Question: please help .. I need it asap.. I will upvote thanks in advance Income Statement for the year ended 2021 2020 2019 000 000 000'

please help .. I need it asap.. I will upvote thanks in advance

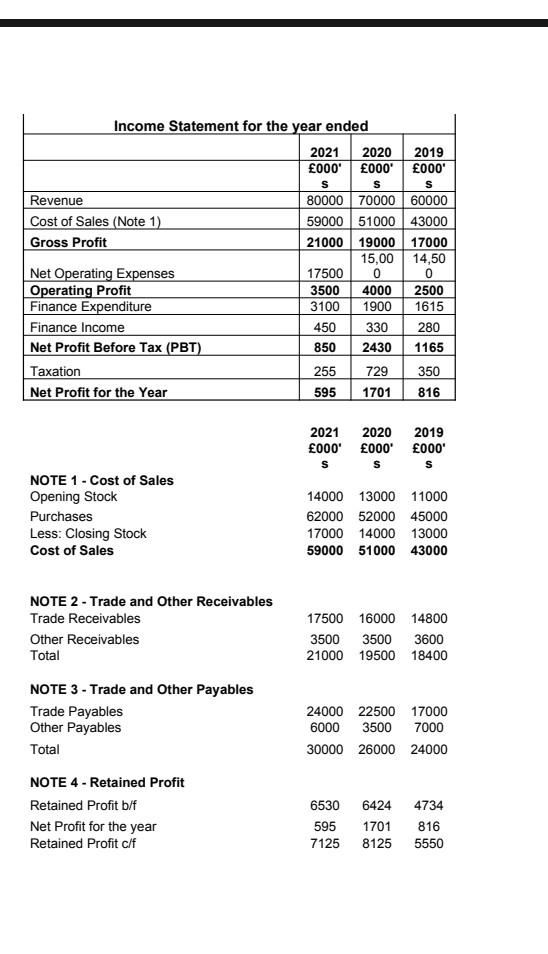

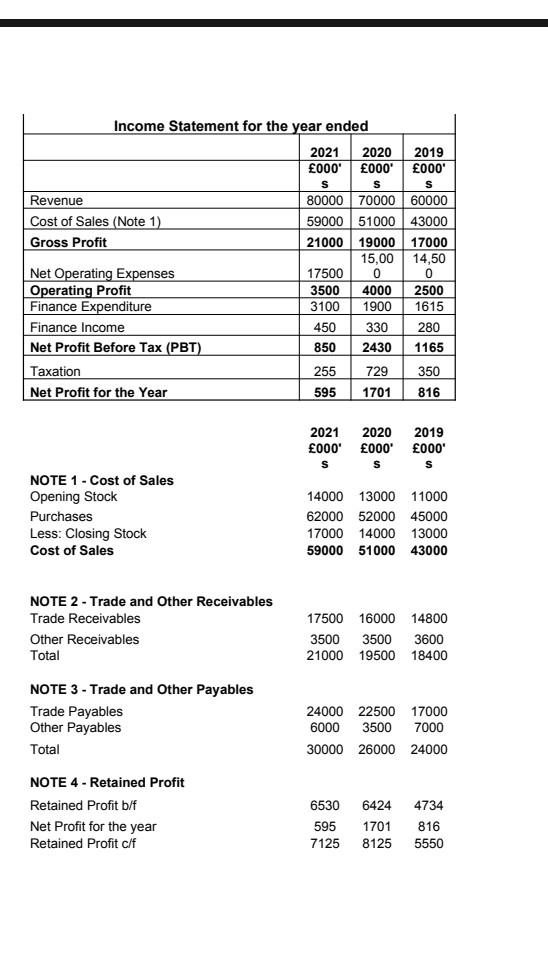

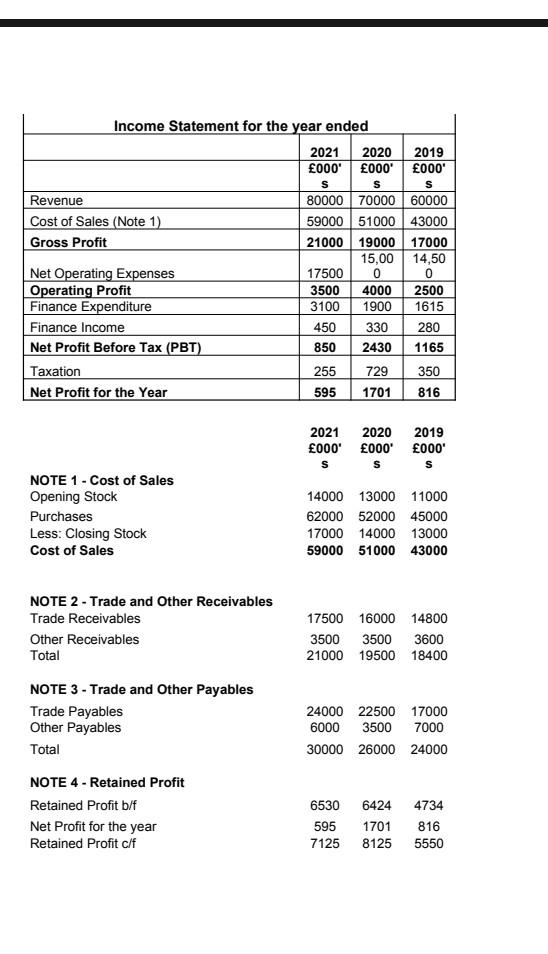

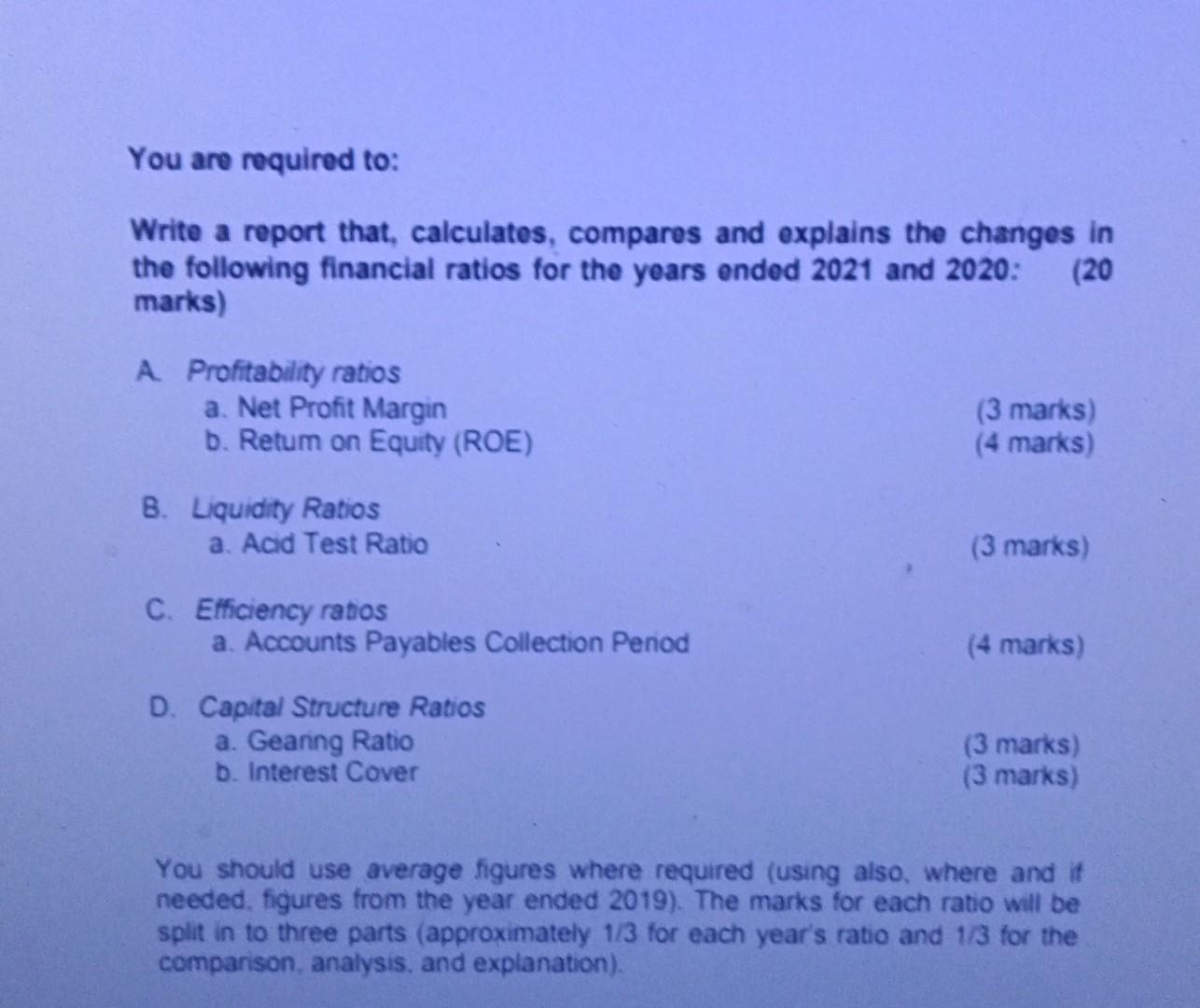

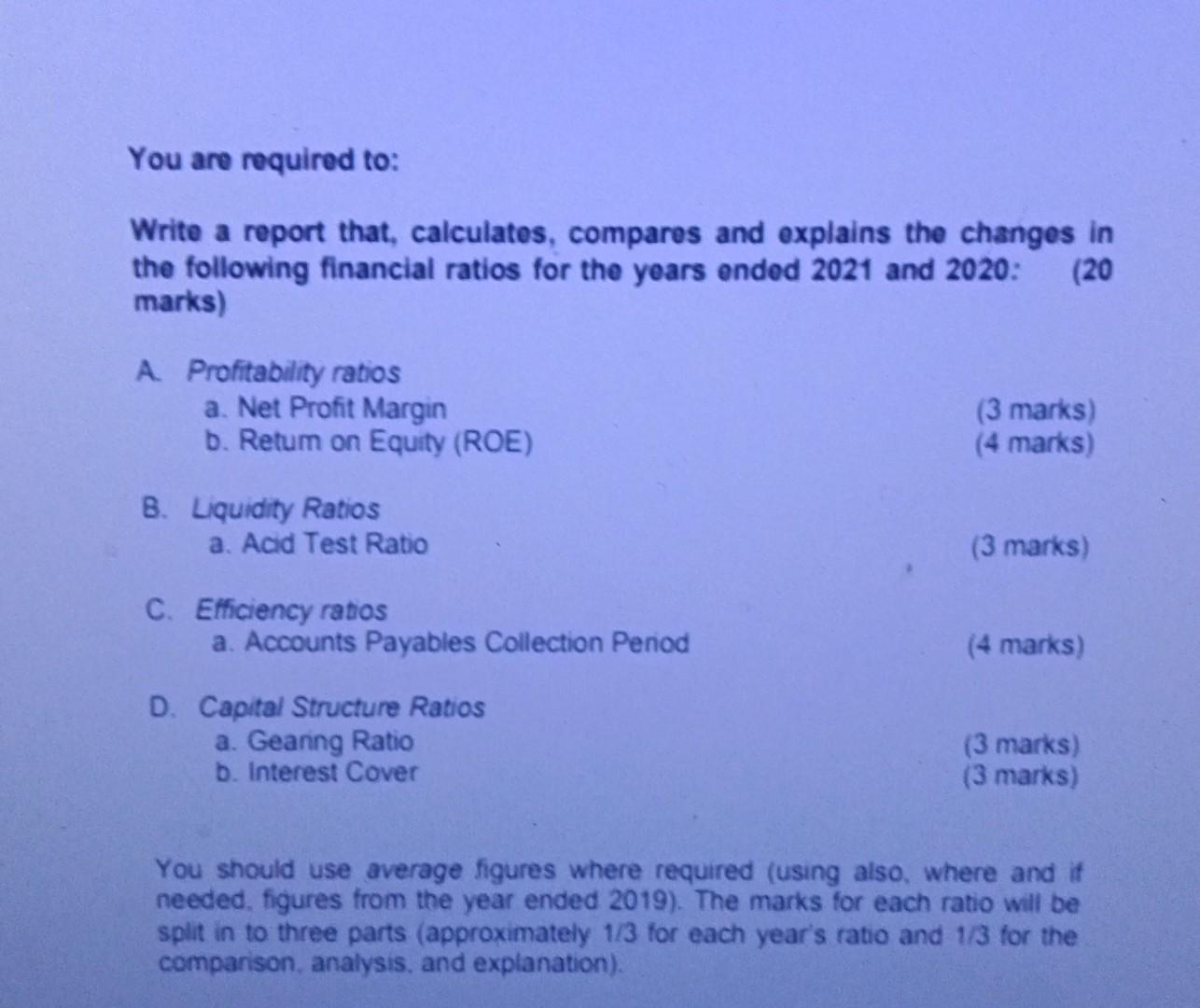

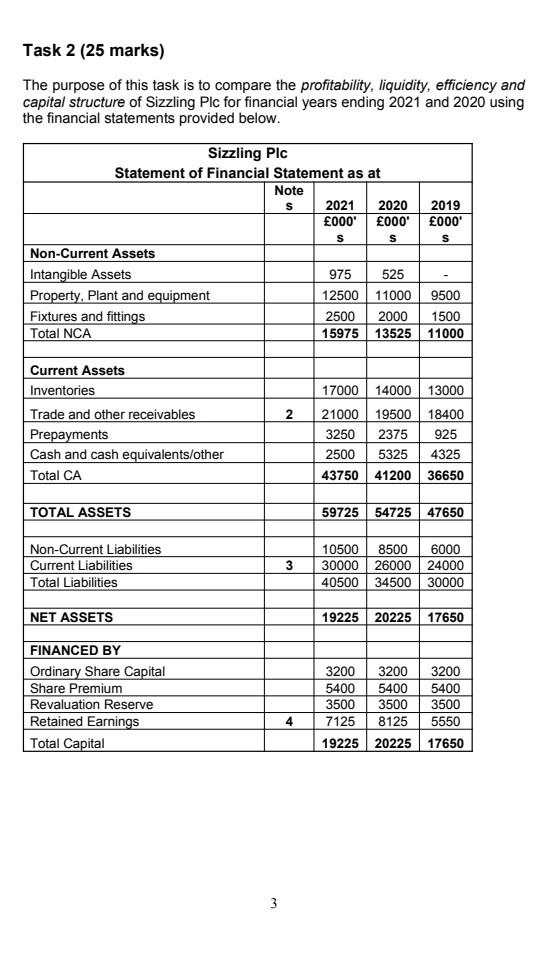

Income Statement for the year ended 2021 2020 2019 000 000 000' S 80000 70000 60000 59000 51000 43000 21000 19000 17000 15,00 14,50 17500 0 0 3500 4000 2500 3100 1900 1615 450 330 280 850 2430 1165 255 729 350 595 1701 816 2021 2020 2019 000 000 000' S s S 14000 13000 11000 62000 52000 45000 17000 14000 13000 59000 51000 43000 17500 16000 14800 3500 3500 3600 21000 19500 18400 24000 22500 17000 6000 3500 7000 30000 26000 24000 6530 6424 4734 595 1701 816 7125 8125 5550 Revenue Cost of Sales (Note 1) Gross Profit Net Operating Expenses Operating Profit Finance Expenditure Finance Income Net Profit Before Tax (PBT) Taxation Net Profit for the Year NOTE 1 - Cost of Sales Opening Stock Purchases Less: Closing Stock Cost of Sales NOTE 2 - Trade and Other Receivables Trade Receivables Other Receivables Total NOTE 3 - Trade and Other Payables Trade Payables Other Payables Total NOTE 4 - Retained Profit Retained Profit b/f Net Profit for the year Retained Profit c/f Income Statement for the year ended 2021 2020 2019 000 000 000' S 80000 70000 60000 59000 51000 43000 21000 19000 17000 15,00 14,50 17500 0 0 3500 4000 2500 3100 1900 1615 450 330 280 850 2430 1165 255 729 350 595 1701 816 2021 2020 2019 000 000 000' S s S 14000 13000 11000 62000 52000 45000 17000 14000 13000 59000 51000 43000 17500 16000 14800 3500 3500 3600 21000 19500 18400 24000 22500 17000 6000 3500 7000 30000 26000 24000 6530 6424 4734 595 1701 816 7125 8125 5550 Revenue Cost of Sales (Note 1) Gross Profit Net Operating Expenses Operating Profit Finance Expenditure Finance Income Net Profit Before Tax (PBT) Taxation Net Profit for the Year NOTE 1 - Cost of Sales Opening Stock Purchases Less: Closing Stock Cost of Sales NOTE 2 - Trade and Other Receivables Trade Receivables Other Receivables Total NOTE 3 - Trade and Other Payables Trade Payables Other Payables Total NOTE 4 - Retained Profit Retained Profit b/f Net Profit for the year Retained Profit c/f Income Statement for the year ended 2021 2020 2019 000 000 000' S 80000 70000 60000 59000 51000 43000 21000 19000 17000 15,00 14,50 17500 0 0 3500 4000 2500 3100 1900 1615 450 330 280 850 2430 1165 255 729 350 595 1701 816 2021 2020 2019 000 000 000' S s S 14000 13000 11000 62000 52000 45000 17000 14000 13000 59000 51000 43000 17500 16000 14800 3500 3500 3600 21000 19500 18400 24000 22500 17000 6000 3500 7000 30000 26000 24000 6530 6424 4734 595 1701 816 7125 8125 5550 Revenue Cost of Sales (Note 1) Gross Profit Net Operating Expenses Operating Profit Finance Expenditure Finance Income Net Profit Before Tax (PBT) Taxation Net Profit for the Year NOTE 1 - Cost of Sales Opening Stock Purchases Less: Closing Stock Cost of Sales NOTE 2 - Trade and Other Receivables Trade Receivables Other Receivables Total NOTE 3 - Trade and Other Payables Trade Payables Other Payables Total NOTE 4 - Retained Profit Retained Profit b/f Net Profit for the year Retained Profit c/f You are required to: Write a report that, calculates, compares and explains the changes in the following financial ratios for the years ended 2021 and 2020: (20 marks) A. Profitability ratios a. Net Profit Margin b. Return on Equity (ROE) (3 marks) (4 marks) B. Liquidity Ratios a. Acid Test Ratio (3 marks) C. Efficiency ratios a. Accounts Payables Collection Period (4 marks) D. Capital Structure Ratios a. Gearing Ratio (3 marks) b. Interest Cover (3 marks) You should use average figures where required (using also, where and if needed, figures from the year ended 2019). The marks for each ratio will be split in to three parts (approximately 1/3 for each year's ratio and 1/3 for the comparison, analysis, and explanation). Task 2 (25 marks) The purpose of this task is to compare the profitability, liquidity, efficiency and capital structure of Sizzling Plc for financial years ending 2021 and 2020 using the financial statements provided below. Sizzling Plc Statement of Financial Statement as at Note S 2021 2020 2019 000' 000* 000' S S S Non-Current Assets Intangible Assets 975 525 Property, Plant and equipment 12500 11000 9500 Fixtures and fittings 2500 2000 1500 Total NCA 15975 13525 11000 Current Assets Inventories 17000 14000 13000 Trade and other receivables 2 21000 19500 18400 Prepayments 3250 2375 925 2500 5325 4325 Cash and cash equivalents/other Total CA 43750 41200 36650 TOTAL ASSETS 59725 54725 47650 Non-Current Liabilities Current Liabilities 10500 8500 6000 30000 26000 24000 40500 34500 30000 Total Liabilities NET ASSETS 19225 20225 17650 FINANCED BY Ordinary Share Capital 3200 3200 3200 5400 5400 5400 3500 3500 3500 Share Premium Revaluation Reserve Retained Earnings Total Capital 7125 8125 5550 19225 20225 17650 3 3 4 Income Statement for the year ended 2021 2020 2019 000 000 000' S 80000 70000 60000 59000 51000 43000 21000 19000 17000 15,00 14,50 17500 0 0 3500 4000 2500 3100 1900 1615 450 330 280 850 2430 1165 255 729 350 595 1701 816 2021 2020 2019 000 000 000' S s S 14000 13000 11000 62000 52000 45000 17000 14000 13000 59000 51000 43000 17500 16000 14800 3500 3500 3600 21000 19500 18400 24000 22500 17000 6000 3500 7000 30000 26000 24000 6530 6424 4734 595 1701 816 7125 8125 5550 Revenue Cost of Sales (Note 1) Gross Profit Net Operating Expenses Operating Profit Finance Expenditure Finance Income Net Profit Before Tax (PBT) Taxation Net Profit for the Year NOTE 1 - Cost of Sales Opening Stock Purchases Less: Closing Stock Cost of Sales NOTE 2 - Trade and Other Receivables Trade Receivables Other Receivables Total NOTE 3 - Trade and Other Payables Trade Payables Other Payables Total NOTE 4 - Retained Profit Retained Profit b/f Net Profit for the year Retained Profit c/f Income Statement for the year ended 2021 2020 2019 000 000 000' S 80000 70000 60000 59000 51000 43000 21000 19000 17000 15,00 14,50 17500 0 0 3500 4000 2500 3100 1900 1615 450 330 280 850 2430 1165 255 729 350 595 1701 816 2021 2020 2019 000 000 000' S s S 14000 13000 11000 62000 52000 45000 17000 14000 13000 59000 51000 43000 17500 16000 14800 3500 3500 3600 21000 19500 18400 24000 22500 17000 6000 3500 7000 30000 26000 24000 6530 6424 4734 595 1701 816 7125 8125 5550 Revenue Cost of Sales (Note 1) Gross Profit Net Operating Expenses Operating Profit Finance Expenditure Finance Income Net Profit Before Tax (PBT) Taxation Net Profit for the Year NOTE 1 - Cost of Sales Opening Stock Purchases Less: Closing Stock Cost of Sales NOTE 2 - Trade and Other Receivables Trade Receivables Other Receivables Total NOTE 3 - Trade and Other Payables Trade Payables Other Payables Total NOTE 4 - Retained Profit Retained Profit b/f Net Profit for the year Retained Profit c/f Income Statement for the year ended 2021 2020 2019 000 000 000' S 80000 70000 60000 59000 51000 43000 21000 19000 17000 15,00 14,50 17500 0 0 3500 4000 2500 3100 1900 1615 450 330 280 850 2430 1165 255 729 350 595 1701 816 2021 2020 2019 000 000 000' S s S 14000 13000 11000 62000 52000 45000 17000 14000 13000 59000 51000 43000 17500 16000 14800 3500 3500 3600 21000 19500 18400 24000 22500 17000 6000 3500 7000 30000 26000 24000 6530 6424 4734 595 1701 816 7125 8125 5550 Revenue Cost of Sales (Note 1) Gross Profit Net Operating Expenses Operating Profit Finance Expenditure Finance Income Net Profit Before Tax (PBT) Taxation Net Profit for the Year NOTE 1 - Cost of Sales Opening Stock Purchases Less: Closing Stock Cost of Sales NOTE 2 - Trade and Other Receivables Trade Receivables Other Receivables Total NOTE 3 - Trade and Other Payables Trade Payables Other Payables Total NOTE 4 - Retained Profit Retained Profit b/f Net Profit for the year Retained Profit c/f You are required to: Write a report that, calculates, compares and explains the changes in the following financial ratios for the years ended 2021 and 2020: (20 marks) A. Profitability ratios a. Net Profit Margin b. Return on Equity (ROE) (3 marks) (4 marks) B. Liquidity Ratios a. Acid Test Ratio (3 marks) C. Efficiency ratios a. Accounts Payables Collection Period (4 marks) D. Capital Structure Ratios a. Gearing Ratio (3 marks) b. Interest Cover (3 marks) You should use average figures where required (using also, where and if needed, figures from the year ended 2019). The marks for each ratio will be split in to three parts (approximately 1/3 for each year's ratio and 1/3 for the comparison, analysis, and explanation). Task 2 (25 marks) The purpose of this task is to compare the profitability, liquidity, efficiency and capital structure of Sizzling Plc for financial years ending 2021 and 2020 using the financial statements provided below. Sizzling Plc Statement of Financial Statement as at Note S 2021 2020 2019 000' 000* 000' S S S Non-Current Assets Intangible Assets 975 525 Property, Plant and equipment 12500 11000 9500 Fixtures and fittings 2500 2000 1500 Total NCA 15975 13525 11000 Current Assets Inventories 17000 14000 13000 Trade and other receivables 2 21000 19500 18400 Prepayments 3250 2375 925 2500 5325 4325 Cash and cash equivalents/other Total CA 43750 41200 36650 TOTAL ASSETS 59725 54725 47650 Non-Current Liabilities Current Liabilities 10500 8500 6000 30000 26000 24000 40500 34500 30000 Total Liabilities NET ASSETS 19225 20225 17650 FINANCED BY Ordinary Share Capital 3200 3200 3200 5400 5400 5400 3500 3500 3500 Share Premium Revaluation Reserve Retained Earnings Total Capital 7125 8125 5550 19225 20225 17650 3 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts