Question: Please help for question 3, Thanks! Intro You've created a portfolio of two stocks with the following investment weights and returns: A B Stock A

Please help for question 3, Thanks!

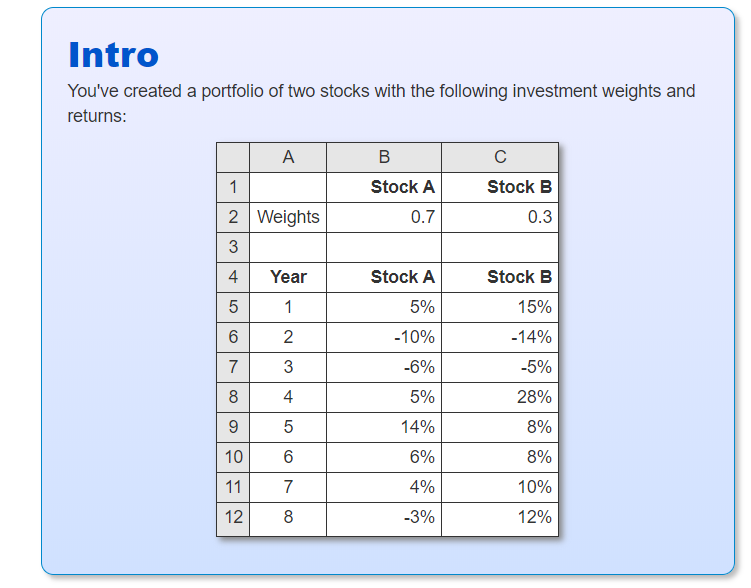

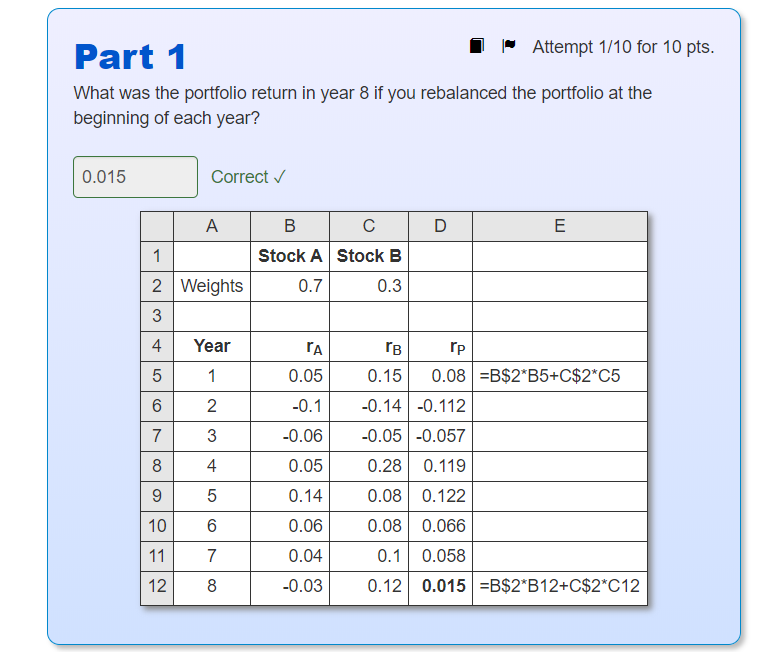

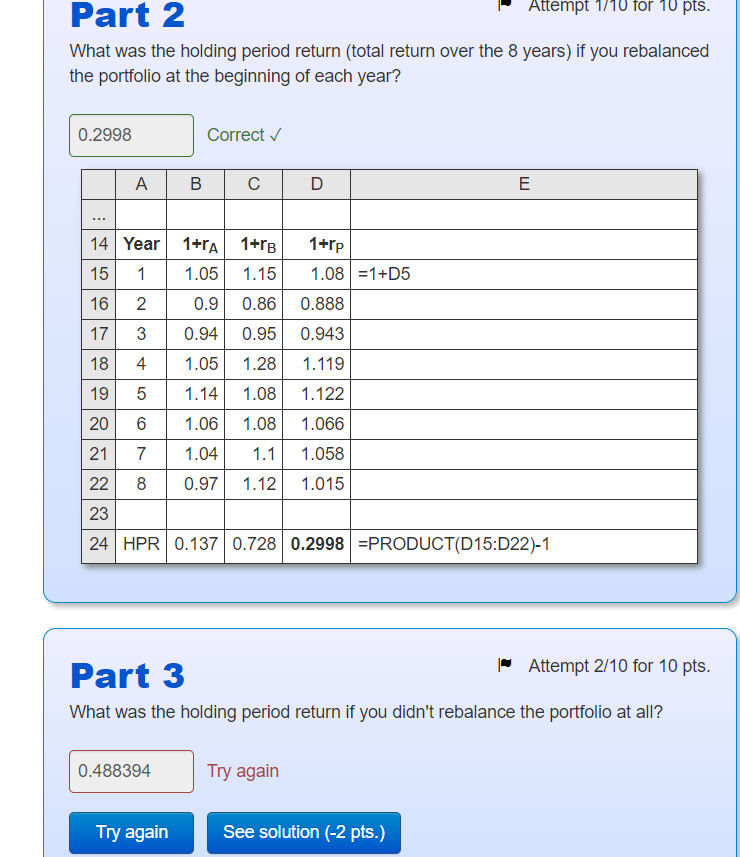

Intro You've created a portfolio of two stocks with the following investment weights and returns: A B Stock A C Stock B 0.3 2 Weights 0.7 Year Stock A Stock B 15% 1 5% -10% -14% 7 -6% -5% 2 3 4 5 28% 9 8% 6 5% 14% 6% 4% -3% 8% 10% 12% Part 1 i Attempt 1/10 for 10 pts. What was the portfolio return in year 8 if you rebalanced the portfolio at the beginning of each year? 0.015 Correct v A D B C Stock A Stock B 0.7 0.3 2 Weights 4 Yearrar rp 5 1 0 .05 0.15 0.08 =B$2*B5+C$2*C5 6 2 -0.1 -0.14 -0.112 7 3 -0.06 -0.05 -0.057 0.05 0.28 0.119 0.14 0.08 0.122 106 0.06 0.08 0.066 7 0.04 0.1 0.058 128 -0.03 0.12 0.015 =B$2*B12+C$2*C12 8 o o voloton Part 2 Attempt 1/10 for 10 pts. What was the holding period return (total return over the 8 years) if you rebalanced the portfolio at the beginning of each year? 0.2998 Correct v A B C D E 14 Year 1+rA 15 1 1.05 16 2 0.9 17 3 0.94 184 1.05 1.14 20 6 1 .06 21 7 1.04 8 0.97 1+B 1.15 0.86 0.95 1.28 1.08 1.08 1.1 1.12 1+rp 1.08 =1+D5 0.888 0.943 1.119 1.122 1.066 1.058 1.015 24 HPR 0.1370.728 0.2998 =PRODUCT(D15:D22)-1 Part 3 | Attempt 2/10 for 10 pts. What was the holding period return if you didn't rebalance the portfolio at all? 0.488394 Try again Try again See solution (-2 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts