Question: Please help fill out the chart correctly and I need the correct numbers too Required information [The following information applies to the questions displayed below.)

Please help fill out the chart correctly and I need the correct numbers too

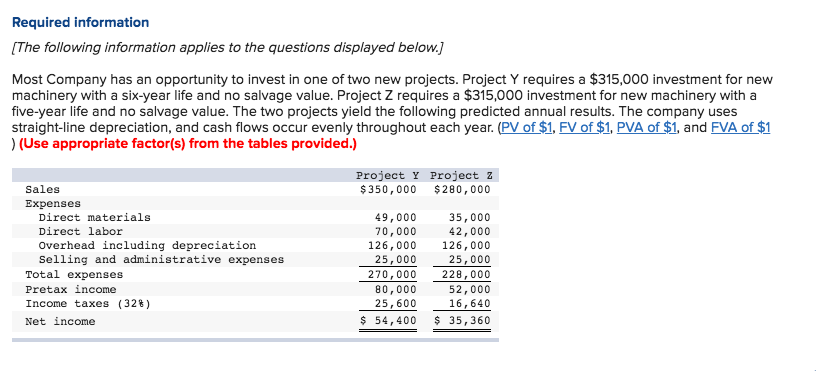

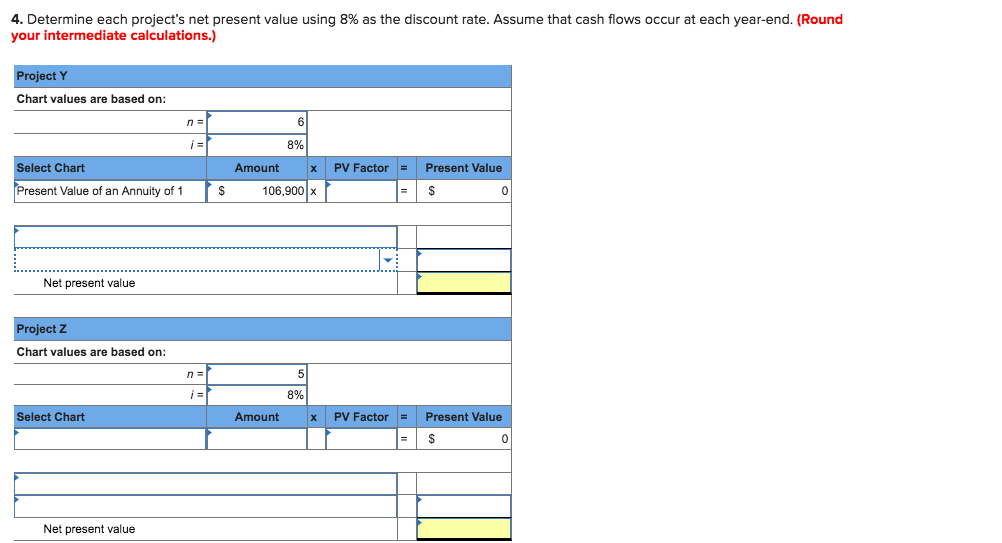

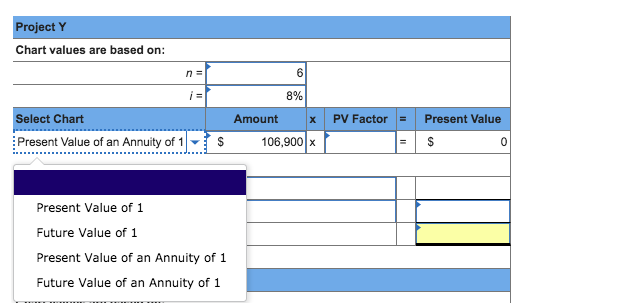

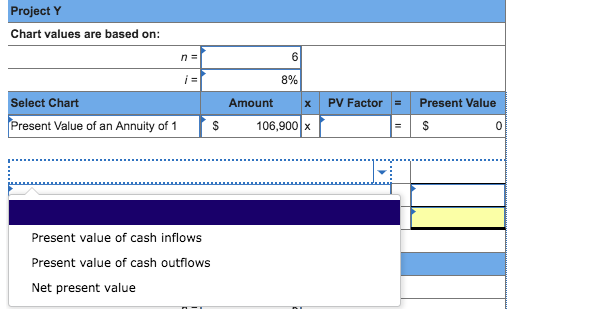

Required information [The following information applies to the questions displayed below.) Most Company has an opportunity to invest in one of two new projects. Project Y requires a $315,000 investment for new machinery with a six-year life and no salvage value. Project Z requires a $315,000 investment for new machinery with a five-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided.) Project Y Project 2 $350,000 $280,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses 35,000 42,000 126,000 126,000 25,000 228,000 52,000 16, 640 $ 54,400 35,360 49,000 70,000 Total expenses Pretax income Income taxes (32%) Net income 25,000 270,000 80,000 25, 600 4. Determine each project's net present value using 8% as the discount rate. Assume that cash flows occur at each year-end. (Round your intermediate calculations.) Project Y Chart values are based on: 6 8% Select Chart Amount X PV FactorPresent Value Present Value of an Annuity of 1 106,900x Net present value roject Z Chart values are based on: 8% Select Chart Amount X PV FactorPresent Value 0 Net present value Project Y Chart values are based on: 6 8% Select Chart Amount X PV FactorPresent Value Present Value of an Annuity of 1S 106,900 x 0 Present Value of1 Future Value of 1 Present Value of an Annuity of 1 Future Value of an Annuity of 1 Project Y Chart values are based on: 6 8% Select Chart Amount X PV FactorPresent Value Present Value of an Annuity of 1 106,900 x 0 Present value of cash inflows Present value of cash outflows Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts