Question: Please help. How can I solve this on excel? Torreo Coffee Roaster is considering replacing one of its existing machines with a new one. Torreo

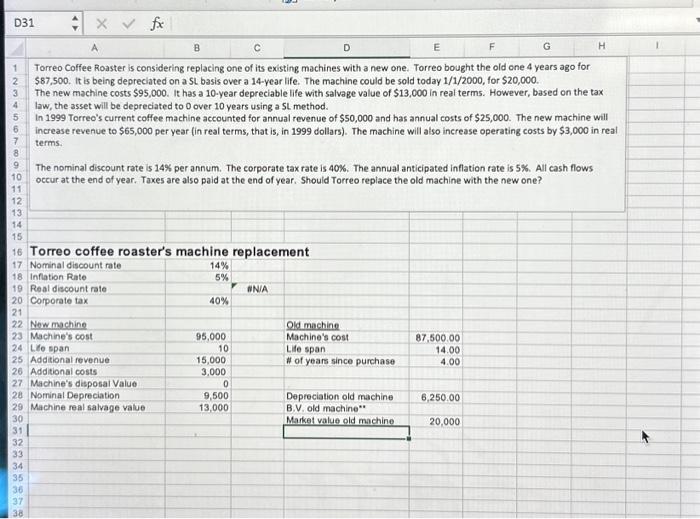

Torreo Coffee Roaster is considering replacing one of its existing machines with a new one. Torreo bought the old one 4 years ago for $87,500. It is being depreciated on a SL basis over a 14-year life. The machine could be sold today 1/1/2000, for $20,000. The new machine costs $95,000. It has a 10-year depreciable life with salvage value of $13,000 in real terms. However, based on the tax law, the asset will be depreciated to 0 over 10 years using a SL method. In 1999 Torreo's current coffee machine accounted for annual revenue of $50,000 and has annual costs of $25,000. The new machine will increase revenue to $65,000 per year (in real terms, that is, in 1999 dollars). The machine will also increase operating costs by $3,000 in real terms. The nominal discount rate is 14% per annum. The corporate tax rate is 40%. The annual anticipated inflation rate is 5%. All cash flows occur at the end of year. Taxes are also paid at the end of year. Should Torreo replace the old machine with the new one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts