Question: please help for this question Insurance Pricing, Behavioral Bias and Adverse Selec- tion (50%) In this exercise, you are asked to analyze the health insurance.

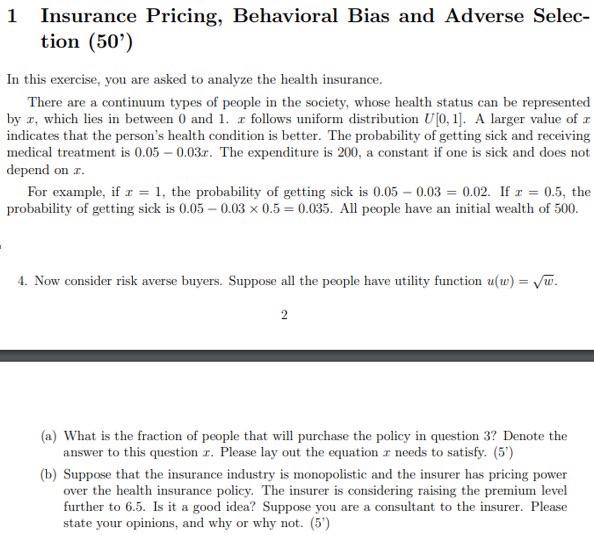

Insurance Pricing, Behavioral Bias and Adverse Selec- tion (50%) In this exercise, you are asked to analyze the health insurance. There are a continuum types of people in the society, whose health status can be represented by 1, which lies in between 0 and 1. follows uniform distribution U[0,1]. A larger value ofr indicates that the person's health condition is better. The probability of getting sick and receiving medical treatment is 0.05 -0.03.r. The expenditure is 200, a constant if one is sick and does not depend on r. For example, if 1 = 1, the probability of getting sick is 0.05 -0.03 = 0.02. If r = 0.5, the probability of getting sick is 0.05 -0.03 x 0.5 = 0.035. All people have an initial wealth of 500. 4. Now consider risk averse buyers. Suppose all the people have utility function u(x) = VW. 2 (a) What is the fraction of people that will purchase the policy in question 3? Denote the answer to this question r. Please lay out the equation r needs to satisfy. (5) (b) Suppose that the insurance industry is monopolistic and the insurer has pricing power over the health insurance policy. The insurer is considering raising the premium level further to 6.5. Is it a good idea? Suppose you are a consultant to the insurer. Please state your opinions, and why or why not. (5) Insurance Pricing, Behavioral Bias and Adverse Selec- tion (50%) In this exercise, you are asked to analyze the health insurance. There are a continuum types of people in the society, whose health status can be represented by 1, which lies in between 0 and 1. follows uniform distribution U[0,1]. A larger value ofr indicates that the person's health condition is better. The probability of getting sick and receiving medical treatment is 0.05 -0.03.r. The expenditure is 200, a constant if one is sick and does not depend on r. For example, if 1 = 1, the probability of getting sick is 0.05 -0.03 = 0.02. If r = 0.5, the probability of getting sick is 0.05 -0.03 x 0.5 = 0.035. All people have an initial wealth of 500. 4. Now consider risk averse buyers. Suppose all the people have utility function u(x) = VW. 2 (a) What is the fraction of people that will purchase the policy in question 3? Denote the answer to this question r. Please lay out the equation r needs to satisfy. (5) (b) Suppose that the insurance industry is monopolistic and the insurer has pricing power over the health insurance policy. The insurer is considering raising the premium level further to 6.5. Is it a good idea? Suppose you are a consultant to the insurer. Please state your opinions, and why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts