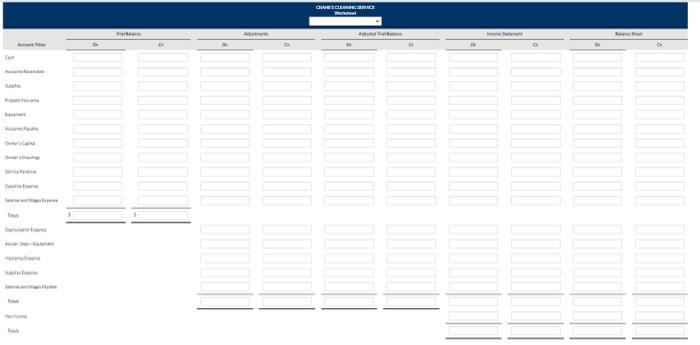

Question: Please Help. I need help with the worksheet and down please. Which part is too small? Crane Clark opened Crane's Cleaning Service on July 1,

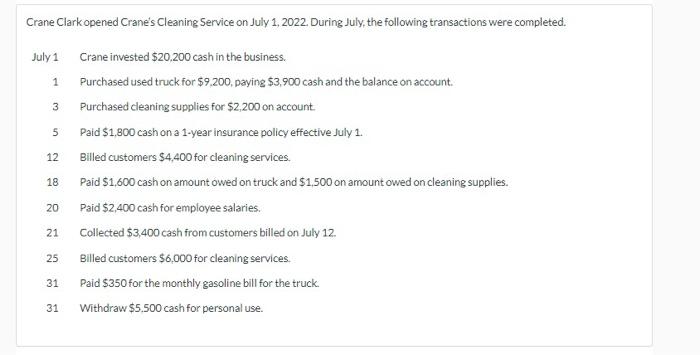

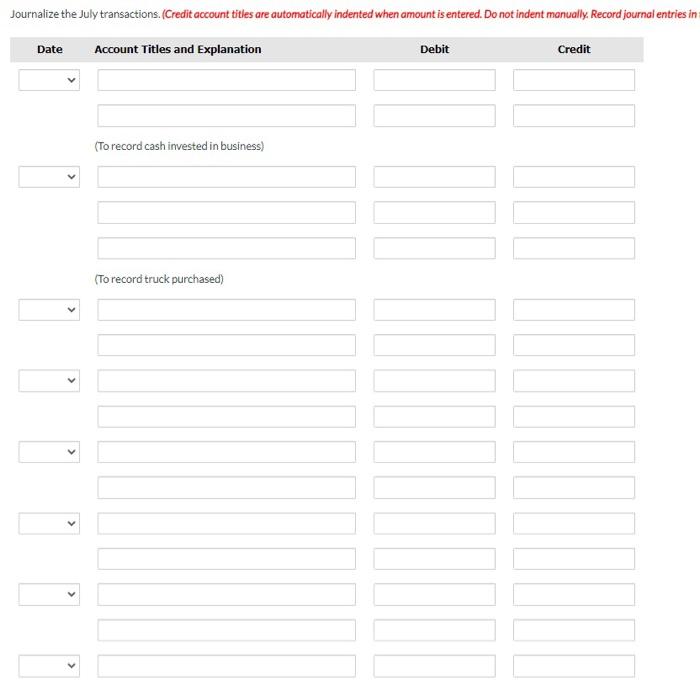

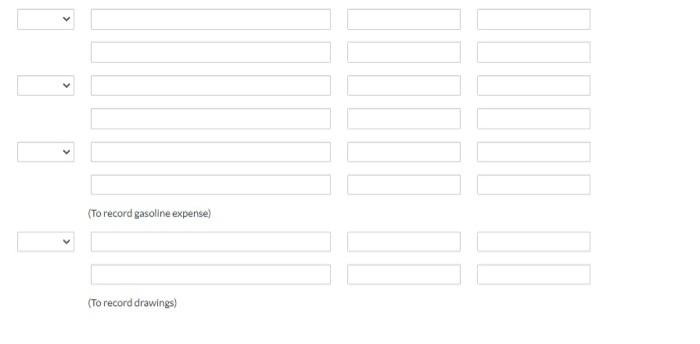

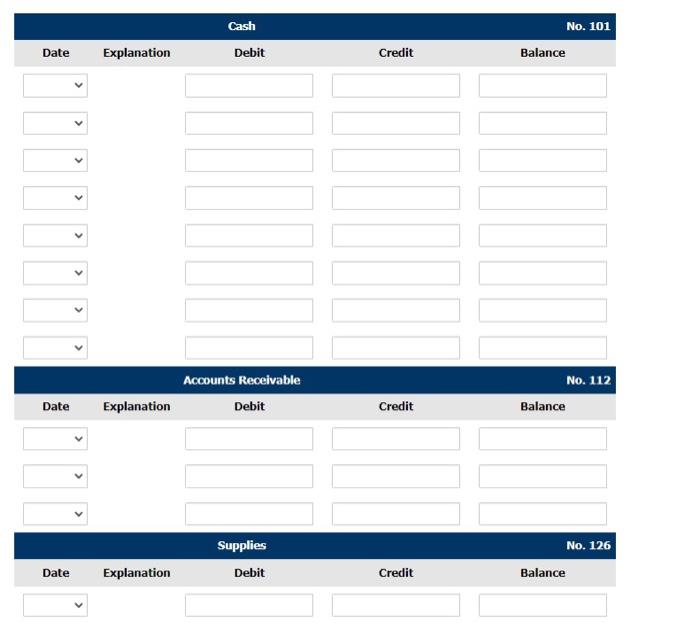

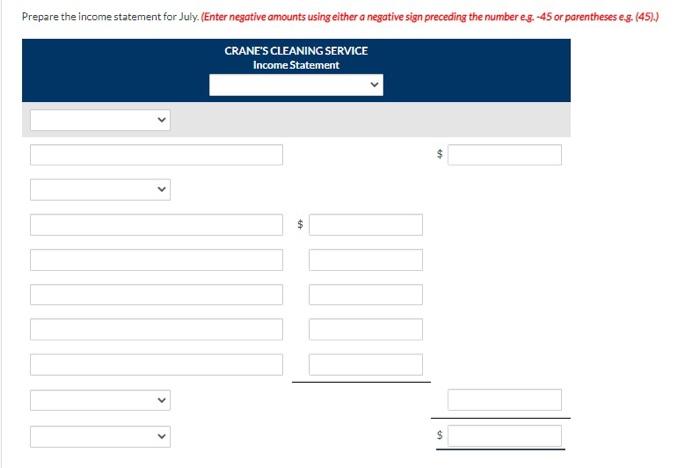

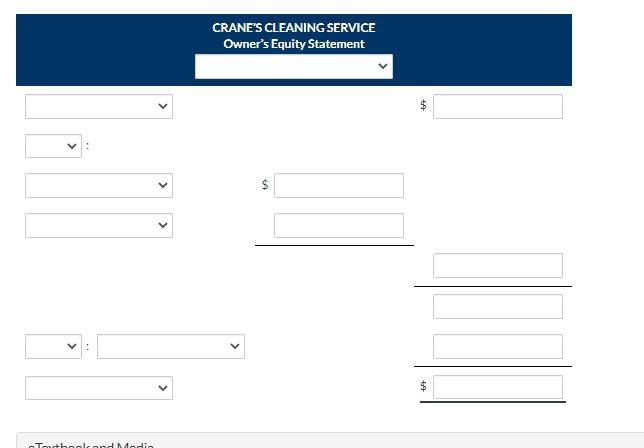

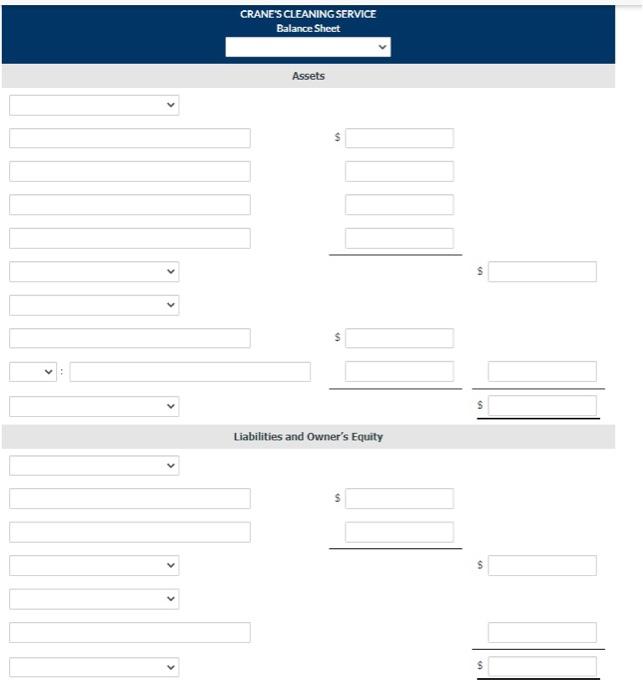

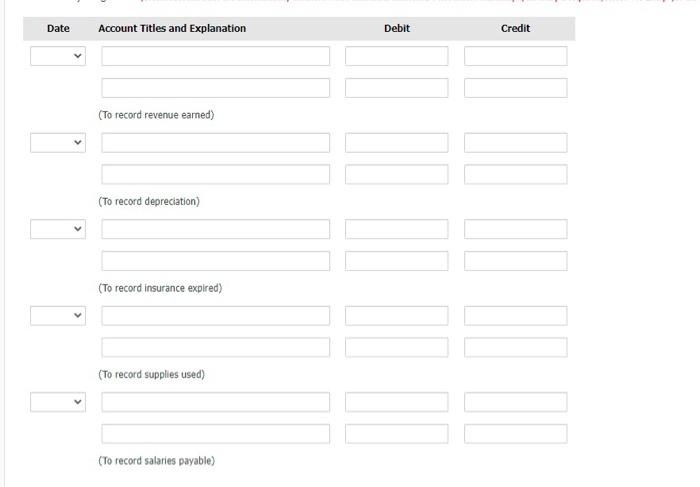

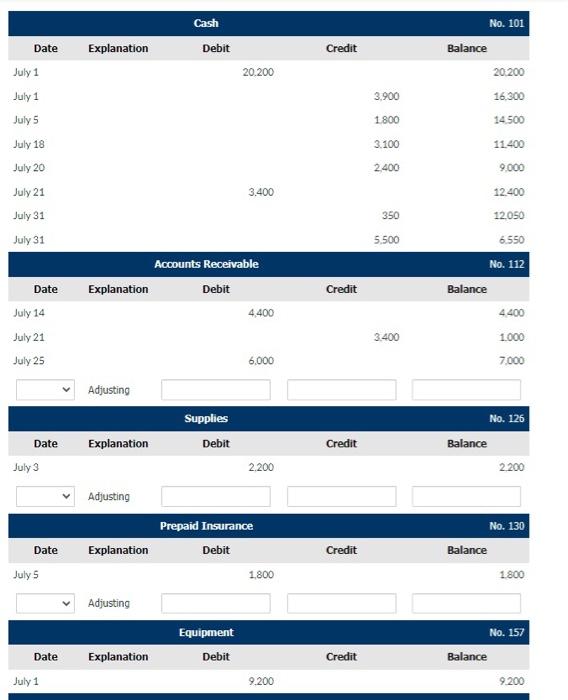

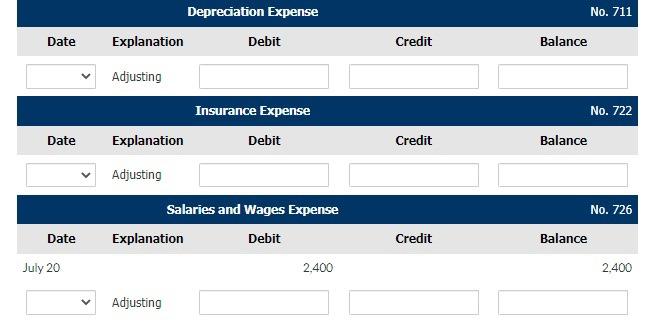

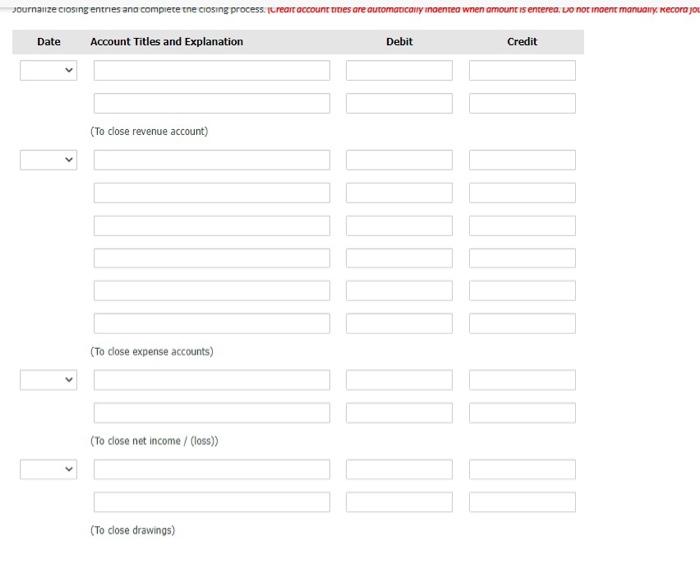

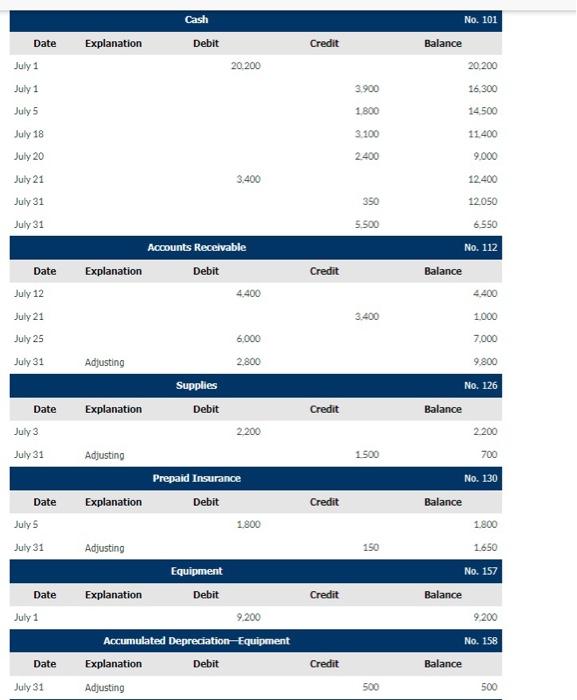

Crane Clark opened Crane's Cleaning Service on July 1, 2022. During July, the following transactions were completed. Crane invested $20,200 cash in the business. Purchased used truck for $9.200, paying $3,900 cash and the balance on account. Purchased cleaning supplies for $2,200 on account. Paid $1,800 cash on a 1-year insurance policy effective July 1. Billed customers $4,400 for cleaning services. Paid $1,600 cash on amount owed on truck and $1,500 on amount owed on cleaning supplies. Paid $2,400 cash for employee salaries. Collected $3,400 cash from customers billed on July 12. Billed customers $6,000 for cleaning services. Paid $350 for the monthly gasoline bill for the truck. Withdraw $5,500 cash for personal use. July 1 1 3 5 12 18 20 21 25 31 31 Journalize the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in Account Titles and Explanation Credit Date (To record cash invested in business) (To record truck purchased) Debit 100000 DOD (To record gasoline expense) (To record drawings) 100000 11 Date Explanation > Date Date Explanation Explanation Cash Debit Accounts Receivable Debit Supplies Debit Credit Credit Credit No. 101 Balance Balance No. 112 Balance No. 126 Date Date Date Date Date Date Explanation Date Date Explanation 100 10 Tothookand Media CRANE'S CLEANING SERVICE Owner's Equity Statement : CRANE'S CLEANING SERVICE Balance Sheet Assets $ Liabilities and Owner's Equity S S INI Date Account Titles and Explanation (To record revenue earned) (To record depreciation) (To record insurance expired) (To record supplies used) (To record salaries payable) Debit 00 00 00 00 Credit Date July 1 July 1 July 5 July 18 July 20 July 21 July 31 July 31 Date July 14 July 21 July 25 Date July 3 Date July 5 Date July 1 Explanation Explanation Adjusting Explanation Adjusting Explanation Adjusting Explanation Cash Debit Supplies Debit 20.200 Accounts Receivable Debit 3.400 Equipment Debit 4,400 6,000 2.200 Prepaid Insurance Debit 1.800 9.200 Credit Credit Credit Credit Credit 3,900 1.800 3.100 2,400 350 5,500 3.400 Balance Balance Balance Balance Balance No. 101 20,200 16,300 14.500 11.400 9,000 12.400 12,050 6.550 No. 112 4.400 1.000 7,000 No. 126 2.200 No. 130 1.800 No. 157 9.200 Date Date July 1 July 3 July 18 Date Date July 1 Date July 31 Date July 14 July 25 Date July 31 Date Accumulated Depreciation Equipment Debit Explanation Adjusting Explanation Explanation Adjusting Explanation 3.100 Salaries and Wages Payable Debit Explanation Explanation Adjusting Explanation Explanation Adjusting Accounts Payable Debit Owner's Capital Debit Owner's Drawings Debit 5,500 Service Revenue Debit Gasoline Expense Debit Supplies Expense Debit 350 Credit Credit Credit Credit Credit Credit Credit Credit 5,300 2,200 20,200 4,400 6.000 Balance Balance Balance No. 158 Balance No. 201 5,300 7,500 4,400 No. 212 Balance Balance No. 301 Balance 20,200 No. 306 5,500 No. 400 Balance 4,400 10,400 No. 633 350 No. 631 Date Date Date July 20 Explanation Adjusting Explanation Adjusting Explanation Adjusting Depreciation Expense Debit Insurance Expense Debit Salaries and Wages Expense Debit 2,400 Credit Credit Credit Balance Balance Balance No. 711 No. 722 No. 726 2,400 Journalize closing entries and complete the closing process. (Creait account tities are automatically indented when amount is enterea. Do not ingent manually. Kecora jou Date Account Titles and Explanation (To close revenue account) (To close expense accounts) (To close net income / (loss)) (To close drawings) Debit Credit 1000 10 00 Date July 1 July 1 July 5 July 18 July 20 July 21 July 31 July 31 Date July 12 July 21 July 25 July 31 Date July 3 July 31 Date July 5 July 31 Date July 1 Date July 31 Explanation Explanation Adjusting Explanation Adjusting Explanation Adjusting Explanation Cash Explanation Adjusting Debit Supplies Debit Accounts Receivable Debit 20,200 Equipment 3,400 Debit 4,400 6,000 2,800 Prepaid Insurance Debit 2.200 1.800 9,200 Accumulated Depreciation Equipment Debit Credit Credit Credit Credit Credit Credit 3.900 1,800 3.100 2.400 350 5.500 3.400 1.500 150 500 Balance Balance Balance No. 101 Balance Balance Balance 20,200 16,300 14.500 11,400 9.000 12,400 6.550 No. 112 12.050 4,400 1.000 7,000 9,800 No. 126 2.200 700 No. 130 1.800 1.650 No. 157 9.200 No. 158 500 Date July 1 July 3 July 18 Date July 31 Date July 1 Date July 31 Date Explanation Explanation Adjusting Explanation Closing Closing Explanation Closing 3.100 Salaries and Wages Payable Debit Explanation Closing Closing Closing Accounts Payable Debit Owner's Capital Debit Owner's Drawings Debit 5.500 Income Summary Debit Credit Credit Credit Credit Credit 5,300 2,200 1,050 20,200 Balance Balance Balance Balance Balance No. 201 5,300 7.500 4,400 No. 212 1.050 No. 301 20,200 No. 306 5,500 No. 350 Date July 12 July 25 July 31 Date July 31 Date July 31 Date July 31 Date July 31 Date July 20 July 31 Explanation Adjusting Closing Explanation Closing Explanation Closing Explanation Adjusting Closing Explanation Adjusting Closing Explanation Adjusting Closing Service Revenue Debit Gasoline Expense Debit Supplies Expense Debit Debit Depreciation Expense 350 1.500 Insurance Expense Debit 500 150 Salaries and Wages Expense Debit 2,400 1.050 Credit Credit Credit Credit Credit Credit 4,400 6.000 2,800 Balance Balance Balance Balance Balance Balance No. 400 4,400 10,400 13,200 No. 633 350 No. 631 1.500 No. 711 500 No. 722 150 No. 726 2,400 3,450 Prepare a post-closing trial balance at July 31. Totals CRANE'S CLEANING SERVICE Post-Closing Trial Balance Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts