Question: please help! i need to make a chart for my answers with this to indicate the numbers and which project should be taken. Robinson Corporation

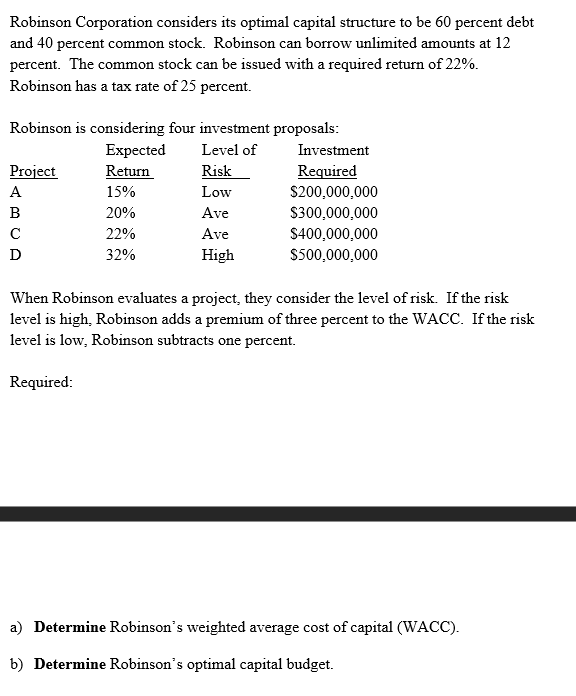

please help! i need to make a chart for my answers with this to indicate the numbers and which project should be taken. Robinson Corporation considers its optimal capital structure to be percent debt

and percent common stock. Robinson can borrow unlimited amounts at

percent. The common stock can be issued with a required return of

Robinson has a tax rate of percent.

Robinson is considering four investment proposals:

When Robinson evaluates a project, they consider the level of risk. If the risk

level is high, Robinson adds a premium of three percent to the WACC. If the risk

level is low, Robinson subtracts one percent.

Required:

a Determine Robinson's weighted average cost of capital WACC

b Determine Robinson's optimal capital budget.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock