Question: Please help finish the table and show work. Amortization Schedule - Student Loan 2 Fixed rate loan at 4.5% 3 10 year repayment 4 with

Please help finish the table and show work.

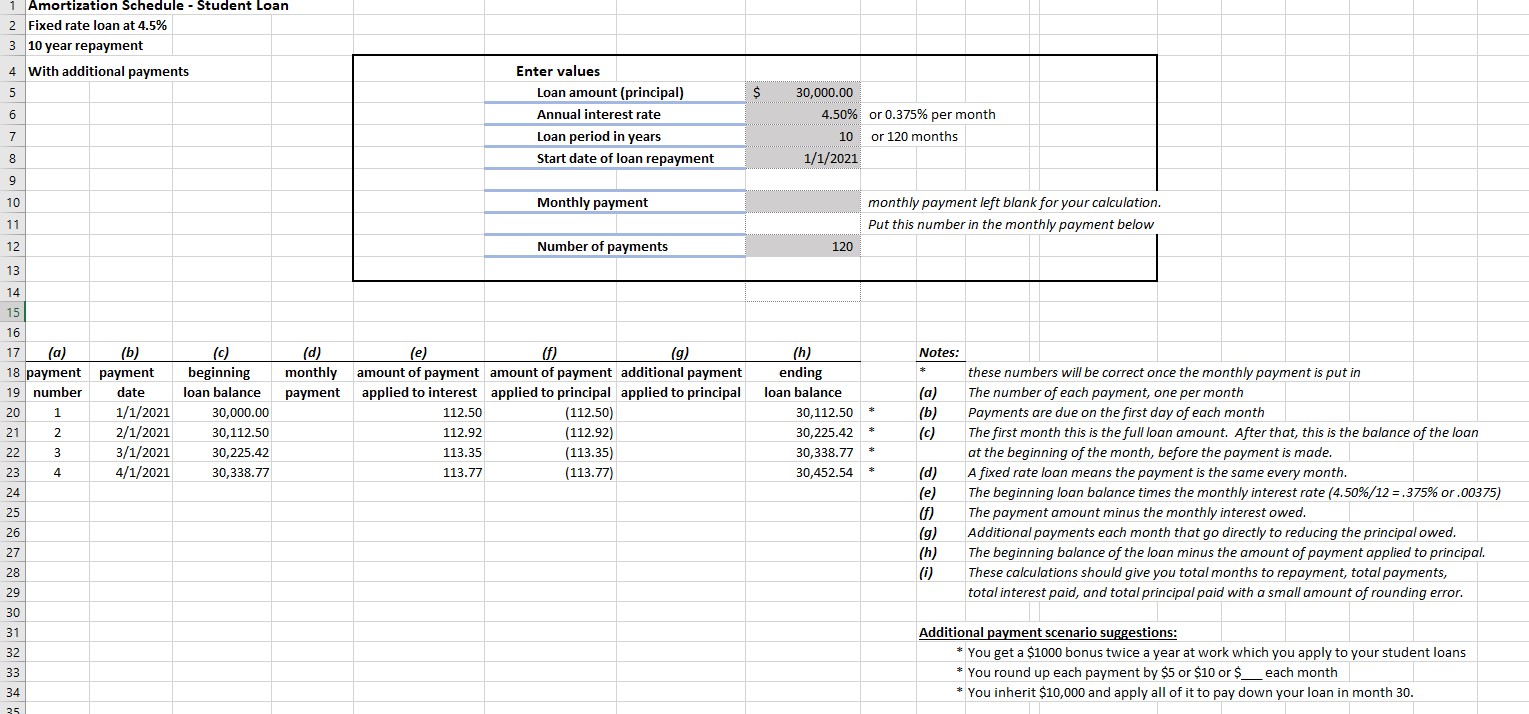

Amortization Schedule - Student Loan 2 Fixed rate loan at 4.5% 3 10 year repayment 4 with additional payments 5 $ 6 Enter values Loan amount (principal) Annual interest rate Loan period in years Start date of loan repayment 30,000.00 4.50% or 0.375% per month 10 or 120 months 1/1/2021 7 8 9 10 Monthly payment monthly payment left blank for your calculation. Put this number in the monthly payment below 11 12 Number of payments 120 13 Notes: * (d) monthly payment 14 15 16 17 (a) (b) 18 payment payment 19 number date 20 1 1/1/2021 21 2 2/1/2021 22 3 3/1/2021 23 4 4/1/2021 24 25 26 27 28 29 30 (c) beginning loan balance 30,000.00 30,112.50 30,225.42 30,338.77 (e) 02 (g) amount of payment amount of payment additional payment applied to interest applied to principal applied to principal 112.50 (112.50) 112.92 (112.92) 113.35 (113.35) 113.77 (113.77) (h) ending loan balance 30,112.50 30,225.42 30,338.77 30,452.54 (a) (b) (c) (d) (e) f) (g) (h) (0) these numbers will be correct once the monthly payment is put in The number of each payment, one per month Payments are due on the first day of each month The first month this is the full loan amount. After that, this is the balance of the loan at the beginning of the month, before the payment is made. A fixed rate loan means the payment is the same every month. The beginning loan balance times the monthly interest rate (4.50%/12 = .375% or.00375) The payment amount minus the monthly interest owed. Additional payments each month that go directly to reducing the principal owed. The beginning balance of the loan minus the amount of payment applied to principal. These calculations should give you total months to repayment, total payments, total interest paid, and total principal paid with a small amount of rounding error. 31 32 33 34 35 Additional payment scenario suggestions: * You get a $1000 bonus twice a year at work which you apply to your student loans * You round up each payment by $5 or $10 or $_each month * You inherit $10,000 and apply all of it to pay down your loan in month 30. Amortization Schedule - Student Loan 2 Fixed rate loan at 4.5% 3 10 year repayment 4 with additional payments 5 $ 6 Enter values Loan amount (principal) Annual interest rate Loan period in years Start date of loan repayment 30,000.00 4.50% or 0.375% per month 10 or 120 months 1/1/2021 7 8 9 10 Monthly payment monthly payment left blank for your calculation. Put this number in the monthly payment below 11 12 Number of payments 120 13 Notes: * (d) monthly payment 14 15 16 17 (a) (b) 18 payment payment 19 number date 20 1 1/1/2021 21 2 2/1/2021 22 3 3/1/2021 23 4 4/1/2021 24 25 26 27 28 29 30 (c) beginning loan balance 30,000.00 30,112.50 30,225.42 30,338.77 (e) 02 (g) amount of payment amount of payment additional payment applied to interest applied to principal applied to principal 112.50 (112.50) 112.92 (112.92) 113.35 (113.35) 113.77 (113.77) (h) ending loan balance 30,112.50 30,225.42 30,338.77 30,452.54 (a) (b) (c) (d) (e) f) (g) (h) (0) these numbers will be correct once the monthly payment is put in The number of each payment, one per month Payments are due on the first day of each month The first month this is the full loan amount. After that, this is the balance of the loan at the beginning of the month, before the payment is made. A fixed rate loan means the payment is the same every month. The beginning loan balance times the monthly interest rate (4.50%/12 = .375% or.00375) The payment amount minus the monthly interest owed. Additional payments each month that go directly to reducing the principal owed. The beginning balance of the loan minus the amount of payment applied to principal. These calculations should give you total months to repayment, total payments, total interest paid, and total principal paid with a small amount of rounding error. 31 32 33 34 35 Additional payment scenario suggestions: * You get a $1000 bonus twice a year at work which you apply to your student loans * You round up each payment by $5 or $10 or $_each month * You inherit $10,000 and apply all of it to pay down your loan in month 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts