Question: Please help I am having a hard time in answering b and c Bracken, Louden, and Menser, who share profits and losses in a ratio

Please help I am having a hard time in answering b and c

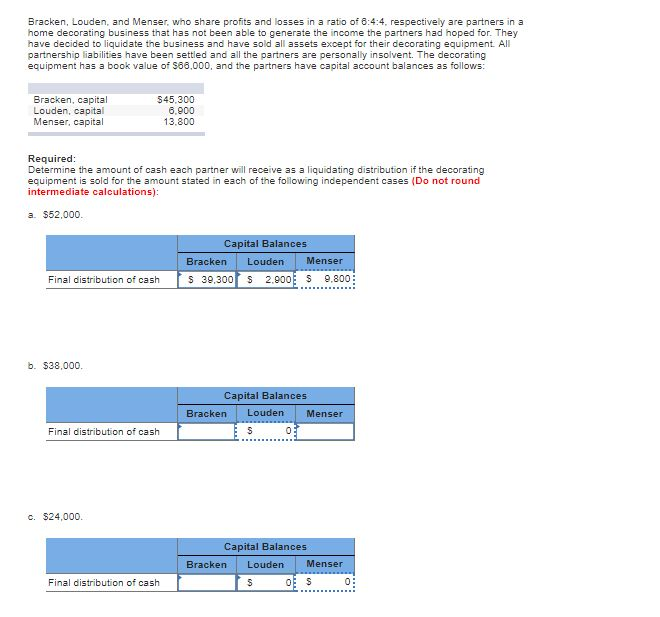

Bracken, Louden, and Menser, who share profits and losses in a ratio of 8:4:4, respectively are partners in a home decorating business that has not been able to generate the income the partners had hoped for. They have decided to liquidate the business and have sold all assets except for their decorating equipment All partnership liabilities have been settled and all the partners are personally insolvent. The decorating equipment has a book value of $66,000, and the partners have capital account balances as follows Bracken, capital Louden, capital Menser, capital 545.300 6,900 13.800 Required Determine the amount of cash each partner will receive as a liquidating distribution if the decorating equipment is sold for the amount stated in each of the following independent cases (Do not round intermediate calculations): a. $52,000 Capital Balances Bracken Louden Menser 5 39,300 2,900E 9,800 Final distribution of cash b. $38,000 Capital Balances Bracken Louden Menser Final distribution of cash C. $24,000 Capital Balances Bracken Louden Menser Final distribution of cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts