Question: please help how to solve True or False: The time value of money states that money received in the future is worth less than money

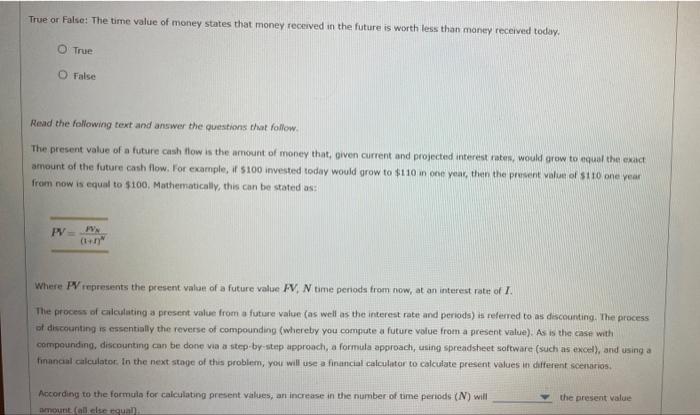

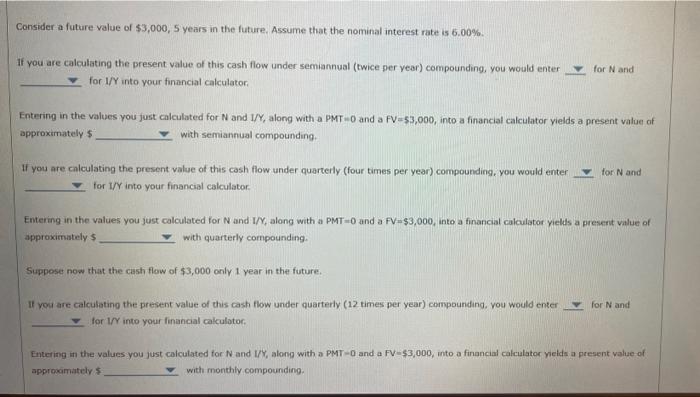

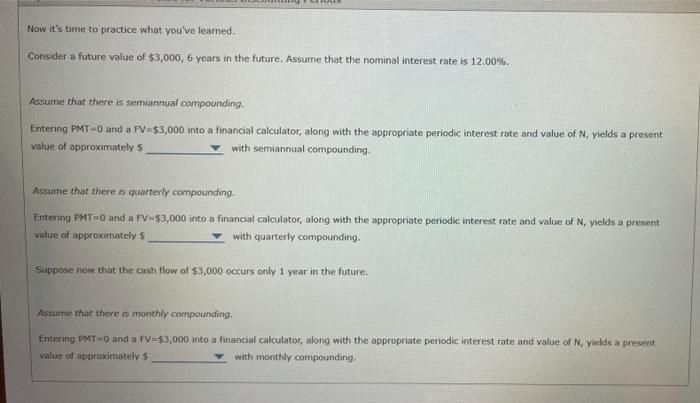

True or False: The time value of money states that money received in the future is worth less than money received today. True False Read the following text and answer the questions that follow. The present value of a future cash flow is the armount of money that, given current and projected interest rates, would grow to equar the exald amount of the future cash flow. For example, if 5100 invested today would grow to $110 in one year, then the present value of 5110 one year from now is equal to $100, Mathematically, this can be stated as: PV=(t+r)4rvA Where PV represents the present value of a future value FV,N time periods from now, at an interest rate of I. The process of calculating a present value from a future value (as well as the interest rate and periods) is relened to as descounting. The process of discounting is essentially the reverse of compounding (whereby you compute a future volue from a present value). As is the case with compounding, discounting can be done via a step-by-step approach, a formula approach, using spreadsheet software (such as excel), and using a financial calculator. In the next stage of this problem, you will use a financial calculator to calculate present values in different scentios. According to thie formula for calculating present values, an increase in the number of tame periods (N) will the present value Consider a future value of $3,000,5 years in the future. Assume that the nominal interest rate is 6.00%. If you are calculating the present value of this cash flow under semiannual (twice per year) compounding, you would enter for N and for I/Y into your financial calculator. Entering in the values you just calculated for N and U/Y, along with a PMT =0 and a FV=53,000, into a financial calculator yields a present value of approxirnately $ with semiannual compounding. If you are calculating the present value of this cosh flow under quarterly (four times per year) compounding, you would enter forN and for 1/Y into your financial calculator. Entering in the values you just calculated for N and I/Y, along with a PMT =0 and a FV=$3,000, into a financial calculator yields a present value of approxitnately $ with quarterly compounding. Suppose now that the cash flow of $3,000 only 1 year in the future. II ved are calculating the present value of this cash flow under quarterly ( 12 times per year) compouniding, vou would enter for N and for 1/Y into your financial cakculotor. Entering in the values you just calculated for N and I/Y, along with a PMT Q and a FV$3,000, into a financial calculator yelds a present value of approxamately $ with monthly compounding. Now it's time to practice what you've learned. Consider a future value of $3,000,6 years in the future. Assume that the nominal interest rate is 12.00%. Assume that there is semiannual compounding. Entering PMT =0 and a FV=$3,000 into a financial calculator, along with the appropriate periodic interest rate and value of N, yields a present value of approximately $ with semiannual compounding. Assume that there is quarterly compounding. Entening PMT =0 and a FV- $3,000 into a financal calculator, along with the appropriate periodic interest rate and value of N, yields a present value of approximately $ with quarterly compounding. Suppose now that the cash flow of $3,000 occurs only 1 year in the future. Assume that there is monthly compounding. Entering pMT =0 and a FV =$3,000 into a financial calculator, along with the appropriate periodic interest rate and value of N, yields a present value of approximately 5 with monthly compounding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts