Question: please help guys . with steps. thank you Question 3 Samuel, a fund manager, has $2,000,000 to invest on behalf of his client. He is

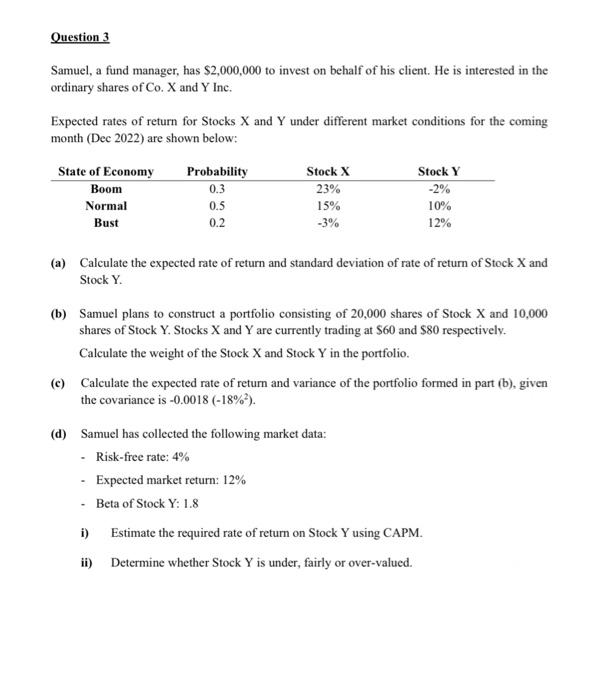

Question 3 Samuel, a fund manager, has $2,000,000 to invest on behalf of his client. He is interested in the ordinary shares of Co. X and Y Inc. Expected rates of return for Stocks X and Y under different market conditions for the coming month (Dec 2022) are shown below: (a) Calculate the expected rate of return and standard deviation of rate of return of Stock X and Stock Y. (b) Samuel plans to construct a portfolio consisting of 20,000 shares of Stock X and 10,000 shares of Stock Y. Stocks X and Y are currently trading at $60 and $80 respectively. Calculate the weight of the Stock X and Stock Y in the portfolio. (c) Calculate the expected rate of return and variance of the portfolio formed in part (b), given the covariance is 0.0018(18%2). (d) Samuel has collected the following market data: - Risk-free rate: 4% - Expected market return: 12% - Beta of Stock Y:1.8 i) Estimate the required rate of return on Stock Y using CAPM. ii) Determine whether Stock Y is under, fairly or over-valued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts