Question: PLEASE HELP Galbraith Co. is considering a four-year project that will require an initial investment of $9,000. The base-case cash flows for this project are

PLEASE HELP

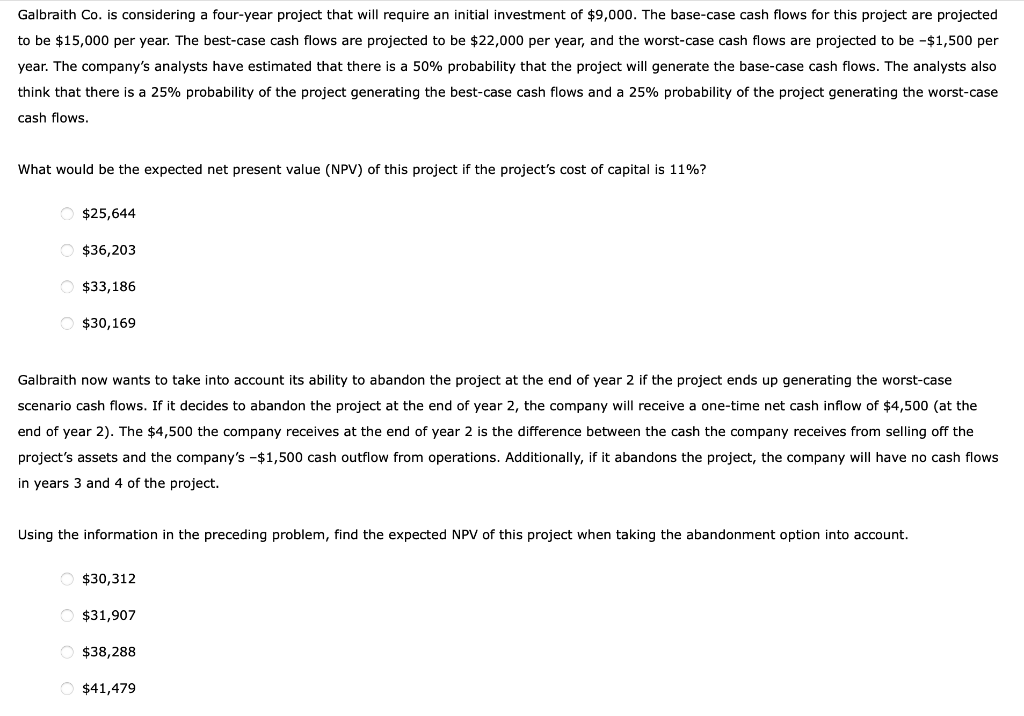

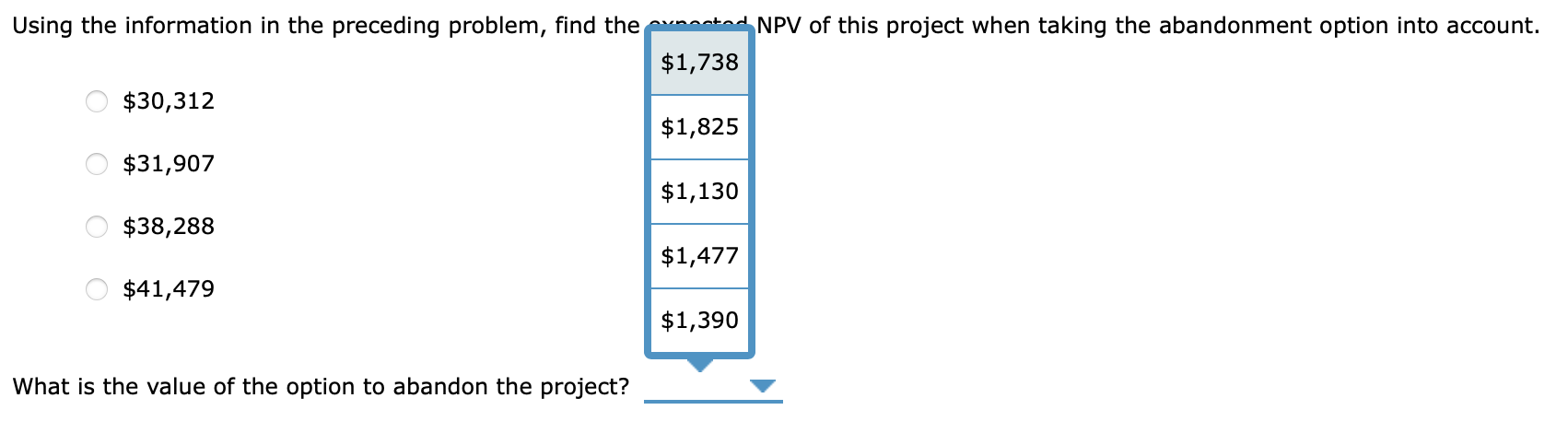

Galbraith Co. is considering a four-year project that will require an initial investment of $9,000. The base-case cash flows for this project are projected to be $15,000 per year. The best-case cash flows are projected to be $22,000 per year, and the worst-case cash flows are projected to be $1,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project's cost of capital is 11% ? $25,644$36,203$33,186$30,169 Galbraith now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project at the end of year 2 , the company will receive a one-time net cash inflow of $4,500 (at the end of year 2). The $4,500 the company receives at the end of year 2 is the difference between the cash the company receives from the project's assets and the company's $1,500 cash outflow from operations. Additionally, if it abandons the project, the company will have no cash flows in years 3 and 4 of the project. Using the information in the preceding problem, find the expected NPV of this project when taking the abandonment option into account. $30,312$31,907$38,288$41,479 $30,312$31,907$38,288$41,479 What is the value of the option to abandon the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts