Question: PLEASE HELP I HAVE AN ASSIGNMENT DUE IN 20 mins On January 14 , the end of the first pay period of the year, a

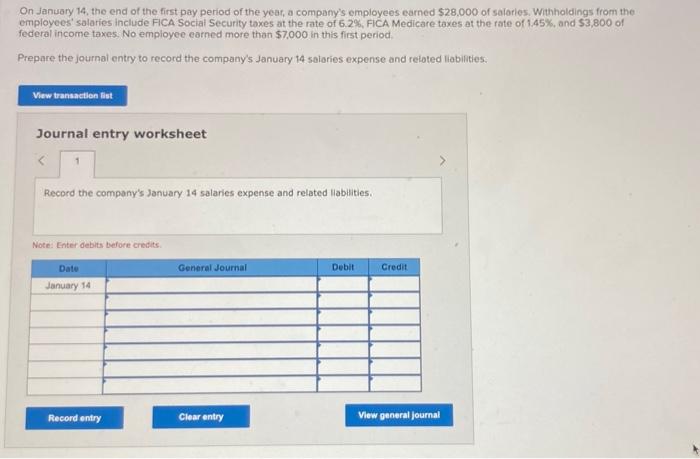

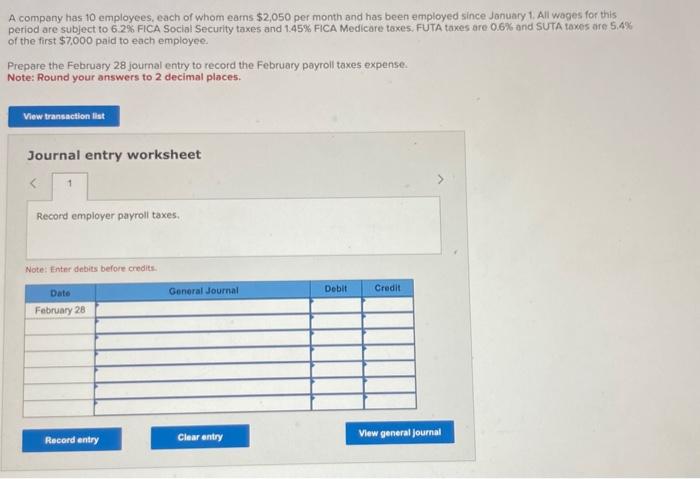

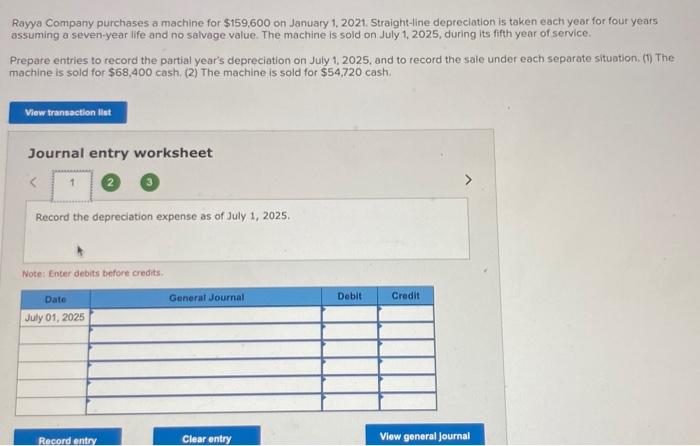

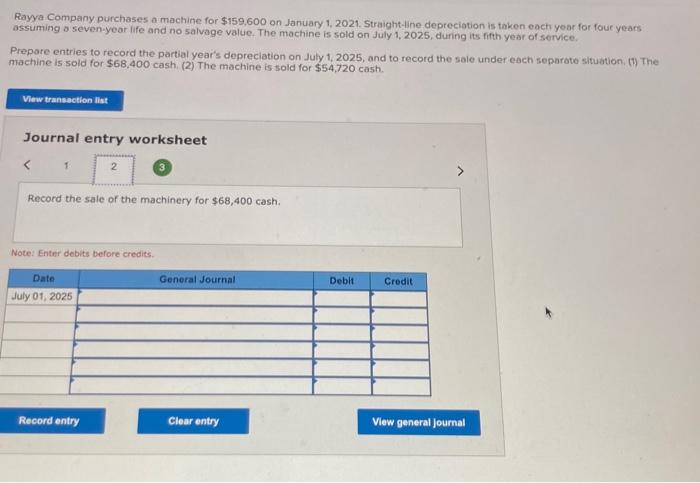

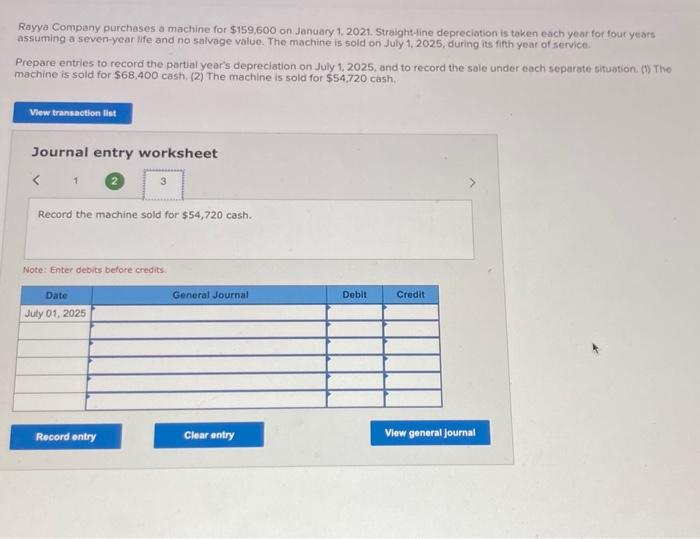

On January 14 , the end of the first pay period of the year, a company's employees earned $28,000 of salaries. Withhaldings from the employees' salaries include FCA Social Security toxes at the rate of 6.2%, FiCA Medicare taxes at the rate of 1.45%, and $3,800 of federal income taxes, No employee earned more than $7,000 in this first period. Prepare the journal entry to record the company's January 14 salaries expense and reloted liabilities: Journal entry worksheet Record the company's January 14 salaries expense and related llabllities. Note: Enter debits before credits. A company has 10 employees, each of whom earns $2,050 per month and has been employed since January 1. All wages for this period are subject to 6.2% FICA Social Security taxes and 1.45\% FICA Medicare toxes. FUTA takes are 0.6% and $ UTA taxes are 5.4% of the first $7,000 paid to each employee. Prepare the February 28 joumal entry to record the February payroll taxes expense. Note: Round your answers to 2 decimal places. Journal entry worksheet Rayya Company purchases a machine for $159,600 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a seven-year life and no salvage value. The machine is sold on July 1, 2025 , during its fifth year of service. Prepare entries to record the partial year's depreciation on July 1, 2025, and to record the sale under each separate situation. (1) The machine is sold for $68,400 cash. (2) The machine is sold for $54,720 cash. Journal entry worksheet Record the depreciation expense as of July 1, 2025. Note: Enter debits before credits Rayya Company purchases a machine for $159,600 on January 1, 2021 . Straight-line depreciation is taken each year for fouc vears assuming o seven-year life and no salvage value. The machine is sold on July 1, 2025 , during its fifth year of service. Prepare entries to record the partial year's depreciation on July 1, 2025, and to record the sale under each separote situation, (1) The machine is sold for $68,400 cash. (2) The machine is sold for $54,720 cash. Journal entry worksheet Record the sale of the machinery for $68,400 cash. Note: Enter debits before credies. Rayya Company purchases a machine for $159,600 on January 1,2021. Straight-line depreciation is taken each year for four yeds assuming a seven-year life and no salvage value. The machine is sold on July 1, 2025, during its firth year of service. Prepare entries to record the partial year's depreciation on July 1.2025 , and to record the sale under each separate situation. ( 7 ) The machine is sold for $68,400 cash. (2) The machine is sold for $54,720 cash. Journal entry worksheet Record the machine sold for $54,720 cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts