Question: Please help, I am not sure if my amortization schedule is correct and I am confused on how to record the retirement of bonds. Note:

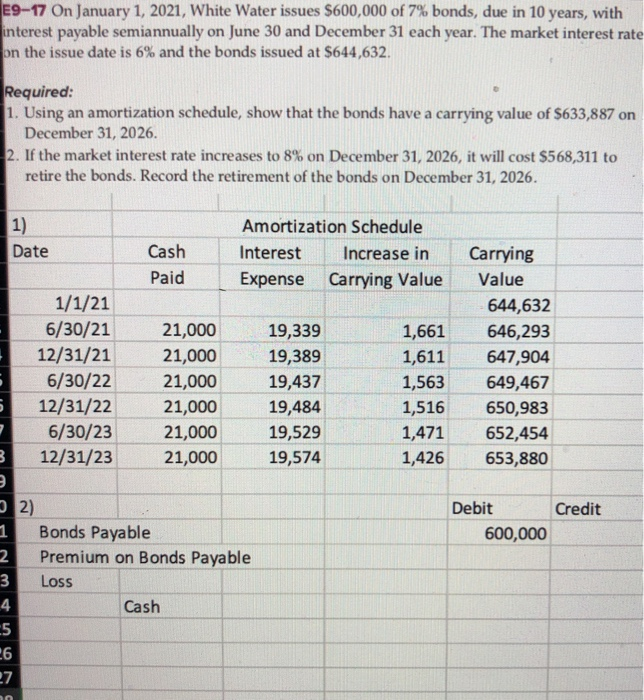

E9-17 On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate on the issue date is 6% and the bonds issued at $644,632. Required: 1. Using an amortization schedule, show that the bonds have a carrying value of $633,887 on December 31, 2026. 2. If the market interest rate increases to 8% on December 31, 2026, it will cost $568,311 to retire the bonds. Record the retirement of the bonds on December 31, 2026. Date Cash Paid Amortization Schedule Interest Increase in Expense Carrying Value 1/1/21 6/30/21 12/31/21 6/30/22 12/31/22 6/30/23 12/31/23 21,000 21,000 21,000 21,000 21,000 21,000 19,339 19,389 19,437 19,484 19,529 19,574 1,661 1,611 1,563 1,516 1,471 1,426 Carrying Value 644,632 646,293 647,904 649,467 650,983 652,454 653,880 2) Credit Debit 600,000 Bonds Payable Premium on Bonds Payable Loss Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts