Question: Please help! I can't figure this out and only have 1 attempt On January 1, 2019, Tamarisk Company, a small machine-tool manufacturer, acquired for $2,170,000

Please help! I can't figure this out and only have 1 attempt

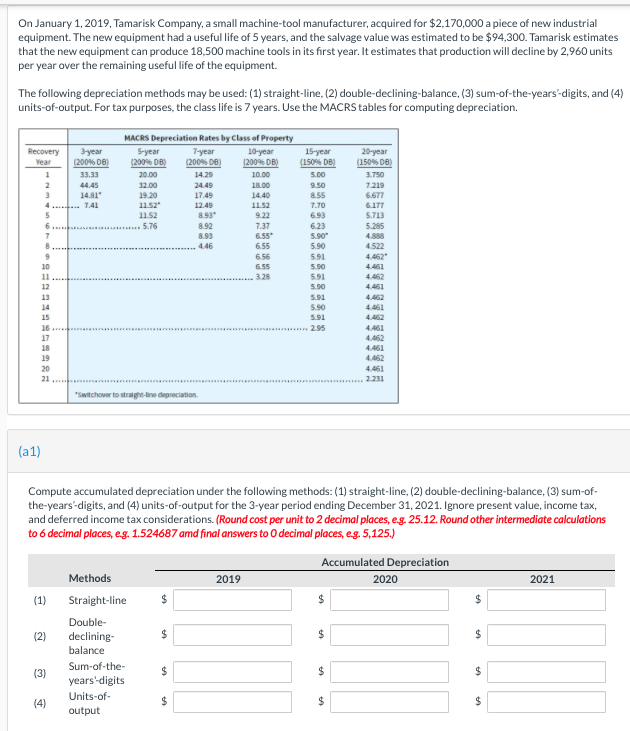

On January 1, 2019, Tamarisk Company, a small machine-tool manufacturer, acquired for $2,170,000 a piece of new industrial equipment. The new equipment had a useful life of 5 years, and the salvage value was estimated to be $94,300. Tamarisk estimates that the new equipment can produce 18,500 machine tools in its first year. It estimates that production will decline by 2,960 units per year over the remaining useful life of the equipment. The following depreciation methods may be used: (1) straight-line, (2) double-declining-balance, (3) sum-of-the-years-digits, and (4) units-of-output. For tax purposes, the class life is 7 years. Use the MACRS tables for computing depreciation. MACRS Depreciation Rates by Class of Property Recovery Byear S-year 7 year 10-year Year (200% DB) (200% DB) (200% DB) 1200% DB) 1 33.33 20.00 14.29 10.00 2 24.49 18.00 3 14.81" 19.20 17.49 14.40 4.-... 14 11.52 12.49 11.52 5 1152 8.93 9.22 6............... 5.76 8.92 7.37 7 8.93 6.55 4.46 6.55 9 6.56 10 6.55 11 3.28 15-year (150% DB) 5.00 9.50 8.55 7.70 20-year (150% DB 3.750 7.219 6.677 5.713 5.285 6.23 5.90" 5.90 5.91 5.50 5.91 4.522 5.00 13 14 15 5.91 5.90 5.91 2.95 4.461 4.461 17 18 19 20 4.461 2.231 Switchower to straight-line depreciation (21) Compute accumulated depreciation under the following methods: (1) straight-line, (2) double-declining-balance, (3) sum-of- the-years"-digits, and (4) units-of-output for the 3-year period ending December 31, 2021. Ignore present value, income tax, and deferred income tax considerations. (Round cost per unit to 2 decimal places, eg. 25.12. Round other intermediate calculations to 6 decimal places, eg, 1.524687 and final answers to decimal places, eg. 5,125.) Accumulated Depreciation Methods 2019 2020 2021 1) Straight-line $ $ $ (2) $ $ $ Double- declining balance Sum-of-the- years'-digits Units-of- output (3) $ $ $ (4) $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts