Question: please help have been stuck on this question for hours. thank you Your company is considering a project with the following after-tax cash flows (in

please help have been stuck on this question for hours. thank you

please help have been stuck on this question for hours. thank you

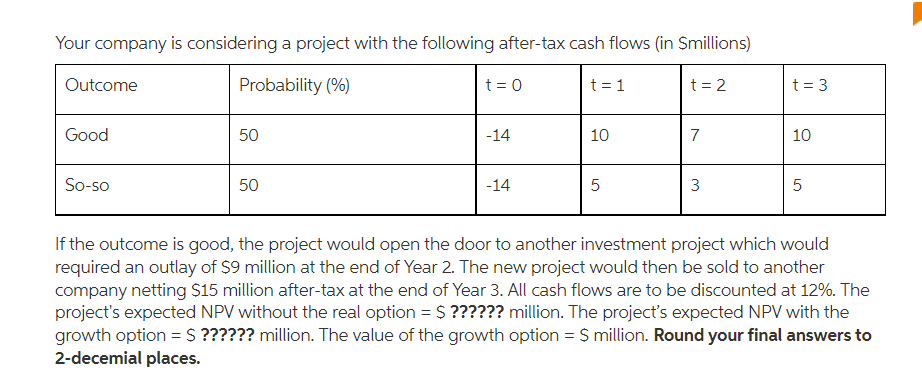

Your company is considering a project with the following after-tax cash flows (in Smillions) Outcome Probability (%) t=0 t=1 t = 2 t=3 Good 50 -14 10 7 10 So-so 50 -14 5 3 5 If the outcome is good, the project would open the door to another investment project which would required an outlay of $9 million at the end of Year 2. The new project would then be sold to another company netting $15 million after-tax at the end of Year 3. All cash flows are to be discounted at 12%. The project's expected NPV without the real option = $ ?????? million. The project's expected NPV with the growth option = $ ?????? million. The value of the growth option = $ million. Round your final answers to 2-decemial places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts