Question: please help i am stuck, need help question 1 a-c Styles 1) This question asks you to estimate the value of one share of stock

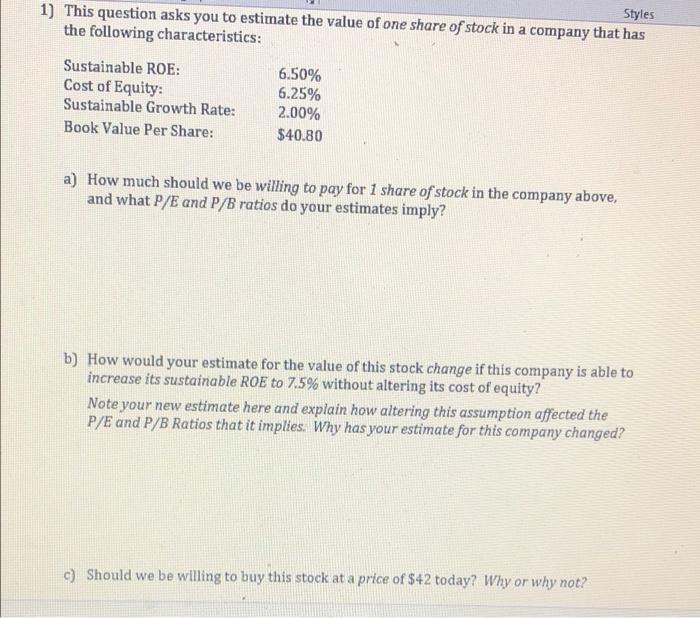

Styles 1) This question asks you to estimate the value of one share of stock in a company that has the following characteristics: Sustainable ROE: Cost of Equity: Sustainable Growth Rate: Book Value Per Share: 6.50% 6.25% 2.00% $40.80 a) How much should we be willing to pay for 1 share of stock in the company above, and what P/E and P/B ratios do your estimates imply? b) How would your estimate for the value of this stock change if this company is able to increase its sustainable ROE to 7.5% without altering its cost of equity? Note your new estimate here and explain how altering this assumption affected the P/E and P/B Ratios that it implies. Why has your estimate for this company changed? c) Should we be willing to buy this stock at a price of $42 today? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts