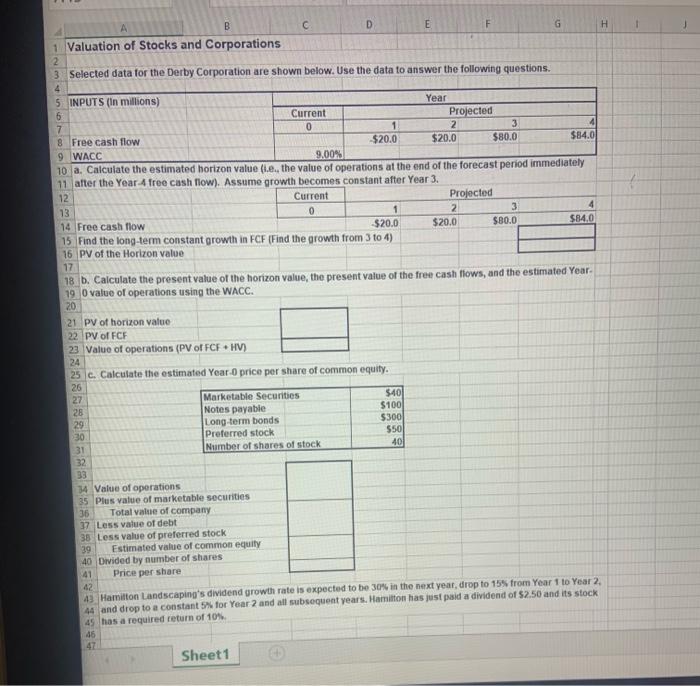

Question: please help H B D E F G 1 Valuation of Stocks and Corporations 2 3 Selected data for the Derby Corporation are shown below.

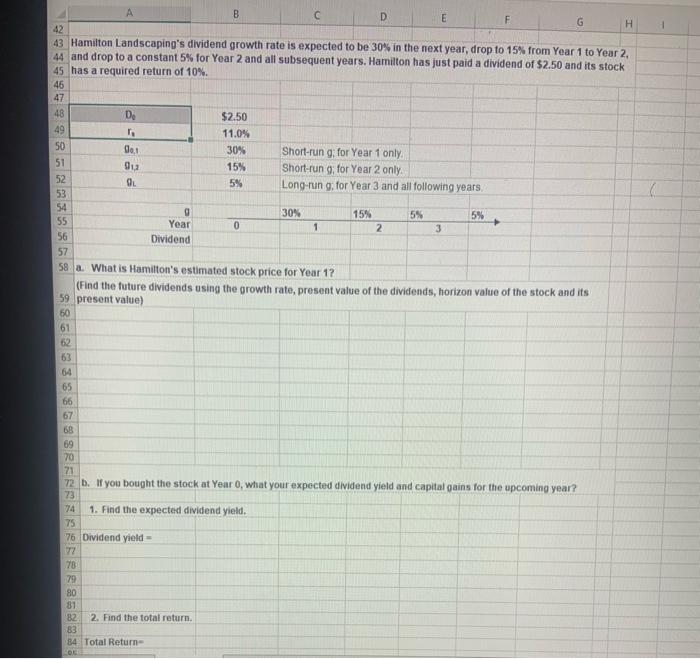

H B D E F G 1 Valuation of Stocks and Corporations 2 3 Selected data for the Derby Corporation are shown below. Use the data to answer the following questions. 4 5 INPUTS (in millions) Year 6 Current Projected 7 0 1 2 3 8 Free cash flow $20.0 $20.0 $80.0 $84.0 9 WACC 9.00% 10 a. Calculate the estimated horizon Value fi.e., the value of operations at the end of the forecast period immediately 11 after the Year-4 free cash flow). Assume growth becomes constant after Year 3. 12 Current Projected 13 0 1 2 3 14. Free cash flow $20.0 $20.0 $80.0 $84.0 15 Find the long-term constant growth in FCF (Find the growth from 3 to 4) 16 PV of the Horizon value 17 18 b. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year. 19 O value of operations using the WACC. 20 21 PV of horizon value 22 PV of FCF 23 Value of operations (PV of FCF HV) 24 25 c. Calculate the estimated Year-Oprice per share of common equity. 26 27 Marketable Securities 540) 28 Notes payable $100 29 Long-term bonds $300 30 Preferred stock $50 31 Number of shares of stock 40 33 34 Value of operations 35 Plus value of marketable securities 36 Total value of company 37 Less value of debt 38 Less value of preferred stock 39 Estimated value of common equity 40 Divided by number of shares 41 Price per share 42 43 Hamilton Landscaping's dividend growth rate is expected to be 30% in the next year, drop to 15 from Year 1 to Year 2 44 and drop to a constant 5% for Year 2 and all subsequent years. Hamilton has just paid a dividend of $2.50 and its stock 45 has a required return of 10% 46 Sheet1 B D E F G H 42 43 Hamilton Landscaping's dividend growth rate is expected to be 30% in the next year, drop to 15% from Year 1 to Year 2 44 and drop to a constant 5% for Year 2 and all subsequent years. Hamilton has just paid a dividend of $2.50 and its stock 45 has a required return of 10%. 46 48 De $2.50 49 . 11.0% 50 001 30% Short-rung: for Year 1 only 51 gu 15% Short-run g, for Year 2 only 52 OL 5% Long-run g, for Year 3 and all following years. 53 54 0 30% 15% 5% 5% 55 Year 0 1 2 3 56 Dividend 57 58 a. What is Hamilton's estimated stock price for Year 12 (Find the future dividends using the growth rate, present value of the dividends, horizon value of the stock and its 59 present value) 60 61 62 63 65 66 67 68 69 70 71 72 b. If you bought the stock at Year 0, what your expected dividend yield and capital gains for the upcoming year? 73 74 1. Find the expected dividend yield. 75 76 Dividend yield 777 78 79 80 81 B2 2. Find the total return 83 84 Total Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts