Question: Please help for my assignment. Please write as detail as you can, this is my first time to learn about those method -1. Selected data

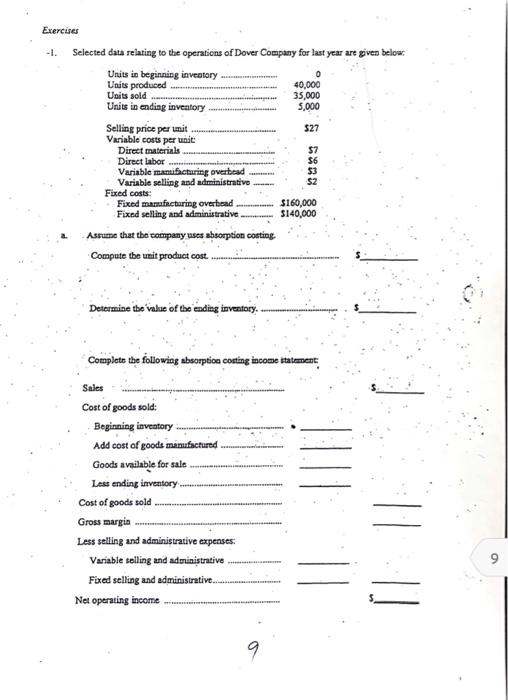

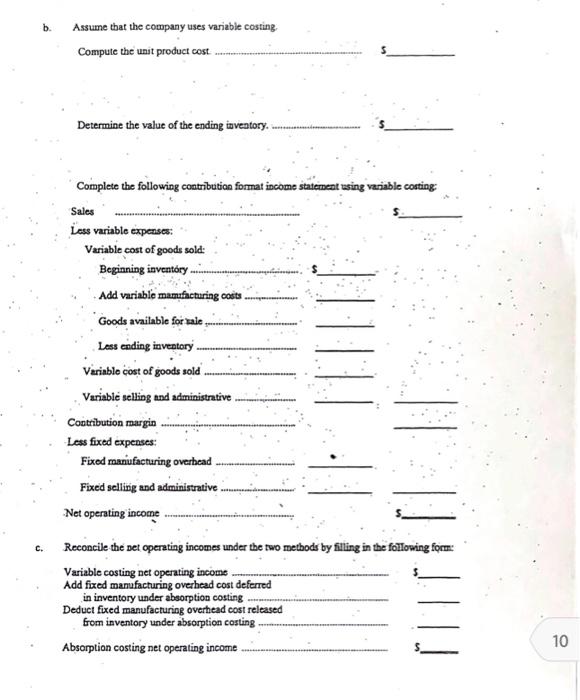

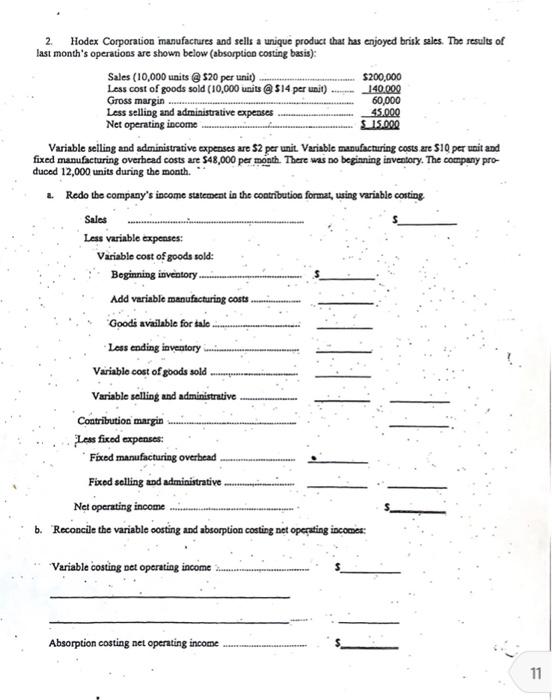

-1. Selected data relating to the operations of Dover Company for last year are given below: a. Asrume that the company uses absorption costing. Compute the unit product cost. 3 Determine the value of the endieg inventory. 5 Complete the following absorptioe corting income itatement; Sales Cost of goods sold: Beginning inveatory Add cost of goods mamifactured Goods available for sale Lest ending imventory Cost of goods sold Gross margin Less selling and administrative expenses: Variable selling and administrative Fixed selling and administrative. Net operating incorne b. Assume that the company uses variable costing. Compute the unit product cost. Determine the value of the ending inventory. 5 Complete the following contribution format income statement asing variable costing Sales Less variable expenses: Variable cost of goods sold: Beginning inventory Add variable mamufacturing costs Goods available for rale Less ending inventory Variable cost of goods sold Variabl selling and administntive Contribution margin Less fixed expenses: Fixod manufacturing overhead Fixed selling and administrative Net operating income c. Reconcile the pet operating incomes under the two methods by filling in the following form: Variable costing net operating income Add fixed manufacturing overhead cost deferred in inventory under absorption costing Deduct fixed manufacturing overhead cost released from inventory under absorption costing Absorption costing net operating income 2. Hodex Corporation manufacnures and sells a unique product that has enjoyed brisk sales. The results of last month's operations are shown below (absorption conting basis): Variable selling and administrative expenses are $2 per unit Varibble manufacturing costs are $10 per unit and fixed manufacturing overhead costs are 548,000 per month. There was no beginning inventory. The company produced 12,000 units during the month. a. Redo the company's income statecent in the coatributioe format, wing variable corting Sales s Less variable expenses: Variable cost of goods sold: Beginning inventory 5 Add variable manufacturing costs Goodi available for tale - Less ending inventory Variable cost of goods sold Variable selling and administrative Contribution margin Less fixed expenses: Fcod manufacturing overbead Fixed selling and adminivtrative Net operating income s. b. Reconcile the variable costing and absorption costing net operting incomes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts