Question: Please help fill out table example on the last image with actual requirements! thank you so much Speedville Marina needs to raise $1.0 million to

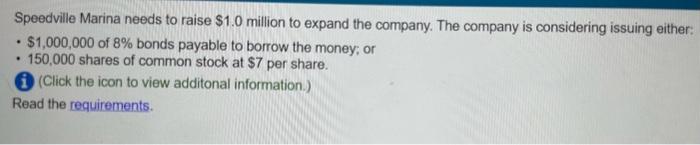

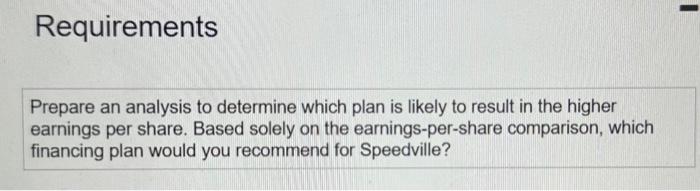

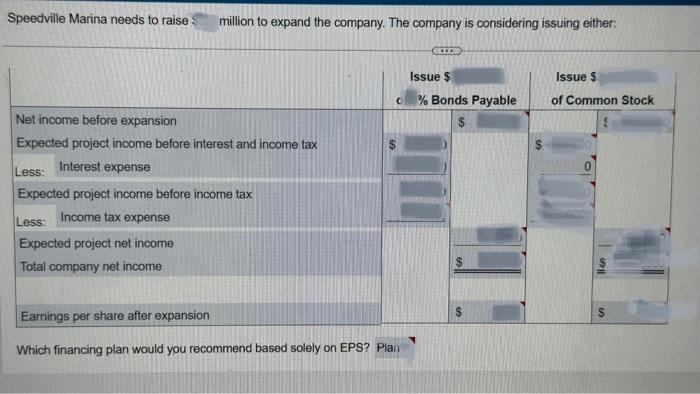

Speedville Marina needs to raise $1.0 million to expand the company. The company is considering issuing either: - $1,000,000 of 8% bonds payable to borrow the money; or - 150,000 shares of common stock at $7 per share. (i) (Click the icon to view additonal information.) Read the requirements. Requirements Prepare an analysis to determine which plan is likely to result in the higher earnings per share. Based solely on the earnings-per-share comparison, which financing plan would you recommend for Speedville? Which financing plan would you recommend based solely on EPS? Speedville Marina needs to raise $1.0 million to expand the company. The company is considering issuing either: - $1,000,000 of 8% bonds payable to borrow the money; or - 150,000 shares of common stock at $7 per share. (i) (Click the icon to view additonal information.) Read the requirements. Requirements Prepare an analysis to determine which plan is likely to result in the higher earnings per share. Based solely on the earnings-per-share comparison, which financing plan would you recommend for Speedville? Which financing plan would you recommend based solely on EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts