Question: please help get the correct answer for the red section on the bottom. everything else is correct the red on the top section is given

please help get the correct answer for the red section on the bottom. everything else is correct the red on the top section is given data

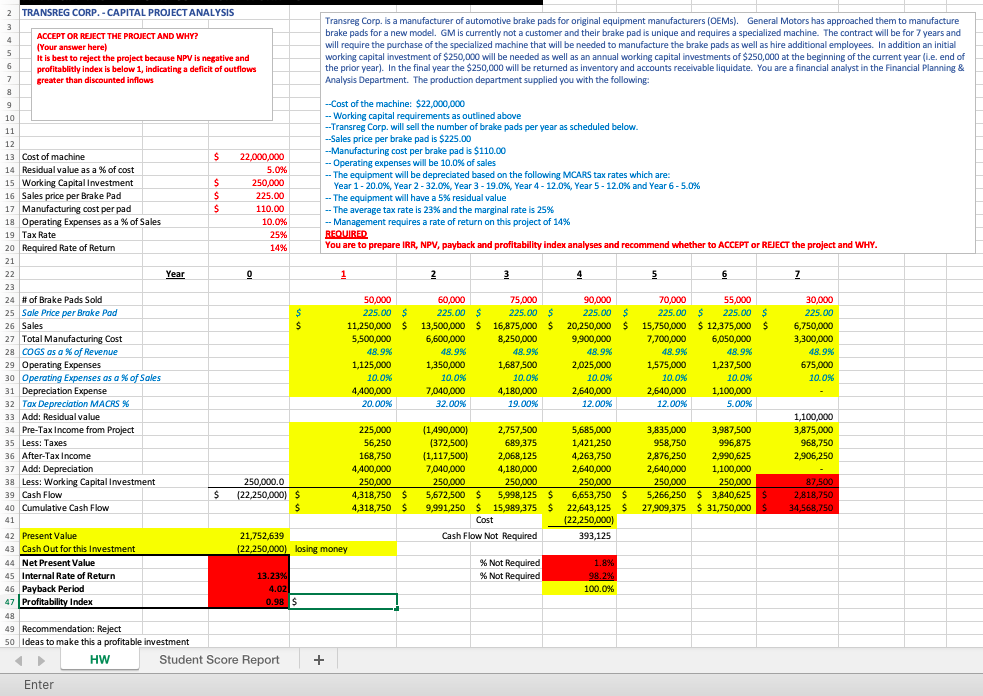

2 TRANSREG CORP. - CAPITAL PROJECT ANALYSIS 2 - Transreg Corp. is a manufacturer of automotive brake pads for original equipment manufacturers (OEMs). General Motors has approached them to manufacture 3 4 ACCEPT OR REJECT THE PROJECT AND WHY? brake pads for a new model. GM is currently not a customer and their brake pad is unique and requires a specialized machine. The contract will be for 7 years and (Your answer here) will require the purchase of the specialized machine that will be needed to manufacture the brake pads as well as hire additional employees. In addition an initial 5 It is best to reject the project because NPV is negative and working capital investment of $250,000 will be needed as well as an annual working capital investments of $250,000 at the beginning of the current year (i.e. end of 6 profitablitly index is below 1, Indicating a deficit of outflows the prior year). In the final year the $250,000 will be returned as inventory and accounts receivable liquidate. You are a financial analyst in the Financial Planning & 7 greater than discounted inflows Analysis Department. The production department supplied you with the following: 8 8 9 --Cost of the machine: $22,000,000 10 - Working capital requirements as outlined above 11 --Transreg Corp. will sell the number of brake pads per year as scheduled below. --Sales price per brake pad is $225.00 12 13 Cost of machine --Manufacturing cost per brake pad is $110.00 $ 22,000,000 - Operating expenses will be 10.0% of sales 14 Residual value as a % of cost 5.0% -- The equipment will be depreciated based on the following MCARS tax rates which are: 15 Working Capital Investment $ 250,000 Year 1-20.0%, Year 2-32.0%, Year 3 - 19.0%, Year 4 - 12.0%, Year 5 - 12.0% and Year 6-5.0% %, % 16 Sales price per Brake Pad $ 225.00 -- The equipment will have a 5% residual value 17 Manufacturing cost per pad $ 110.00 -- The average tax rate is 23% and the marginal rate is 25% 18 Operating Expenses as a % of Sales 10.0% - Management requires a rate of return on this project of 14% 19 Tax Rate 25% REQUIRED 20 Required Rate of Return % 14% You are to prepare IRR, NPV, payback and profitability index analyses and recommend whether to ACCEPT or REJECT the project and WHY. 21 22 Year 0 1 2 3 4 5 6 Z 23 24 # of Brake Pads Sold 50,000 60,000 75,000 90,000 70,000 55,000 30,000 25 Sale Price per Brake Pad $ 225.00 $ 225.00 $ 225.00 $ $ 225.00 $ 225.00 $ 225.00 $ 225.00 26 Sales $ 11,250,000 $ 13,500,000 $ 16,875,000 $ 20,250,000 $ 15,750,000 $12,375,000 $ 6,750,000 27 Total Manufacturing Cost 5,500,000 6,600,000 8,250,000 9,900,000 7,700,000 6,050,000 3,300,000 28 COGS as a % of Revenue 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 29 Operating Expenses 1,125,000 1,350,000 1,687,500 2,025,000 1,575,000 1,237,500 675,000 30 Operating Expenses as a % of Sales a 10.0% 10.0% 10.0% 10.0% 10.0 10.0% 10.0% 31 Depreciation Expense 4,400,000 7,040,000 4,180,000 2,640,000 2,640,000 1,100,000 32 Tax Depreciation MACRS % 20.00% 32.00% 19.00% 12.00% 12.00% 5.00% 33 Add: Residual value 1,100,000 34 Pre-Tax Income from Project 225,000 (1.490,000) 2,757,500 5,685,000 3,835,000 3,987,500 3,875,000 35 Less: Taxes 56,250 (372,500) 689,375 1,421,250 958,750 996,875 968,750 36 After-Tax Income 168,750 (1,117,500) 2,068,125 4,263,750 2,876,250 2,990,625 2,906,250 37 Add: Depreciation 4,400,000 7,040,000 4,180,000 2,640,000 2,640,000 1,100,000 38 Less: Working Capital Investment 250,000.0 250.000 250,000 250,000 250.000 250,000 250,000 87.500 39 Cash Flow $ (22,250,000) $ 4,318,750 $ 5,672,500 $ 5,998,125 $ 6,653,750 $ 5,266,250 $ 3,840,625 $ 2,818,750 40 Cumulative Cash Flow $ 4,318,750 $ 9,991,250 $ 15,989,375 $ 22,643,125 $ 27,909,375 $ 31,750,000 $ 34,568,750 41 Cost (22,250,000) 42 Present Value 21,752,639 Cash Flow Not Required 393,125 43 Cash Out for this Investment (22,250,000) losing money 44 Net Present Value % Not Required 1.8% 45 Internal Rate of Return 13.23% % Not Required 98.2% 46 Payback Period 4.02 100.0% 47 Profitability Index 0.98 $ 48 49 Recommendation: Reject 50 Ideas to make this a profitable Investment HW Student Score Report + Enter 2 TRANSREG CORP. - CAPITAL PROJECT ANALYSIS 2 - Transreg Corp. is a manufacturer of automotive brake pads for original equipment manufacturers (OEMs). General Motors has approached them to manufacture 3 4 ACCEPT OR REJECT THE PROJECT AND WHY? brake pads for a new model. GM is currently not a customer and their brake pad is unique and requires a specialized machine. The contract will be for 7 years and (Your answer here) will require the purchase of the specialized machine that will be needed to manufacture the brake pads as well as hire additional employees. In addition an initial 5 It is best to reject the project because NPV is negative and working capital investment of $250,000 will be needed as well as an annual working capital investments of $250,000 at the beginning of the current year (i.e. end of 6 profitablitly index is below 1, Indicating a deficit of outflows the prior year). In the final year the $250,000 will be returned as inventory and accounts receivable liquidate. You are a financial analyst in the Financial Planning & 7 greater than discounted inflows Analysis Department. The production department supplied you with the following: 8 8 9 --Cost of the machine: $22,000,000 10 - Working capital requirements as outlined above 11 --Transreg Corp. will sell the number of brake pads per year as scheduled below. --Sales price per brake pad is $225.00 12 13 Cost of machine --Manufacturing cost per brake pad is $110.00 $ 22,000,000 - Operating expenses will be 10.0% of sales 14 Residual value as a % of cost 5.0% -- The equipment will be depreciated based on the following MCARS tax rates which are: 15 Working Capital Investment $ 250,000 Year 1-20.0%, Year 2-32.0%, Year 3 - 19.0%, Year 4 - 12.0%, Year 5 - 12.0% and Year 6-5.0% %, % 16 Sales price per Brake Pad $ 225.00 -- The equipment will have a 5% residual value 17 Manufacturing cost per pad $ 110.00 -- The average tax rate is 23% and the marginal rate is 25% 18 Operating Expenses as a % of Sales 10.0% - Management requires a rate of return on this project of 14% 19 Tax Rate 25% REQUIRED 20 Required Rate of Return % 14% You are to prepare IRR, NPV, payback and profitability index analyses and recommend whether to ACCEPT or REJECT the project and WHY. 21 22 Year 0 1 2 3 4 5 6 Z 23 24 # of Brake Pads Sold 50,000 60,000 75,000 90,000 70,000 55,000 30,000 25 Sale Price per Brake Pad $ 225.00 $ 225.00 $ 225.00 $ $ 225.00 $ 225.00 $ 225.00 $ 225.00 26 Sales $ 11,250,000 $ 13,500,000 $ 16,875,000 $ 20,250,000 $ 15,750,000 $12,375,000 $ 6,750,000 27 Total Manufacturing Cost 5,500,000 6,600,000 8,250,000 9,900,000 7,700,000 6,050,000 3,300,000 28 COGS as a % of Revenue 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 29 Operating Expenses 1,125,000 1,350,000 1,687,500 2,025,000 1,575,000 1,237,500 675,000 30 Operating Expenses as a % of Sales a 10.0% 10.0% 10.0% 10.0% 10.0 10.0% 10.0% 31 Depreciation Expense 4,400,000 7,040,000 4,180,000 2,640,000 2,640,000 1,100,000 32 Tax Depreciation MACRS % 20.00% 32.00% 19.00% 12.00% 12.00% 5.00% 33 Add: Residual value 1,100,000 34 Pre-Tax Income from Project 225,000 (1.490,000) 2,757,500 5,685,000 3,835,000 3,987,500 3,875,000 35 Less: Taxes 56,250 (372,500) 689,375 1,421,250 958,750 996,875 968,750 36 After-Tax Income 168,750 (1,117,500) 2,068,125 4,263,750 2,876,250 2,990,625 2,906,250 37 Add: Depreciation 4,400,000 7,040,000 4,180,000 2,640,000 2,640,000 1,100,000 38 Less: Working Capital Investment 250,000.0 250.000 250,000 250,000 250.000 250,000 250,000 87.500 39 Cash Flow $ (22,250,000) $ 4,318,750 $ 5,672,500 $ 5,998,125 $ 6,653,750 $ 5,266,250 $ 3,840,625 $ 2,818,750 40 Cumulative Cash Flow $ 4,318,750 $ 9,991,250 $ 15,989,375 $ 22,643,125 $ 27,909,375 $ 31,750,000 $ 34,568,750 41 Cost (22,250,000) 42 Present Value 21,752,639 Cash Flow Not Required 393,125 43 Cash Out for this Investment (22,250,000) losing money 44 Net Present Value % Not Required 1.8% 45 Internal Rate of Return 13.23% % Not Required 98.2% 46 Payback Period 4.02 100.0% 47 Profitability Index 0.98 $ 48 49 Recommendation: Reject 50 Ideas to make this a profitable Investment HW Student Score Report + Enter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts