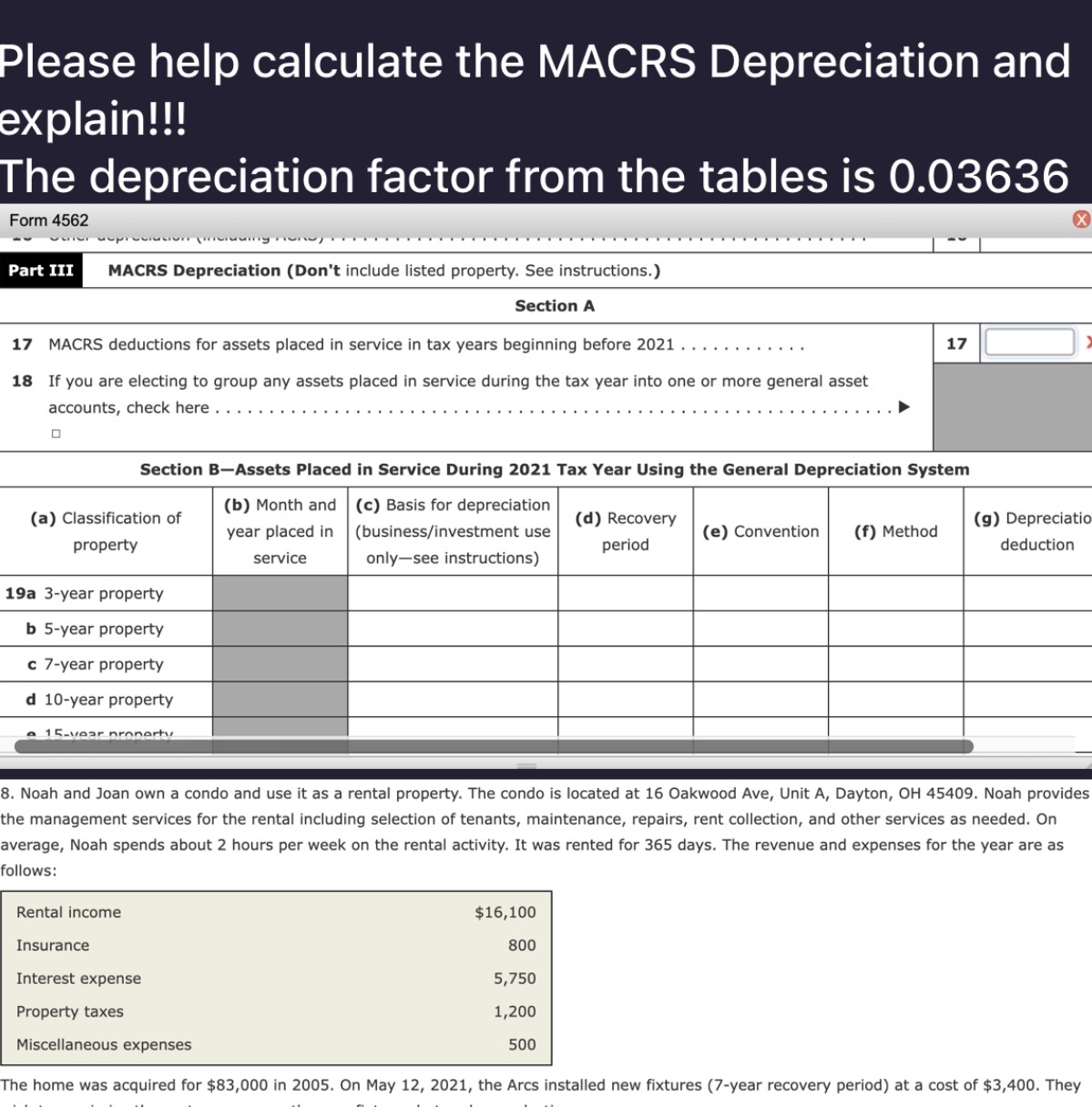

Question: Please help find line 17. MARCS deductions for assets placed in service in tax years beginning before 2021.... lease help calculate the MACRS Depreciation

Please help find line 17. MARCS deductions for assets placed in service in tax years beginning before 2021....

" lease help calculate the MACRS Depreciation and -xplain!!! he depreciation factor from the tables is 0.03636 Form 4562 63 -- nun... uh..i-\\..u..u.. MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2021 . . . . . . . . . . . . 17 1 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here ............................................................... P Section BAssets Placed in Service During 2021 Tax Year Using the General Depreciation System (b) Month and year placed in (c) Basis for depreClation (a) Classification of (cl) Recovery (9) Depreciatio (business/investment use (e) Convention (1') Method property period deduction service onlysee instructions) 19a 3-year property b 5year property c Tyear property d 10-year property n 1 Caron-e arr-snatch: 8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A, Dayton, OH 45409. Noah provides the management services for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about 2 hours per week on the rental activity. It was rented for 365 days. The revenue and expenses for the year are as follows: Rental income Insurance Interest expense Property taxes Miscellaneous expenses $15,100 800 5,750 1,200 500 The home was acquired for $83,000 in 2005. On May 12, 2021, the Arcs installed new xtures (2year recovery period) at a cost of $3,400. They