Question: Please help, I know answer is 9.79 but I really don't know how to get it. Problem 14.4 The stock of GS, which current value

Please help, I know answer is 9.79 but I really don't know how to get it.

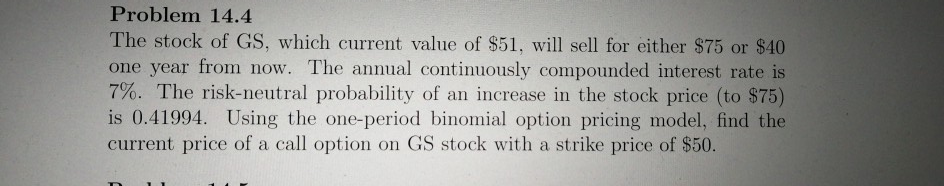

Problem 14.4 The stock of GS, which current value of $51, will sell for either $75 or $40 one year from now. The annual continuously compounded interest rate is 7%. The risk-neutral probability of an increase in the stock price (to $75) is 0.41994. Using the one-period binomial option pricing model, find the current price of a call option on GS stock with a strike price of $50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts