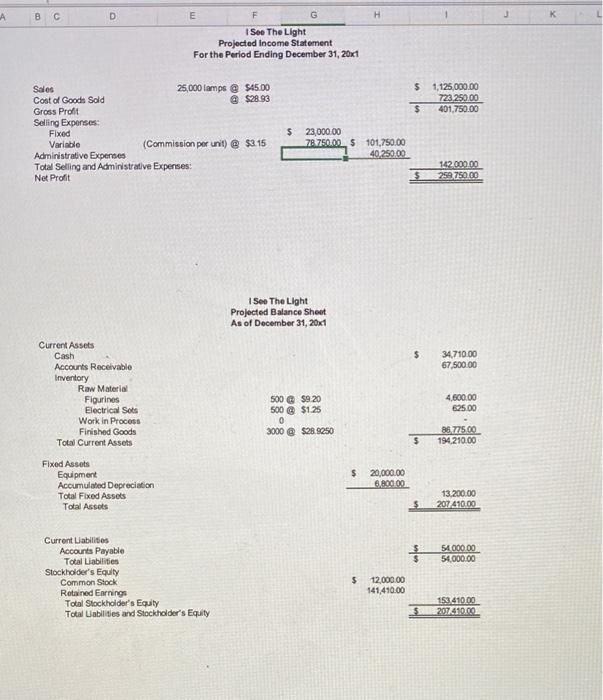

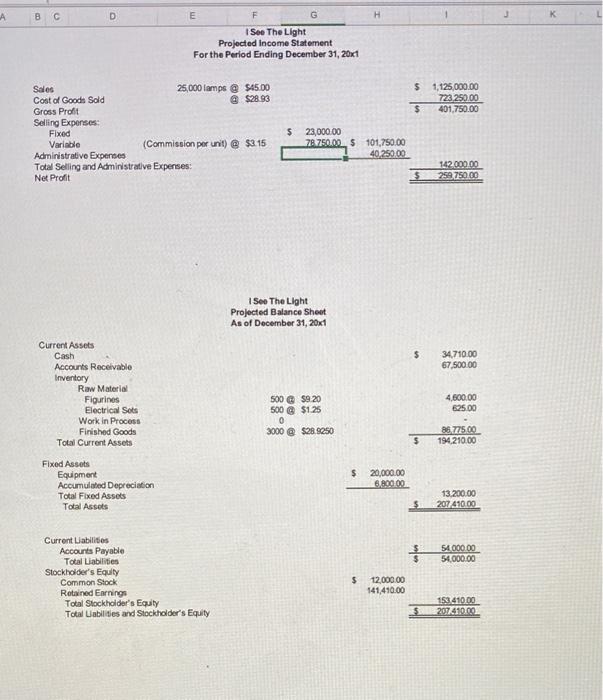

Question: please help. i dont know if im doing this right. thank you. Projocted Income Statement ForthePeriodEndingDecemb 15ee The Light Projected Balance Sheet As of December

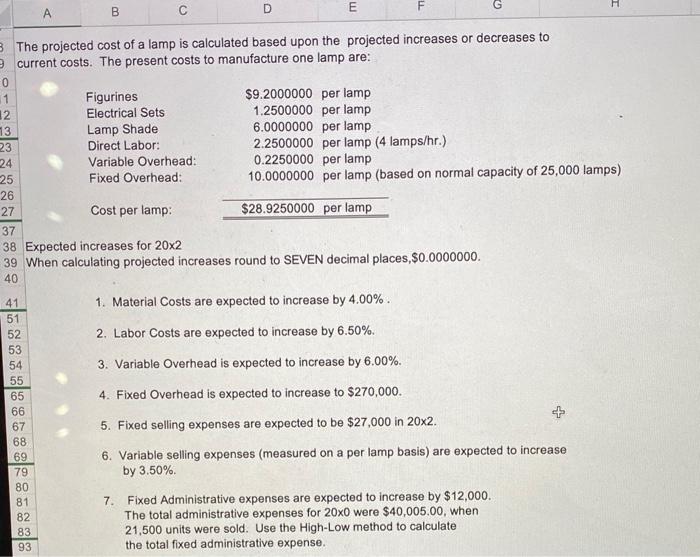

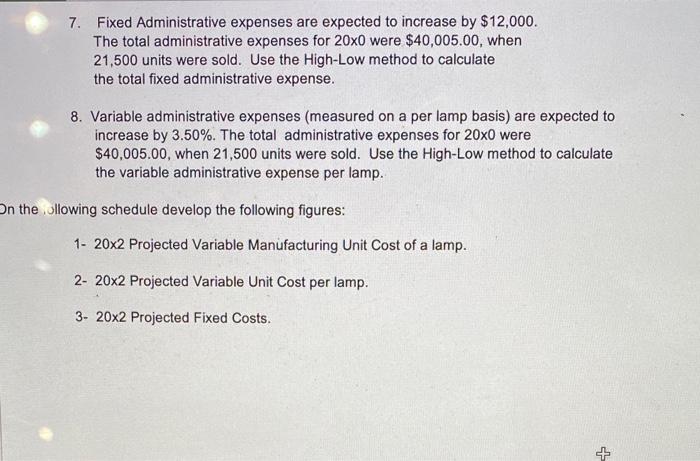

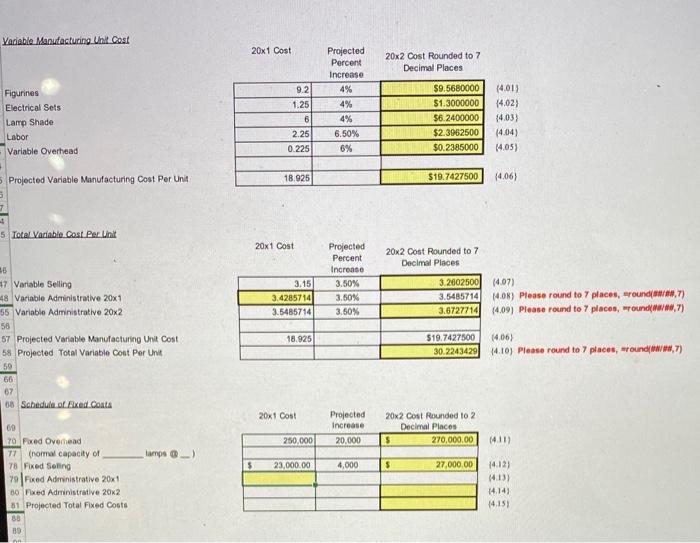

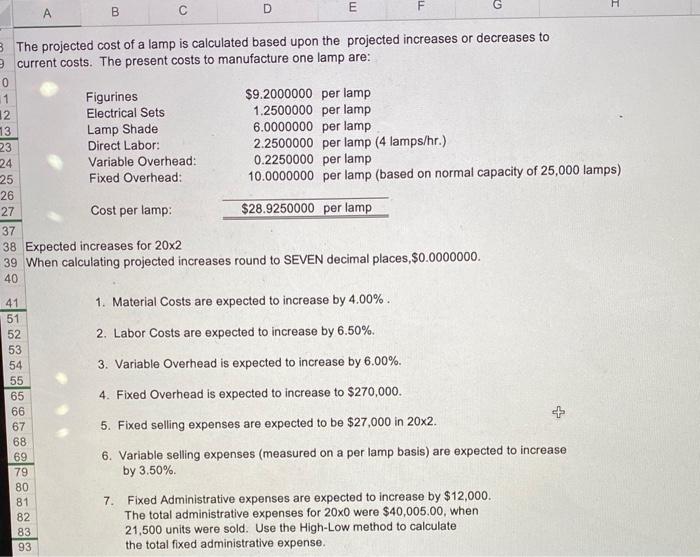

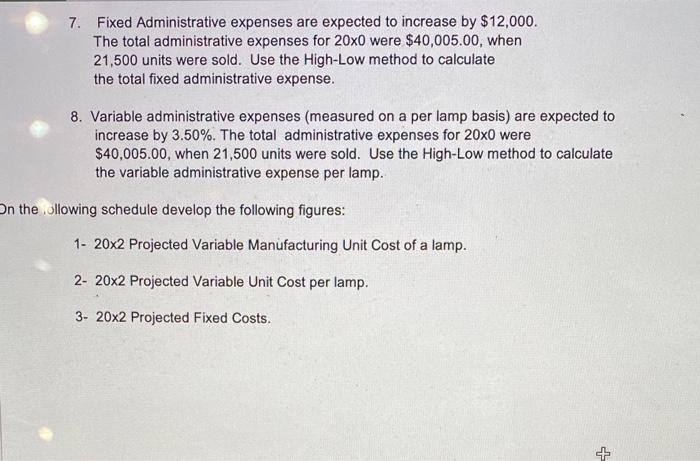

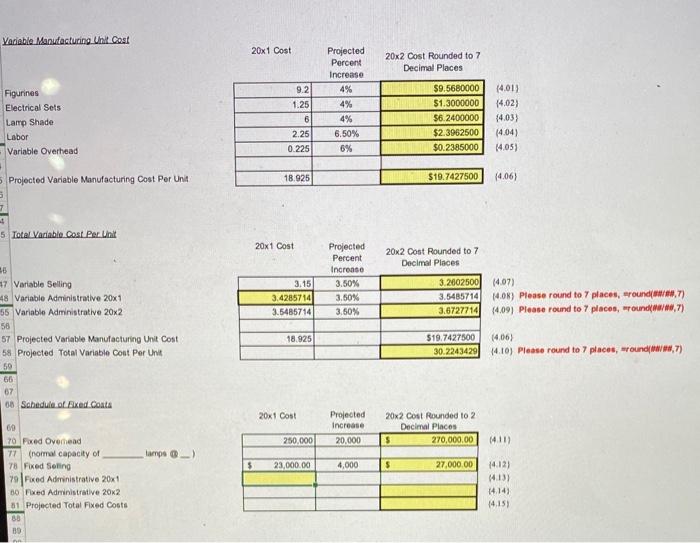

Projocted Income Statement ForthePeriodEndingDecemb 15ee The Light Projected Balance Sheet As of December 31, 20xt 500 \& $9.20 500 (4) $1.25 0 3000 (i) $28.9250 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assots Current Assets Cash Accounts Reccetable Invertory Raw Materid Figurines Electrical Sots Work in Process Firished Goods Total Current Assets Total Assots 86,725005194,210.00 \begin{tabular}{rr} 58,0000020,00000 & \\ & 13,200.00 \\ & 207,410.00 \\ \hline \end{tabular} Curront Liabilitios Accourts Payable Total Liablities Stockholder's Equity Common Stock: 512,000.00141,410.00153,410.00 The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to SEVEN decimal places,\$0.0000000. 1. Material Costs are expected to increase by 4.00%. 2. Labor Costs are expected to increase by 6.50%. 3. Variable Overhead is expected to increase by 6.00%. 4. Fixed Overhead is expected to increase to $270,000. 5. Fixed selling expenses are expected to be $27,000 in 202. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.50%. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. . llowing schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs. Variable Manufacturing Unit cost 201costinrrasenProjectedPercent202costRoundedto7DecimalPlaces Figurines Electrical Sets Lamp Shade Labor Variable Overhead Projected Variable Manulacturing Cost Per Una Please round to 7 places, =round(aw)eten,7) Yease round to 7 places, =roundi(main. Projocted Income Statement ForthePeriodEndingDecemb 15ee The Light Projected Balance Sheet As of December 31, 20xt 500 \& $9.20 500 (4) $1.25 0 3000 (i) $28.9250 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assots Current Assets Cash Accounts Reccetable Invertory Raw Materid Figurines Electrical Sots Work in Process Firished Goods Total Current Assets Total Assots 86,725005194,210.00 \begin{tabular}{rr} 58,0000020,00000 & \\ & 13,200.00 \\ & 207,410.00 \\ \hline \end{tabular} Curront Liabilitios Accourts Payable Total Liablities Stockholder's Equity Common Stock: 512,000.00141,410.00153,410.00 The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to SEVEN decimal places,\$0.0000000. 1. Material Costs are expected to increase by 4.00%. 2. Labor Costs are expected to increase by 6.50%. 3. Variable Overhead is expected to increase by 6.00%. 4. Fixed Overhead is expected to increase to $270,000. 5. Fixed selling expenses are expected to be $27,000 in 202. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 7. Fixed Administrative expenses are expected to increase by $12,000. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.50%. The total administrative expenses for 200 were $40,005.00, when 21,500 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp. . llowing schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs. Variable Manufacturing Unit cost 201costinrrasenProjectedPercent202costRoundedto7DecimalPlaces Figurines Electrical Sets Lamp Shade Labor Variable Overhead Projected Variable Manulacturing Cost Per Una Please round to 7 places, =round(aw)eten,7) Yease round to 7 places, =roundi(main

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts