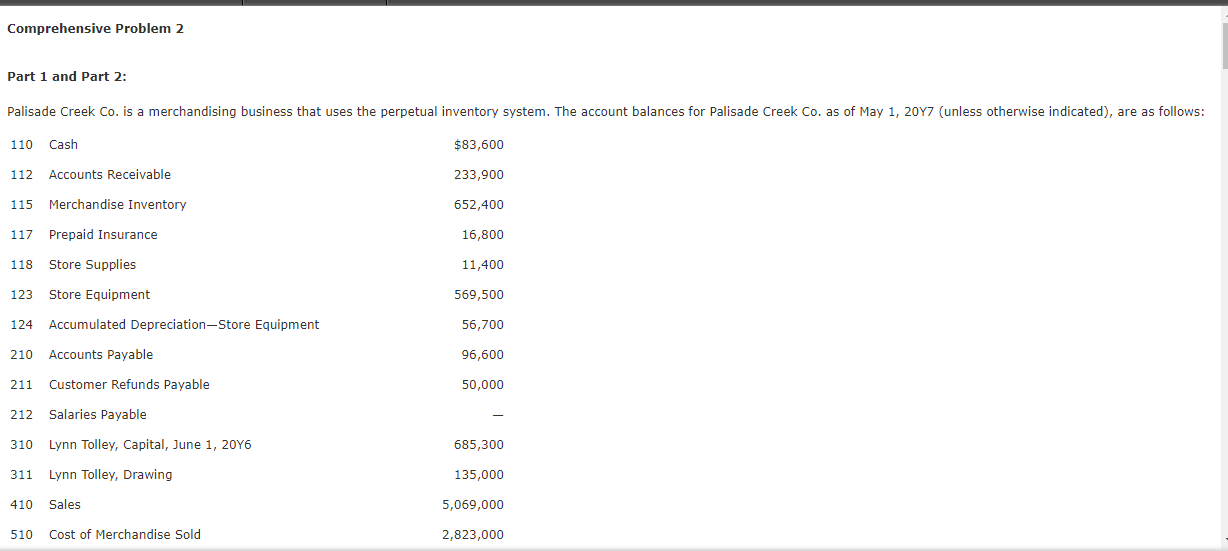

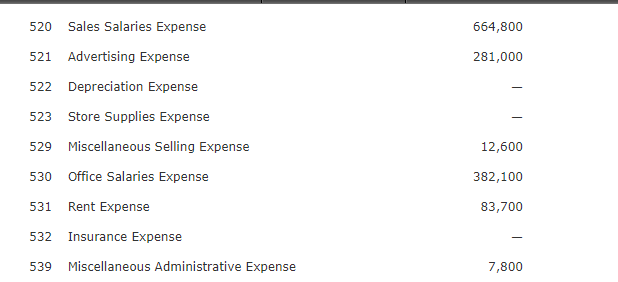

Question: Please help I need help on the ones that are blank thank you Comprehensive Problem 2 Part 1 and Part 2: 520521522523529530531532SalesSalariesExpenseAdvertisingExpenseDepreciationExpenseStoreSuppliesExpenseMiscellaneousSellingExpenseOfficeSalariesExpenseRentExpenseInsuranceExpense664,800281,00012,600382,10083,7007,800 Part 3: NOTE:

Please help I need help on the ones that are blank thank you

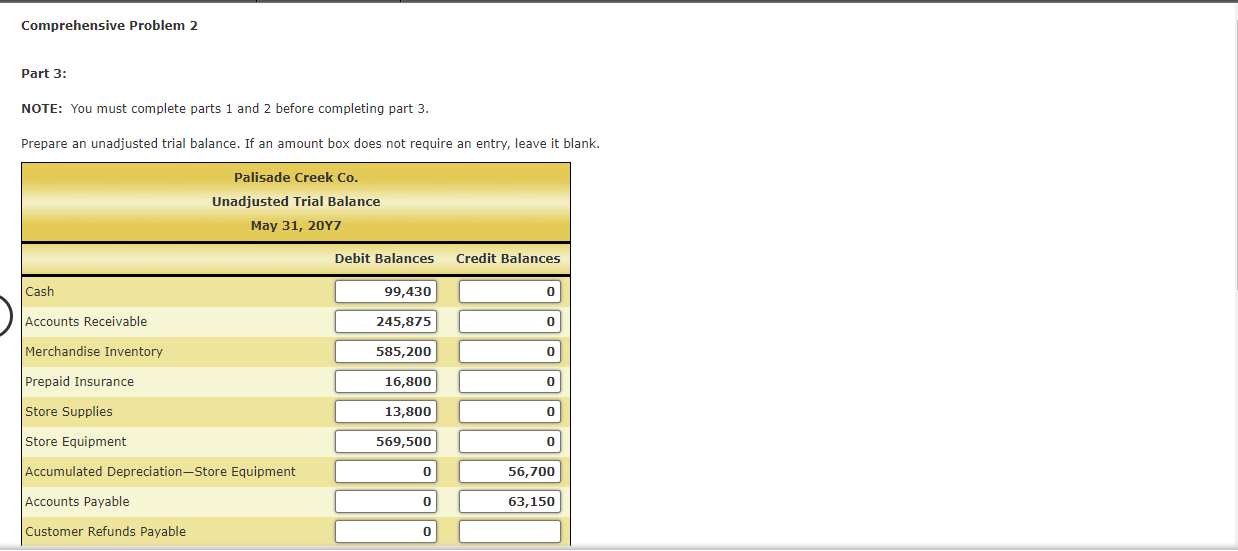

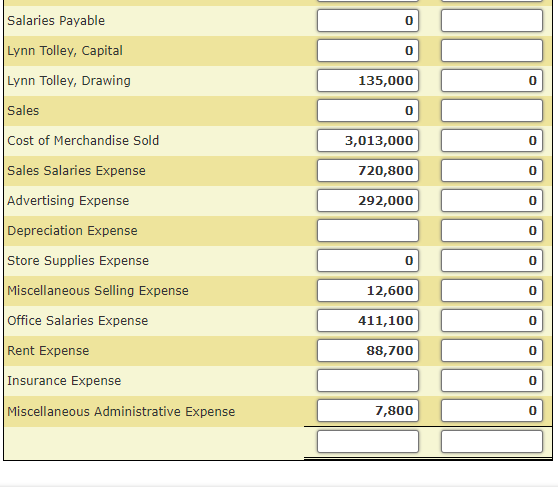

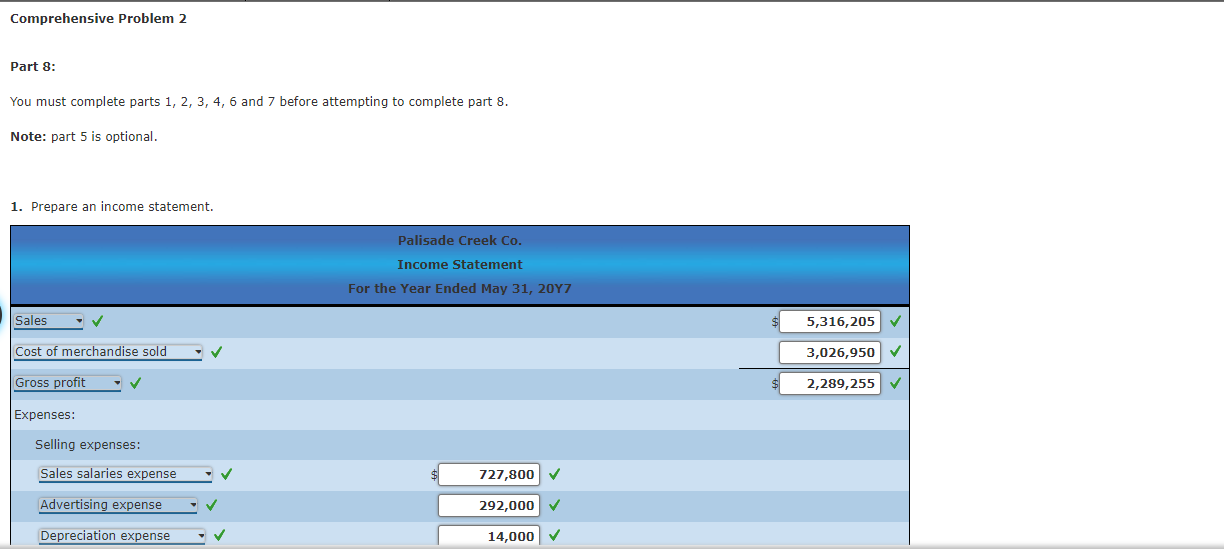

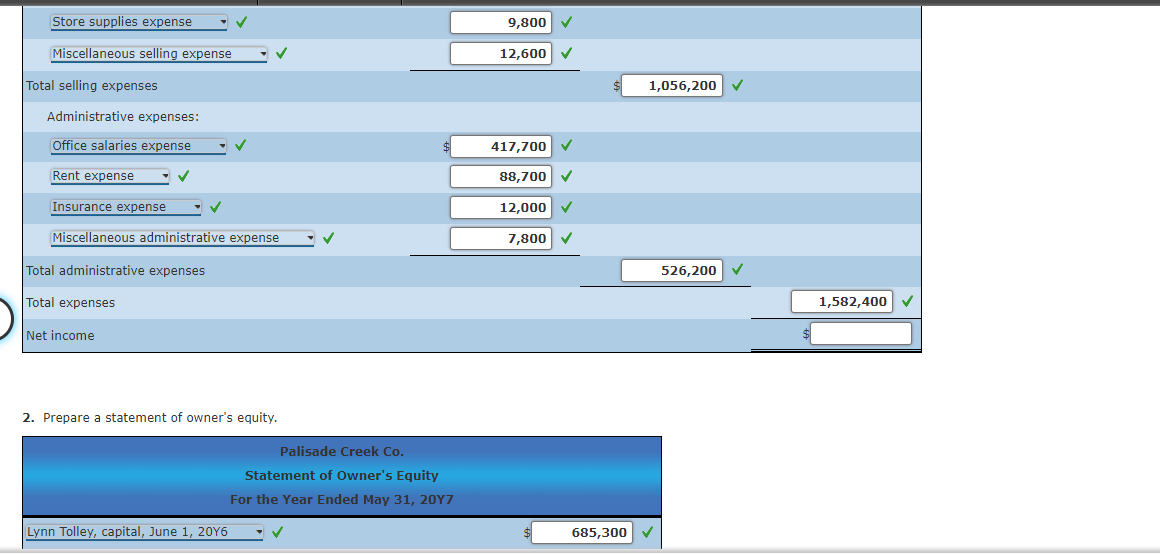

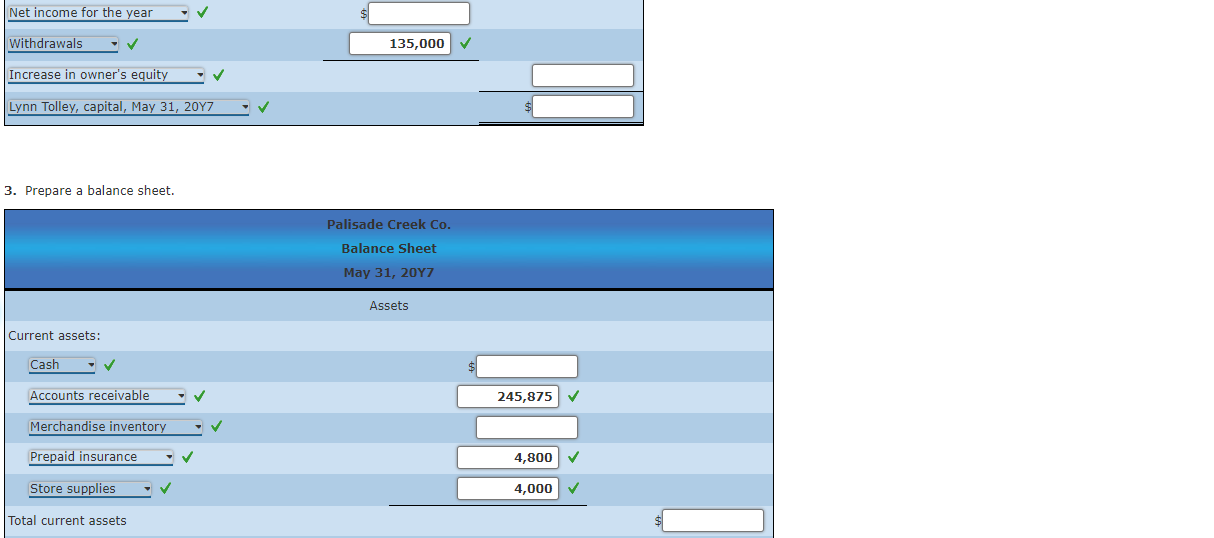

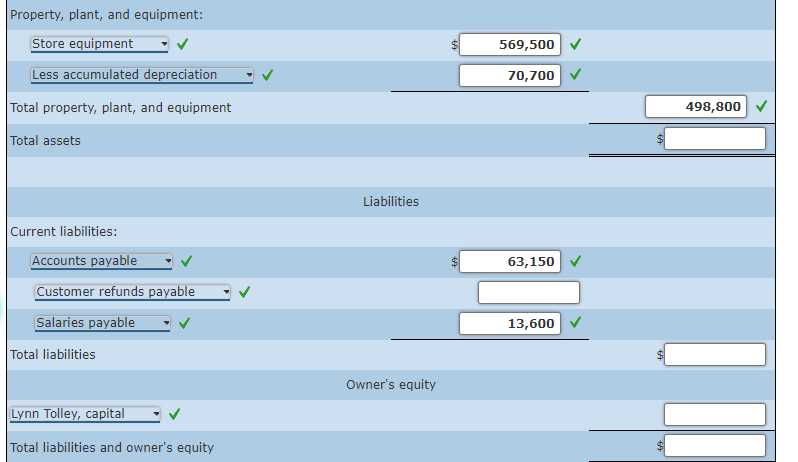

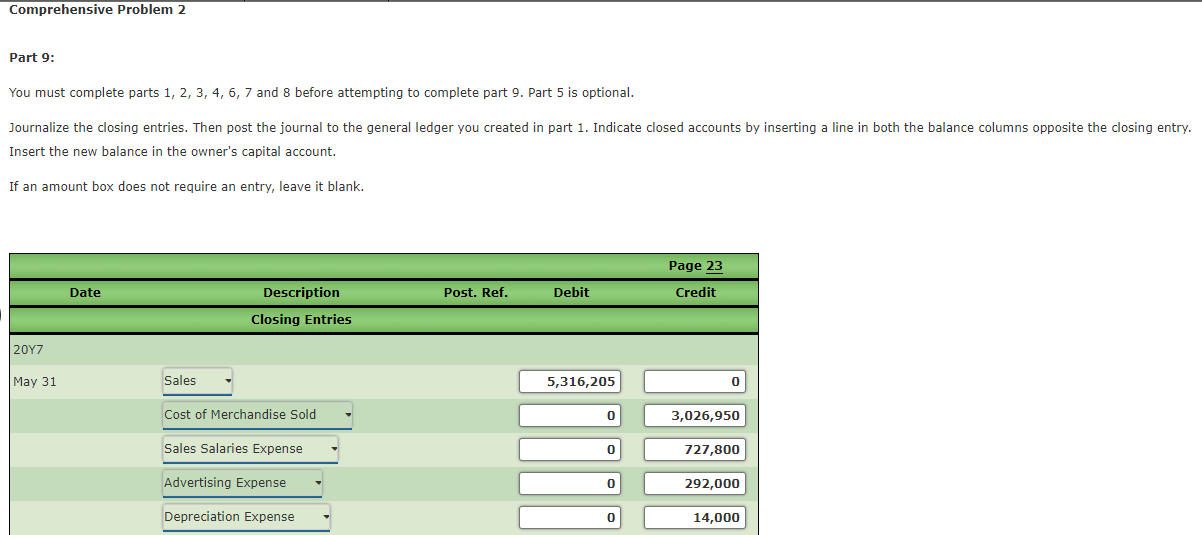

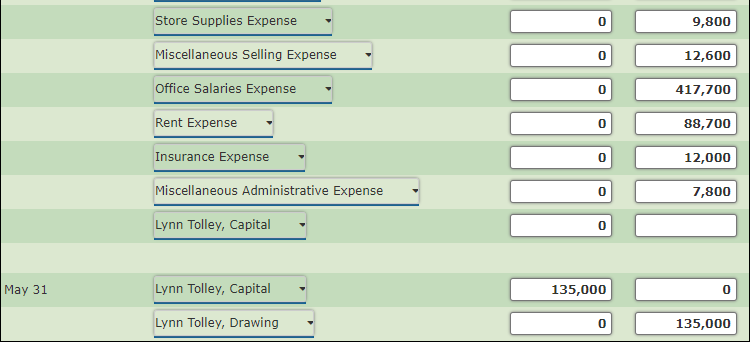

Comprehensive Problem 2 Part 1 and Part 2: 520521522523529530531532SalesSalariesExpenseAdvertisingExpenseDepreciationExpenseStoreSuppliesExpenseMiscellaneousSellingExpenseOfficeSalariesExpenseRentExpenseInsuranceExpense664,800281,00012,600382,10083,7007,800 Part 3: NOTE: You must complete parts 1 and 2 before completing part 3. Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. Part 8: You must complete parts 1,2,3,4,6 and 7 before attempting to complete part 8. Note: part 5 is optional. 1. Prepare an income statement. 2. Prepare a statement of owner's equity. \begin{tabular}{|c|} \hline \\ Salisade Creek Co. \\ Sor the Year Ended May 31, 20Y7 \\ \hline Lynn Tolley, capital, June 1,20Y6 \end{tabular} 3. Prepare a balance sheet. Property, plant, and equipment: Part 9: You must complete parts 1,2,3,4,6,7 and 8 before attempting to complete part 9 . Part 5 is optional. Journalize the closing entries. Then post the journal to the general ledger you created in part 1. Indicate closed accounts by inserting a line in both the balance columns opposite the closing entry. Insert the new balance in the owner's capital account. If an amount box does not require an entry, leave it blank. Comprehensive Problem 2 Part 1 and Part 2: 520521522523529530531532SalesSalariesExpenseAdvertisingExpenseDepreciationExpenseStoreSuppliesExpenseMiscellaneousSellingExpenseOfficeSalariesExpenseRentExpenseInsuranceExpense664,800281,00012,600382,10083,7007,800 Part 3: NOTE: You must complete parts 1 and 2 before completing part 3. Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. Part 8: You must complete parts 1,2,3,4,6 and 7 before attempting to complete part 8. Note: part 5 is optional. 1. Prepare an income statement. 2. Prepare a statement of owner's equity. \begin{tabular}{|c|} \hline \\ Salisade Creek Co. \\ Sor the Year Ended May 31, 20Y7 \\ \hline Lynn Tolley, capital, June 1,20Y6 \end{tabular} 3. Prepare a balance sheet. Property, plant, and equipment: Part 9: You must complete parts 1,2,3,4,6,7 and 8 before attempting to complete part 9 . Part 5 is optional. Journalize the closing entries. Then post the journal to the general ledger you created in part 1. Indicate closed accounts by inserting a line in both the balance columns opposite the closing entry. Insert the new balance in the owner's capital account. If an amount box does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts