Question: please help! i appreciate it! Data concerning a recent period's activity in the Assembly Department, the first processing department in a company that uses the

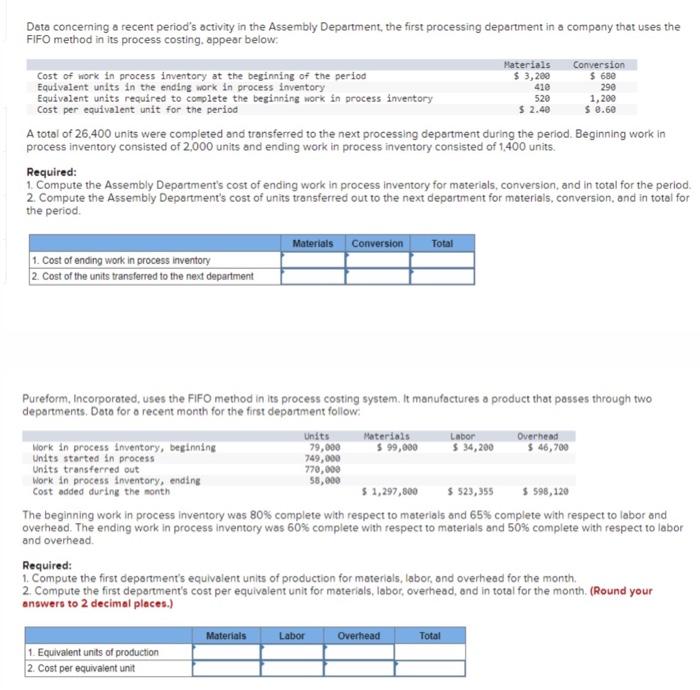

Data concerning a recent period's activity in the Assembly Department, the first processing department in a company that uses the FIFO method in its process costing, appear below: Cost of work in process inventory at the beginning of the period Equivalent units in the ending work in process inventory Equivalent units required to complete the beginning work in process inventory Cost per equivalent unit for the period A total of 26,400 units were completed and transferred to the next processing department during the period. Beginning work in process inventory consisted of 2,000 units and ending work in process inventory consisted of 1,400 units. 1. Cost of ending work in process inventory 2. Cost of the units transferred to the next department Required: 1. Compute the Assembly Department's cost of ending work in process inventory for materials, conversion, and in total for the period. 2. Compute the Assembly Department's cost of units transferred out to the next department for materials, conversion, and in total for the period. Work in process inventory, beginning Units started in processi Units transferred out Work in process inventory, ending Cost added during the month Materials Conversion Pureform, Incorporated, uses the FIFO method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: 1. Equivalent units of production 2. Cost per equivalent unit Units Materials 79,000 749,000 770,000 58,000 Materials $ 99,000 Labor Total Materials $ 3,200 410 520 $ 2.40 $1,297,800 $ 523,355 $ 598,120 The beginning work in process inventory was 80% complete with respect to materials and 65% complete with respect to labor and overhead. The ending work in process inventory was 60% complete with respect to materials and 50% complete with respect to labor and overhead. Overhead Conversion $ 680 290 1,200 $ 0.60 Labor $ 34,200 Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Compute the first department's cost per equivalent unit for materials, labor, overhead, and in total for the month. (Round your answers to 2 decimal places.) Total Overhead $ 46,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts