Question: Please help! I am having trouble figuring out line 1 and the gross sales price (line 2d). Wendy O'Neil (SSN 412-34-5670), who is single, worked

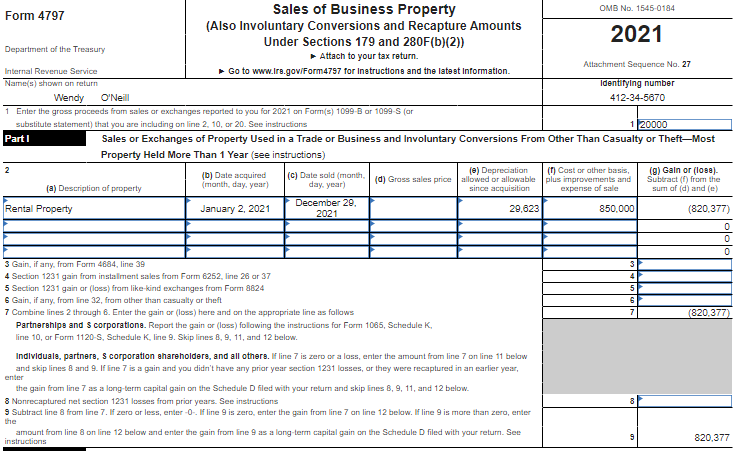

Please help! I am having trouble figuring out line 1 and the gross sales price (line 2d).

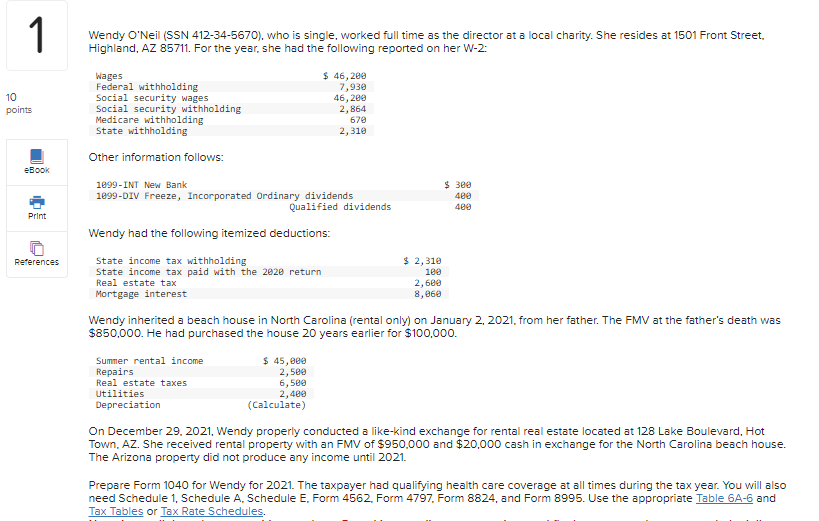

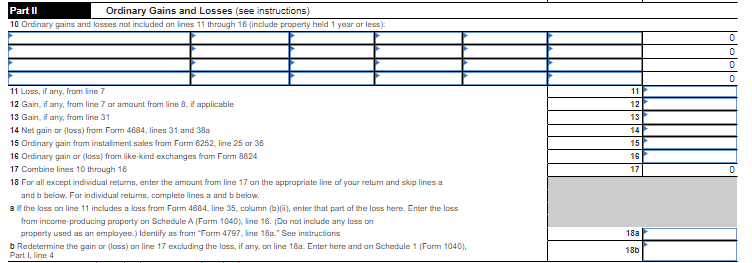

Wendy O'Neil (SSN 412-34-5670), who is single, worked full time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 85711. For the year, she had the following reported on her W-2: Wendy had the following itemized deductions: Wendy inherited a beach house in North Carolina (rental only) on January 2, 2021, from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000. On December 29, 2021. Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Boulevard, Hot Town. AZ. She received rental property with an FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2021. Prepare Form 1040 for Wendy for 2021 . The taxpayer had qualifying health care coverage at all times during the tax year. You will also need Schedule 1, Schedule A. Schedule E, Form 4562, Form 4797, Form 8824, and Form 8995. Use the appropriate Tax Tables or Tax Rate Schedules. Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) \begin{tabular}{l|l} \hline Part II & Ordinary Gains and Losses (see instructions) \\ \hline 10 Oruinary gains and lasses not included on fines 11 thraugh 16 (include property held 1 year or less): \end{tabular} \begin{tabular}{l} \hline \end{tabular} Wendy O'Neil (SSN 412-34-5670), who is single, worked full time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 85711. For the year, she had the following reported on her W-2: Wendy had the following itemized deductions: Wendy inherited a beach house in North Carolina (rental only) on January 2, 2021, from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000. On December 29, 2021. Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Boulevard, Hot Town. AZ. She received rental property with an FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2021. Prepare Form 1040 for Wendy for 2021 . The taxpayer had qualifying health care coverage at all times during the tax year. You will also need Schedule 1, Schedule A. Schedule E, Form 4562, Form 4797, Form 8824, and Form 8995. Use the appropriate Tax Tables or Tax Rate Schedules. Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) \begin{tabular}{l|l} \hline Part II & Ordinary Gains and Losses (see instructions) \\ \hline 10 Oruinary gains and lasses not included on fines 11 thraugh 16 (include property held 1 year or less): \end{tabular} \begin{tabular}{l} \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts