Question: please help , I only have 10 minutes I need the final answer only very fast without explain C Manama Manufacturing has $170,000 to invest

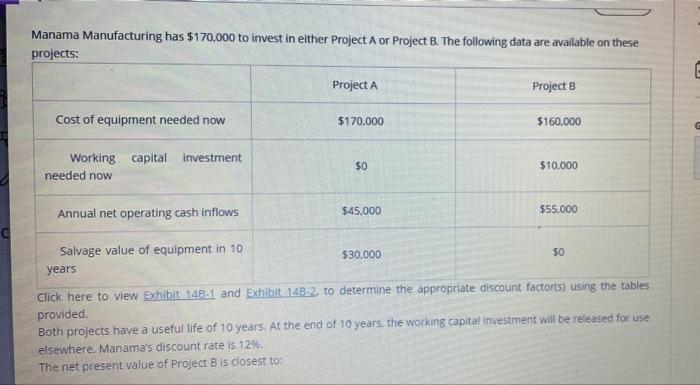

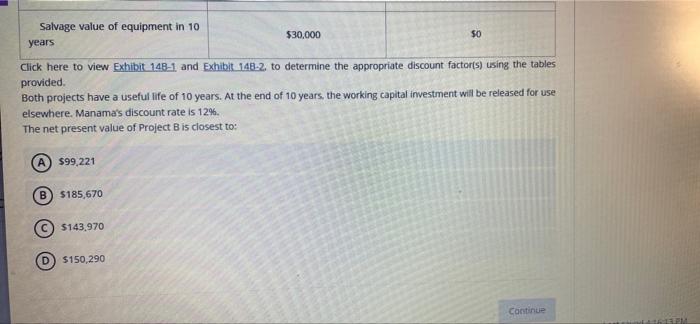

C Manama Manufacturing has $170,000 to invest in either Project A or Project B. The following data are available on these projects: Project A Project B Cost of equipment needed now $170,000 $160.000 Working capital investment $0 $10,000 needed now Annual net operating cash inflows $45,000 $55.000 Salvage value of equipment in 10 $30,000 $0 years Click here to view Exhibit 148-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using the tables provided. Both projects have a useful life of 10 years. At the end of 10 years, the working capital investment will be released for use elsewhere. Manama's discount rate is 12%. The net present value of Project B is closest to: Salvage value of equipment in 10 $30,000 years $0 Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using the tables provided. Both projects have a useful life of 10 years. At the end of 10 years, the working capital investment will be released for use elsewhere. Manama's discount rate is 12%. The net present value of Project B is closest to: A $99,221 B) $185,670 $143,970 $150,290 Continue LA 16:13PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts