Question: please help Formulas R = (SP - INV - Loan + D) / INV: R-Profit / Investment Investor A buys 100 shares of IBM at

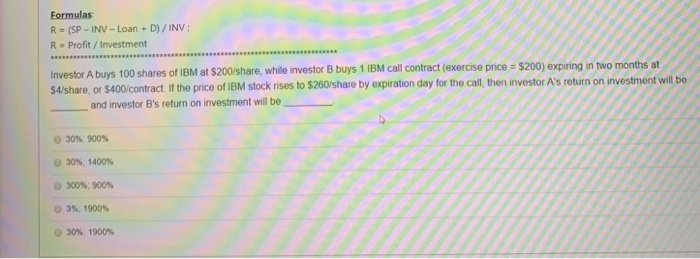

Formulas R = (SP - INV - Loan + D) / INV: R-Profit / Investment Investor A buys 100 shares of IBM at $200/share, while investor B buys 1 IBM call contract (exercise price = $200) expiring in two months at S4/share, or $400/contract. If the price of IBM stock rises to $260/share by expiration day for the call, then investor A's return on investment will be and investor B's return on investment will be 30% 100% 30% 1400% 300%, 900N 3% 1900 30% 1900%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts