Question: please help Highland Mining and Minerals Co. is considering the purchase of two goid mines. Oniy one investment will be made. The Australian goid mine

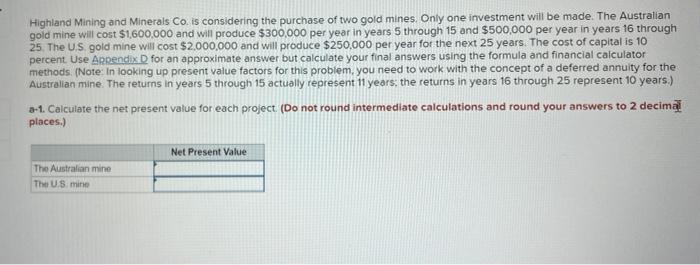

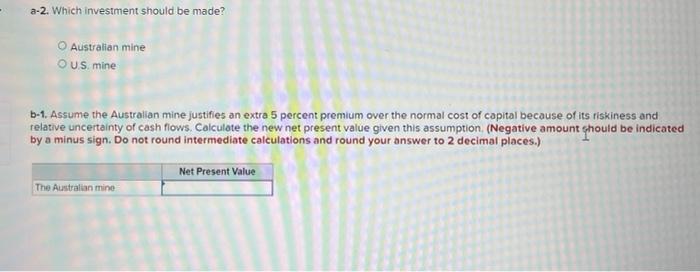

Highland Mining and Minerals Co. is considering the purchase of two goid mines. Oniy one investment will be made. The Australian goid mine will cost $1,600,000 and will produce $300,000 per year in years 5 through 15 and $500,000 per year in years 16 through 25 The US gold mine will cost $2,000,000 and will produce $250,000 per year for the next 25 years. The cost of capital is 10 percent. Use ApRendix D for an approximate answer but calculate your final answers using the formula and financial calculator methods. (Note: In looking up present value factors for this probiem, you need to work with the concept of a deferred annuity for the Australian mine. The returns in years 5 through 15 actually represent 11 years; the returns in years 16 through 25 represent 10 years. a-1. Calculate the net present value for each project. (Do not round intermediate calculations and round your answers to 2 decimai places.) a-2. Which investment should be made? Australian mine US. Sine b-1. Assume the Australian mine justifies an extra 5 percent premium over the normal cost of capital because of its fiskiness and relative uncertainty of cash flows. Calculate the new net present value given this assumption. (Negative amount ohould be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) b-2. Does the new assumption change the investment decision? yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts