Question: Please help for all questions. 1. Carson Equity was recently given the opportunity to bid on an attractive development site in the downtown Wichita Falls.

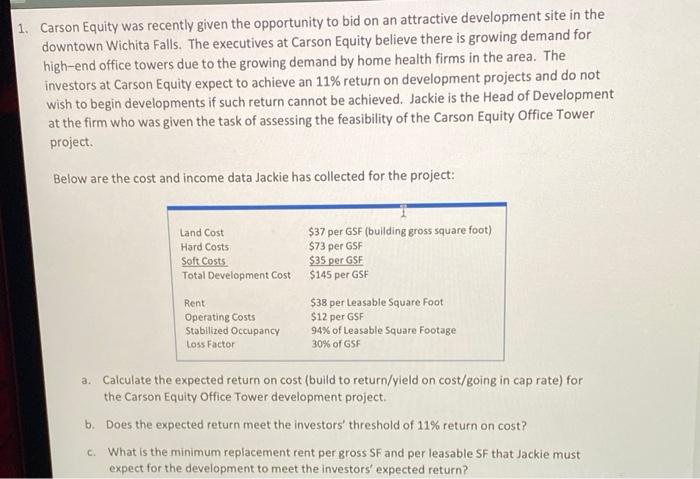

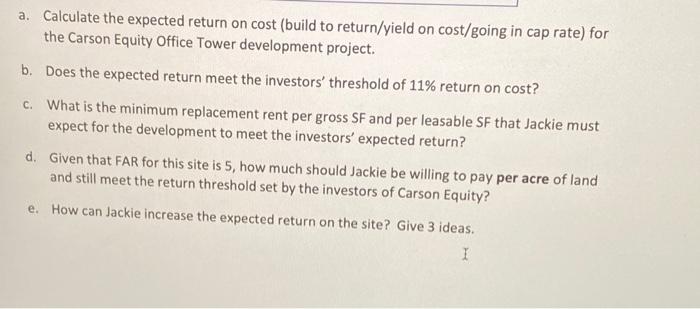

1. Carson Equity was recently given the opportunity to bid on an attractive development site in the downtown Wichita Falls. The executives at Carson Equity believe there is growing demand for high-end office towers due to the growing demand by home health firms in the area. The investors at Carson Equity expect to achieve an 11% return on development projects and do not wish to begin developments if such return cannot be achieved. Jackie is the Head of Development at the firm who was given the task of assessing the feasibility of the Carson Equity Office Tower project. Below are the cost and income data Jackie has collected for the project: Land Cost Hard Costs Soft Costs Total Development Cost $37 per GSF (building gross square foot) $73 per GSF $35 per GSE $145 per GSF $38 per Leasable Square Foot $12 per GSF 94% of Leasable Square Footage 30% of GSF Rent Operating costs Stabilized Occupancy Loss Factor a. Calculate the expected return on cost (build to return/yield on cost/going in cap rate) for the Carson Equity Office Tower development project. b. Does the expected return meet the investors' threshold of 11% return on cost? c. What is the minimum replacement rent per gross SF and per leasable SF that Jackie must expect for the development to meet the investors' expected return? a. Calculate the expected return on cost (build to return/yield on cost/going in cap rate) for the Carson Equity Office Tower development project. b. Does the expected return meet the investors' threshold of 11% return on cost? C. What is the minimum replacement rent per gross SF and per leasable SF that Jackie must expect for the development to meet the investors' expected return? d. Given that FAR for this site is 5, how much should Jackie be willing to pay per acre of land and still meet the return threshold set by the investors of Carson Equity? e. How can Jackie increase the expected return on the site? Give 3 ideas. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts