Question: PLEASE HELP! For the excel part show forumas!!! dyna - Grow is a major player in the global sorghum seed industry. The cash flows of

PLEASE HELP! For the excel part show forumas!!!

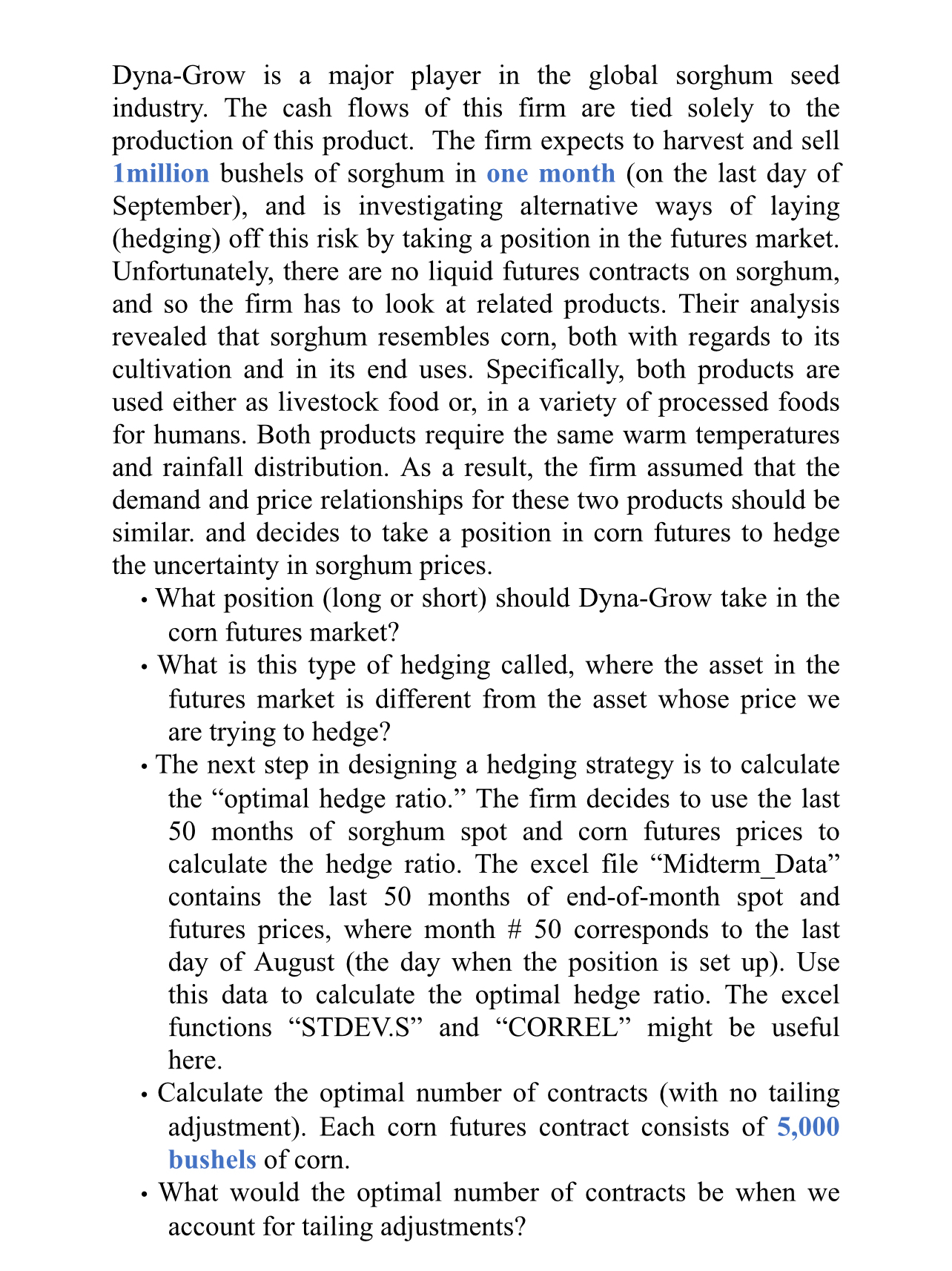

dynaGrow is a major player in the global sorghum seed industry. The cash flows of this firm are tied solely to the production of this product. The firm expects to harvest and sell million bushels of sorghum in one month on the last day of September and is investigating alternative ways of laying hedging off this risk by taking a position in the futures market. Unfortunately, there are no liquid futures contracts on sorghum, and so the firm has to look at related products. Their analysis revealed that sorghum resembles corn, both with regards to its cultivation and in its end uses. Specifically, both products are used either as livestock food or in a variety of processed foods for humans. Both products require the same warm temperatures and rainfall distribution. As a result, the firm assumed that the demand and price relationships for these two products should be similar. and decides to take a position in corn futures to hedge the uncertainty in sorghum prices.

What position long or short should DynaGrow take in the corn futures market?

What is this type of hedging called, where the asset in the futures market is different from the asset whose price we are trying to hedge?

The next step in designing a hedging strategy is to calculate the "optimal hedge ratio." The firm decides to use the last months of sorghum spot and corn futures prices to calculate the hedge ratio. The excel file "MidtermData" contains the last months of endofmonth spot and futures prices, where month # corresponds to the last day of August the day when the position is set up Use this data to calculate the optimal hedge ratio. The excel functions "STDEV.S and "CORREL" might be useful here.

Calculate the optimal number of contracts with no tailing adjustment Each corn futures contract consists of bushels of corn.

What would the optimal number of contracts be when we account for tailing adjustments?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock