Question: Please help find and explain how to find the discount on notes receivable. On December 31, 2020, Monty Inc. rendered services to Beghun Corporation at

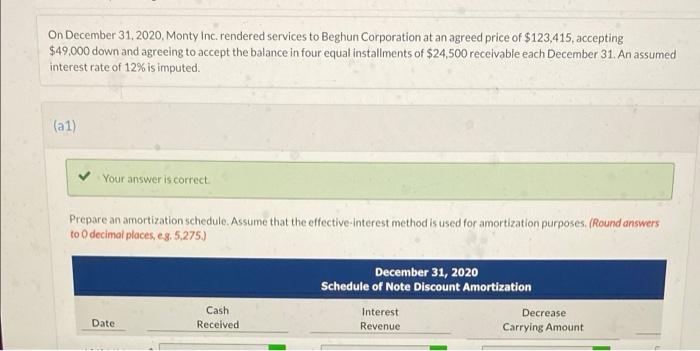

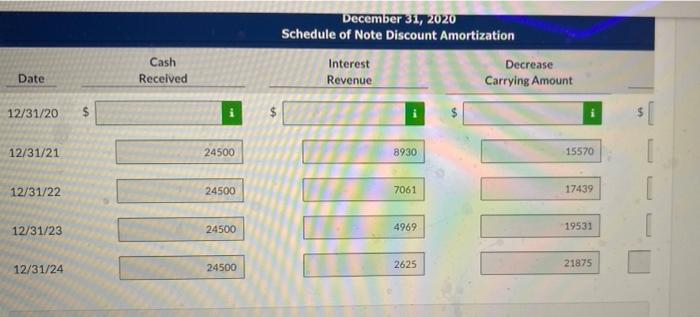

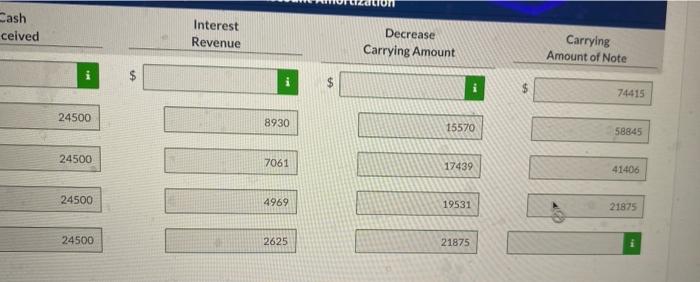

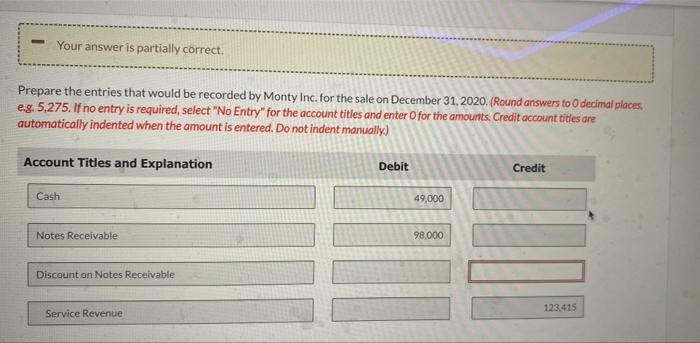

On December 31, 2020, Monty Inc. rendered services to Beghun Corporation at an agreed price of $123,415, accepting $49,000 down and agreeing to accept the balance in four equal installments of $24,500 receivable each December 31. An assumed interest rate of 12% is imputed. (a1) Your answer is correct. Prepare an amortization schedule. Assume that the effective-interest method is used for amortization purposes. (Round answers to 0 decimal places, e.g. 5,275.) December 31, 2020 Schedule of Note Discount Amortization Cash Interest Revenue Date: Received Decrease Carrying Amount Date 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 $ Cash Received 24500 24500 24500 24500 December 31, 2020 Schedule of Note Discount Amortization Interest Revenue 8930 7061 4969 2625 Decrease Carrying Amount 15570 17439 19531 21875 s Cash ceived 24500 24500 24500 24500 Interest Revenue 8930 7061 4969 2625 LA Decrease Carrying Amount 15570 17439 19531 21875 Carrying Amount of Note 74415 58845 41406 21875 Your answer is partially correct. Prepare the entries that would be recorded by Monty Inc. for the sale on December 31, 2020. (Round answers to 0 decimal places, eg. 5,275. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cash Notes Receivable Discount on Notes Receivable Service Revenue 49,000 98,000 123,415

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts