & & \\ \hline & & & \\ \hline & & & \\ \hline Operating CF: & & & \\ \hline Revenues & & & \\ \hline DirectExpenses(200/unit,6%growth) & & & \\ \hline Fixed Costs & & & \\ \hline Depreciation & & & \\ \hline Pre-tax income & & & \\ \hline Taxes at 30\% & & & \\ \hline NOPAT & & & \\ \hline Operating CF & & & \\ \hline & & & \\ \hline CF (TRY) & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts