Question: please help i havent gotten a correct answer yet Ortho Company experienced the following events during its first- and second-year operations: Year 1 Transactions: 1.

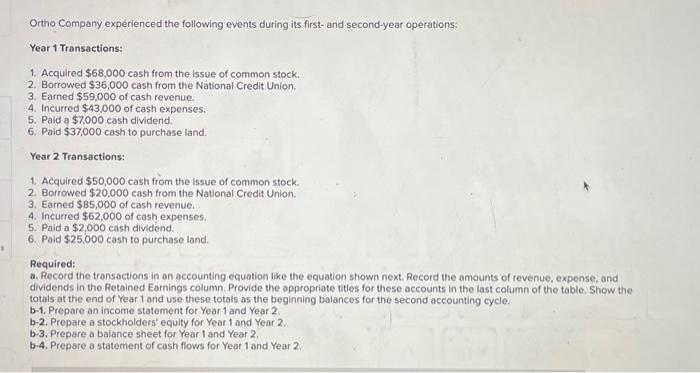

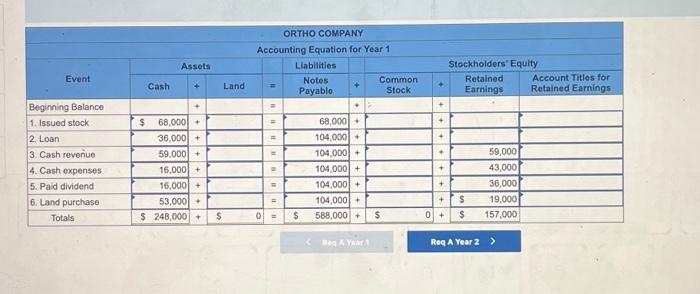

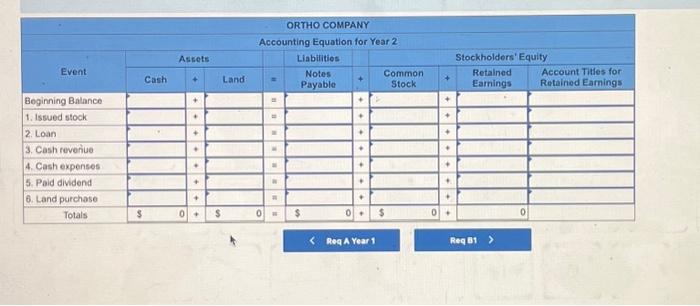

Ortho Company experienced the following events during its first- and second-year operations: Year 1 Transactions: 1. Acquired $68,000 cash from the issue of common stock. 2. Borrowed $36,000 cash from the National Credit Union. 3. Earned $59,000 of cash revenue. 4. Incurred $43,000 of cash expenses. 5. Paid a $7,000 cash dividend. 6. Paid $37,000 cash to purchase land. Year 2 Transactions: 1. Acquired $50,000 cash from the issue of common stock. 2. Borrowed $20,000 cash from the National Credit Union. 3. Earned $85,000 of cash revenue. 4. Incurred $62,000 of cash expenses. 5. Paid a $2,000 cash dividend. 6. Paid $25,000 cash to purchase land. Required: a. Record the transactions in an accounting equation like the equation shown next. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate tites for these accounts in the last column of the table. Show the totals at the end of Year 1 and use these totals as the beginning balances for the second accounting cycle. b-1. Prepare an income statement for Year 1 and Year 2 . b-2. Prepare a stockholders' equity for Year 1 and Year 2 . b-3. Prepare a baiance sheet for Year 1 and Year 2 . b-4. Prepare a statement of cash flows for Year 1 and Year 2. Req A Year 2 ? Ortho Company experienced the following events during its first- and second-year operations: Year 1 Transactions: 1. Acquired $68,000 cash from the issue of common stock. 2. Borrowed $36,000 cash from the National Credit Union. 3. Earned $59,000 of cash revenue. 4. Incurred $43,000 of cash expenses. 5. Paid a $7,000 cash dividend. 6. Paid $37,000 cash to purchase land. Year 2 Transactions: 1. Acquired $50,000 cash from the issue of common stock. 2. Borrowed $20,000 cash from the National Credit Union. 3. Earned $85,000 of cash revenue. 4. Incurred $62,000 of cash expenses. 5. Paid a $2,000 cash dividend. 6. Paid $25,000 cash to purchase land. Required: a. Record the transactions in an accounting equation like the equation shown next. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate tites for these accounts in the last column of the table. Show the totals at the end of Year 1 and use these totals as the beginning balances for the second accounting cycle. b-1. Prepare an income statement for Year 1 and Year 2 . b-2. Prepare a stockholders' equity for Year 1 and Year 2 . b-3. Prepare a baiance sheet for Year 1 and Year 2 . b-4. Prepare a statement of cash flows for Year 1 and Year 2. Req A Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts