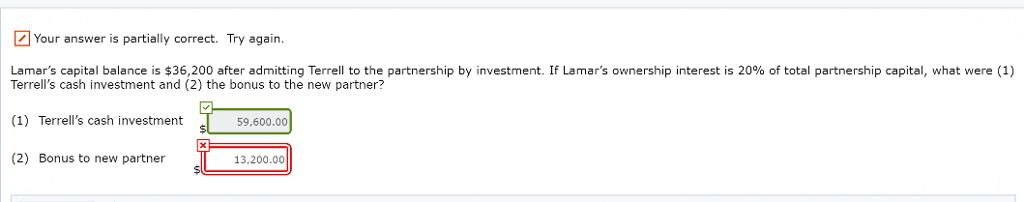

Question: Please help. I missed number 2 and I do not know how to figure the bonus for the new partner. I missed both of these

Please help. I missed number 2 and I do not know how to figure the bonus for the new partner. I missed both of these and would like to know how to compute the answers. Thank you.

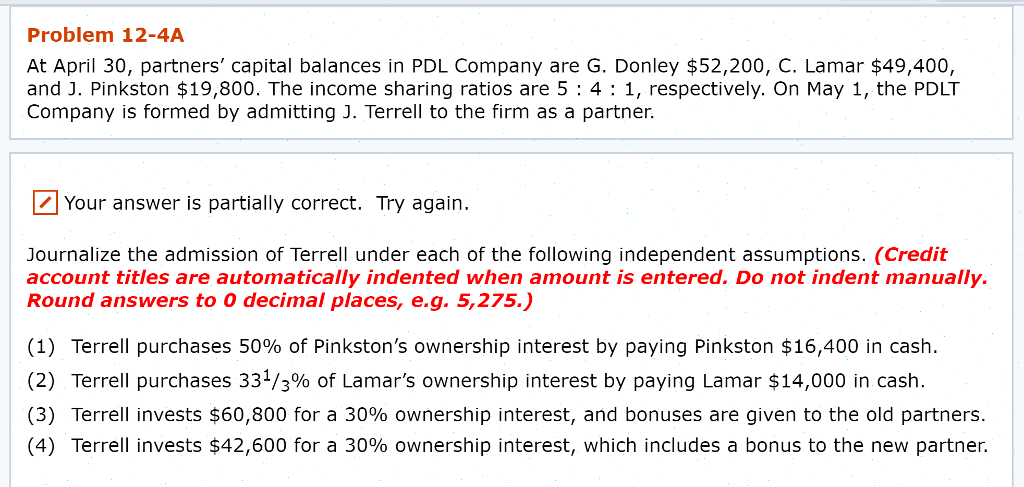

Problem 12-4A At April 30, partners' capital balances in PDL Company are G. Donley $52,200, C. Lamar $49,400, and J. Pinkston $19,800. The income sharing ratios are 5 : 4 : 1, respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner. Your answer is partially correct. Try again. Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) (1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $16,400 in cash. (2) Terrell purchases 331/3% of Lamar's ownership interest by paying Lamar $14,000 in cash. (3) Terrell invests $60,800 for a 30% ownership interest, and bonuses are given to the old partners. (4) Terrell invests $42,600 for a 30% ownership interest, which includes a bonus to the new partner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts