Question: please help! i need 100 percent to pass the assignment Required information Great Adventures Problem AP3-1 The following information applies to the questions displayed below!

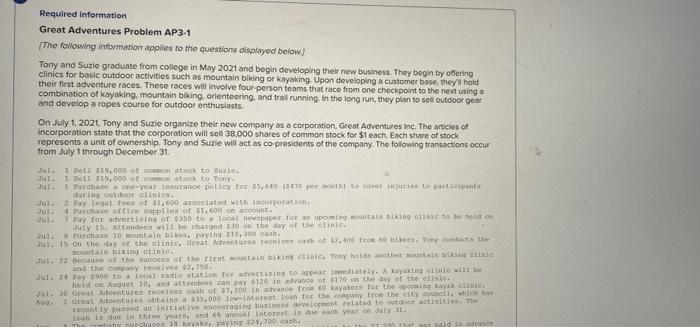

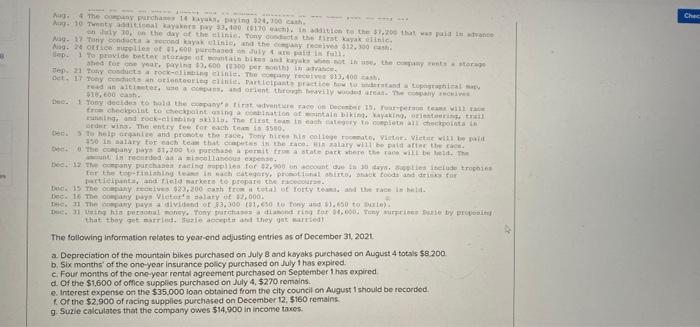

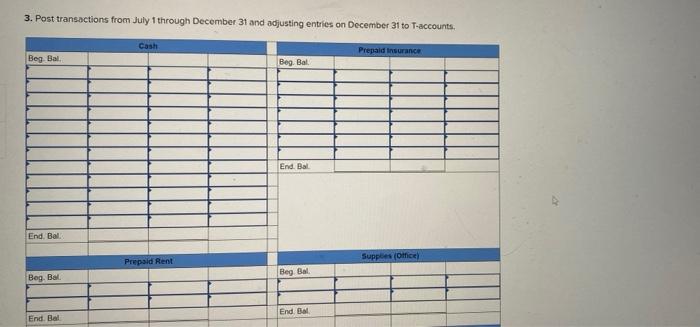

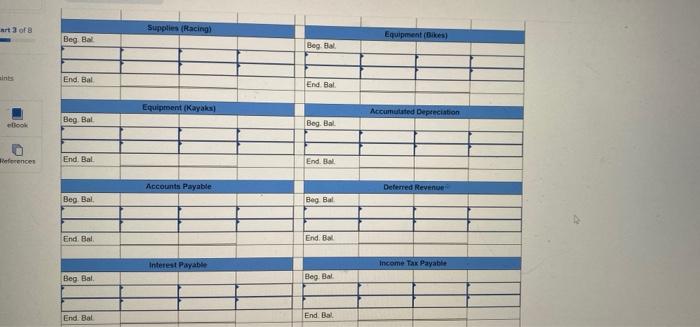

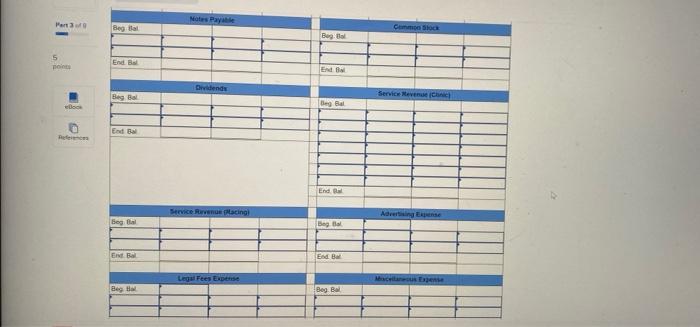

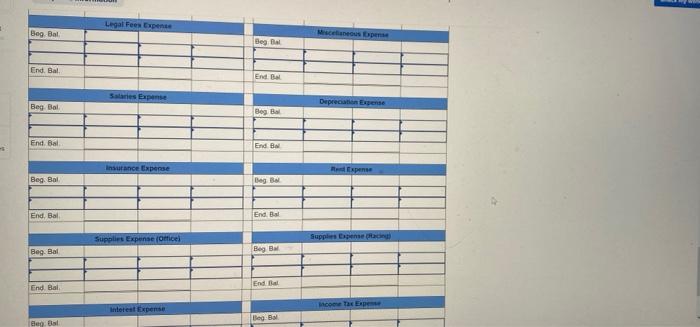

Required information Great Adventures Problem AP3-1 The following information applies to the questions displayed below! Tony and Suzie graduate from college in May 2021 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, they'll hold their first adventure races. These races will involve four person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts On July 1, 2021. Tony and Suzie organize their new company as a corporation, Great Adventures Inc. The articles of incorporation state that the corporation will soll 38.000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie wil act as co presidents of the company. The following transactions occur from July 1 through December 31 Jui. IL 929.000 of comptock to Dutie. Jul I tell 915.000 of stock to Tony. Juh. Marchand one-year Insurance policy for 55.600.6470 th to cipant outdoor clinica Jul? Pa legal ees of 1,600 associated with incorporation Jul Purchase of plieno 1.600 on account. Pay for advertising or $350 to local paper for a contain biking and to be held on July 15. Attendees will be charged on the day of the clinic Jul Purchase 10 nuntain bikos, paying $18.00 saat Jul 15 on the day of the clinic, creat venture of $2.400 fra 0 bets. Tents the mountain biking clinic Jul 22 of the son of the first stain bikini, Tony has another mountain bisa and the company roles 07.150. Jul. 24 ray $500 to local radio station for advertising to appear immediately. A kayaking into the held on August 10, and attendent can pay $120 in advance of $170 on the day of the clinic. Ju. 30 Great Aventures receives canh of 09.200 in advance from a wayakers for the payak aline. 1 Great Adventures obtain a $75,000 low-interest Tean for the pay from the city council rently passed an initiative encouraging his development related to outdat stivities. The is due in three years, and an interest to dyear oy The 10 ways, paying $4,700 ch va 1 Ches Aug. 4 The company purchases 10 X paying 524,100 cash Ag: 10 Tentanales pay $3,600 40170 h. inson ta the 57.20 that was all in one y 10, on the day at the Tony conduct the first week 1) Tomy condictecondavaktines and the company receives $13.00 . A toto ples et 11.000 personu pa mu SED! To provide better startain bikes and to the same Tep 1 Tomy condicts a rock- cine. The company receive $1,400 hea tot ce mar, pavi 13.600 (200 persone oct. 17 Tonyet teori ini, atpants retice how stand uporta the actorent themah Wasily wed the con cui** Dee. Tony decides to hold the pattedyente race Decembe 15. trom checkpoint to checkpoint in nation of intain bikini ning, and rock climbine testenicah to complete all checkpoint in bet wins. The entry fee for each team is $500 too. The one and promote the race: Tony hiru Foto, Victor Victe be 350 in salary for each team that capetes in the race by all the The company ry 01,200 to purchase permite a state park when there will be the in de bancos expense Dec. 12 The company purchasing polles for 2.900 on account belle belude trophies for the thing in cheategory, prema toodarow participants and Trela arkere te propare the c. 15 The man ve 25,00 cash total of Forty to the end Dec. 16 me on pays Vista laty ot 13,000 Thin any pays dividend of $3,300 193.50 Tony and ).650 to D) Den hopeal money. Tony Durch diamond ring for .000 Tony Sety propose that they get married. sute de and they get married The following information relates to year-end adjusting entries as of December 31, 2021 a Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totais $8.200 b. Six months of the one year Insurance policy purchased on July 1 has expired. c. Four months of the one year rental agreement purchased on September has expired d. Of the $1,600 of office supplies purchased on July 4, $270 remains. e Interest expense on the $35.000 loan obtained from the city council on August 1 should be recorded of the $2.900 of racing supplies purchased on December 12, 5160 remains g. Suzie calculates that the company owes $14.900 in income taxes. 3. Post transactions from July 1 through December 31 and adjusting entries on December 31 to T-accounts. Cash Prepaid Insurance Beg Bal. Beg Bal End. Bal End. Bal Suppoes (Office) Prepaid Rent Beg Bal Beg Bal End. Bol End. Bal art 3 of 8 Supplies (Racing Equipment (kes Beg Bal Beg Bal intes End. Bal End Bat Equipment (Kayaks Accumulated Depreciation ook Beg Bat Beg. Bal References End. Bal End. Accounts Payable Deferred Revenue Beg Bal Beg Bal End Bal End B Interest Payable Income Tax Payable Beg Bat Beg Bal End. Bal End Bal Notes Pay Part 3 Beg tal Commons Bogol 5 po End En Service Revenue che Beg Bal Beg Bai co End End Service Revenue placing Advertising Expense Beg Beg Blo! E B End B Legal Fees Expense Beta Beg B Legal Fees Expense Bog Bal Miscellaneous per Begal End. Bal End Sales Expense Beg Bal Depreciation pense Bog B End Bal End Insurance Expense Expense Beg Bal Beg B End, Bal Endal Supplies Expense (Office Supplies per Beg Bal Beg BM End Bal End. Bai, co Tape Interest Expense e B Beg B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts