Question: please help for a like! Josh made $80,000 last year and contributed $5,000 to his 401(k) during the year. He didn't have any other income,

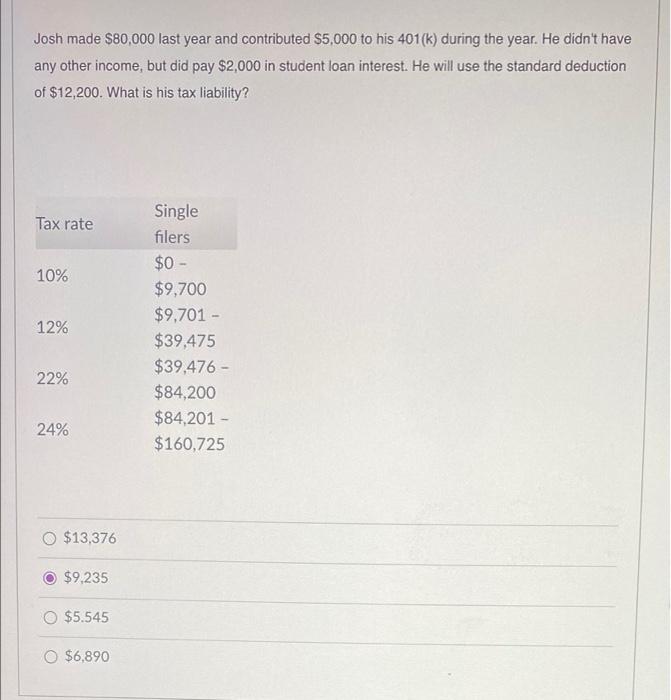

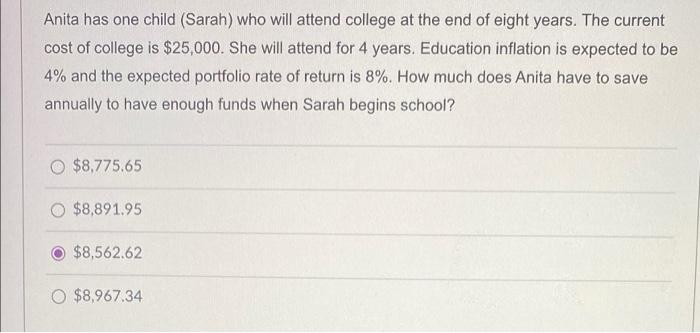

Josh made $80,000 last year and contributed $5,000 to his 401(k) during the year. He didn't have any other income, but did pay $2,000 in student loan interest. He will use the standard deduction of $12,200. What is his tax liability? Tax rate 10% 12% Single filers $0 - $9,700 $9.701 - $39,475 $39,476 - $84,200 $84,201 - $160,725 22% 24% $13,376 $9.235 $5.545 O $6,890 Anita has one child (Sarah) who will attend college at the end of eight years. The current cost of college is $25,000. She will attend for 4 years. Education inflation is expected to be 4% and the expected portfolio rate of return is 8%. How much does Anita have to save annually to have enough funds when Sarah begins school? $8,775.65 $8,891.95 O $8,562.62 O $8,967.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts