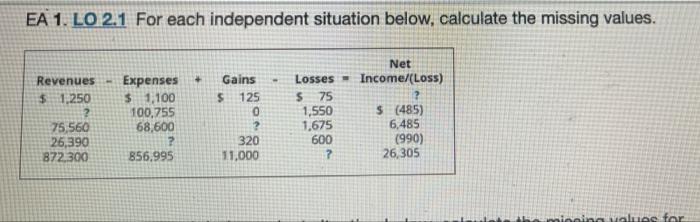

Question: please help have to do this on excel spreadsheet EA 1. LO 2.1 For each independent situation below, calculate the missing values. Net Income/(Loss) Expenses

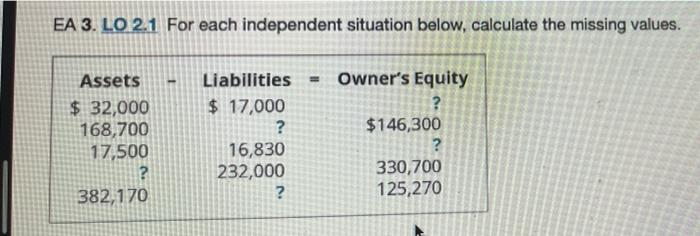

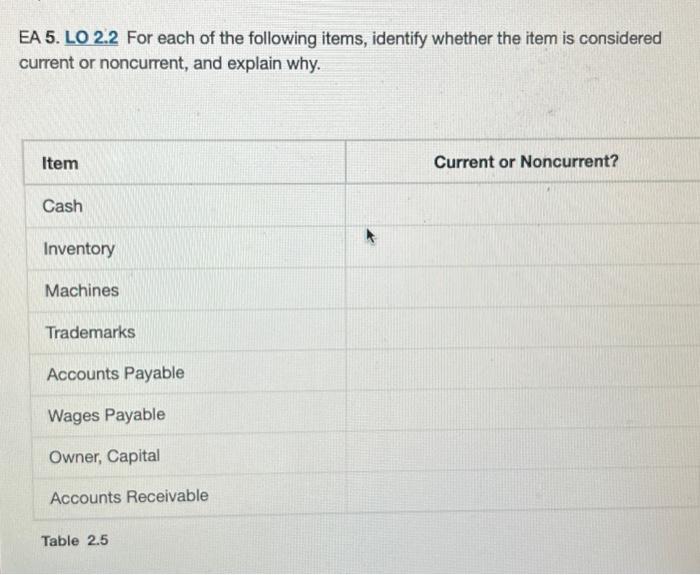

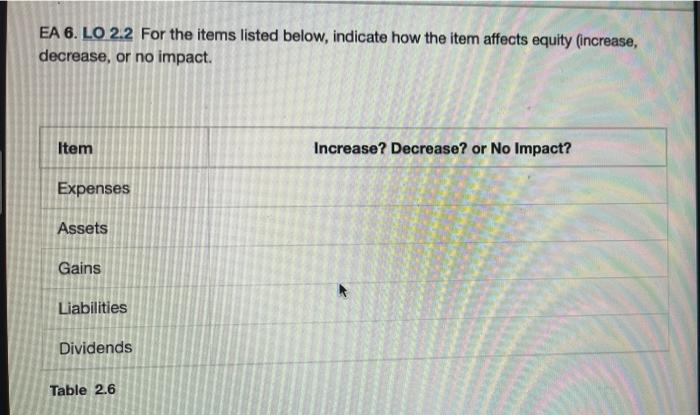

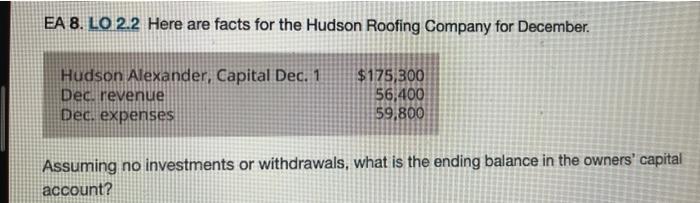

EA 1. LO 2.1 For each independent situation below, calculate the missing values. Net Income/(Loss) Expenses + Gains - Losses Revenues $1,250 $ 1,100 $ 125 S 75 0 1,550 $ (485) 75,560 100,755 68,600 ? 1,675 6,485 26,390 320 600 872,300 856.995 11,000 ? iets the missing values for (990) 26,305 EA 3. LO 2.1 For each independent situation below, calculate the missing values. Assets - Liabilities = Owner's Equity $ 32,000 $ 17,000 ? 168,700 ? $146,300 17,500 16,830 ? ? 232,000 330,700 382,170 ? 125,270 EA 5. LO 2.2 For each of the following items, identify whether the item is considered current or noncurrent, and explain why. Item Current or Noncurrent? Cash Inventory Machines Trademarks Accounts Payable Wages Payable Owner, Capital Accounts Receivable Table 2.5 EA 6. LO 2.2 For the items listed below, indicate how the item affects equity (increase, decrease, or no impact. Item Increase? Decrease? or No Impact? Expenses Assets Gains Liabilities Dividends Table 2.6 EA 8. LO 2.2 Here are facts for the Hudson Roofing Company for December. Hudson Alexander, Capital Dec. 1 $175,300 Dec. revenue 56,400 Dec. expenses 59,800 Assuming no investments or withdrawals, what is the ending balance in the owners' capital account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts