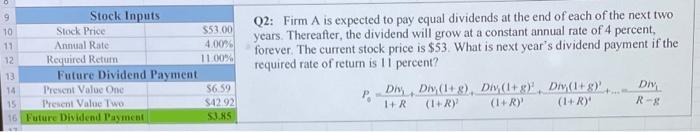

Question: Please Help! How do you fogure out the Future Divided Payment? *figure 9 Stock Inputs 10 Stock Price 553.00 11 Annual Rate 4.00% 12 Required

9 Stock Inputs 10 Stock Price 553.00 11 Annual Rate 4.00% 12 Required Retum 11.00% 13 Future Dividend Payment 14 Present Value One $6.59 15 Present Value Two $42.92 16 Future Dividend payment SUNS Q2: Firm A is expected to pay equal dividends at the end of each of the next two years. Thereafter, the dividend will grow at a constant annual rate of 4 percent, forever. The current stock price is $53. What is next year's dividend payment if the required rate of retum is 11 percent? D Div(1+8), D (+8) Div(+8) (1+R) (1+R) (1+R) DIV R$ 1+R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts