Question: please help , I dont know how to do these asigments . GROUP TINO ASSIGNMENT $1,000 Jand a fair whicchar dan W e preparing Massie

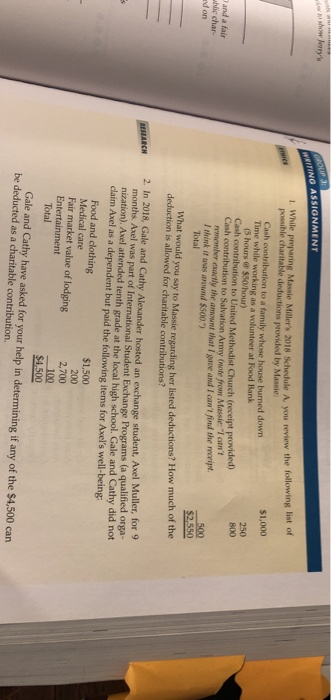

GROUP TINO ASSIGNMENT $1,000 Jand a fair whicchar dan W e preparing Massie Miller's 2018 Schedule A you review the following possible charitable deductions provided by Massie: Cash contribution to a family whose house burned down Time while working as a volunteer at Food Bank (5 hours $50/hour) 250 Cash contribution to United Methodist Church (receipt provided) 800 Cash contribution to Salvation Army (note from Mass rectly the amount that I gue and I can't find the part I think if us around $500.") 500 Total $2.550 What would you say to Massie regarding her listed deductions? How much of the deduction is allowed for charitable contributions? SEARCH 2. In 2018, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified orga nization). Axel attended tenth grade at the local high school. Gale and Cathy did not claim Axelas a dependent but paid the following items for Axel's well-being Food and clothing $1,500 Medical care Fair market value of lodging 2,700 Entertainment 100 Total $4,500 Gale and Cathy have asked for your help in determining if any of the $4,500 can be deducted as a charitable contribution. 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts