Question: please help i & ii Question 6 i. The following exchange rates are available Buying Selling Dutch guilders (AUD) per US$ AUD1.8545/US$ AUD1.9025/US $ Canadian

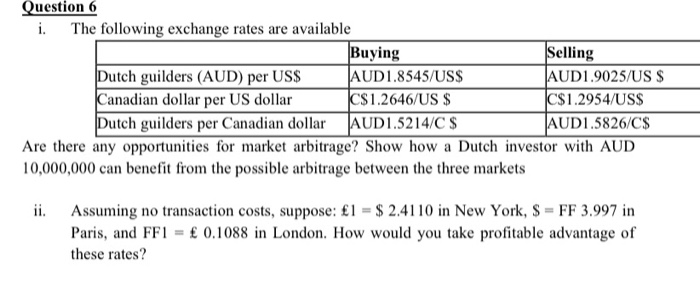

Question 6 i. The following exchange rates are available Buying Selling Dutch guilders (AUD) per US$ AUD1.8545/US$ AUD1.9025/US $ Canadian dollar per US dollar C$1.2646/US $ C$1.2954/US$ Dutch guilders per Canadian dollar AUD1.5214/C $ JAUD1.5826/C$ Are there any opportunities for market arbitrage? Show how a Dutch investor with AUD 10,000,000 can benefit from the possible arbitrage between the three markets ii. Assuming no transaction costs, suppose: 1 = $ 2.4110 in New York, $ = FF 3.997 in Paris, and FF1 = 0.1088 in London. How would you take profitable advantage of these rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts