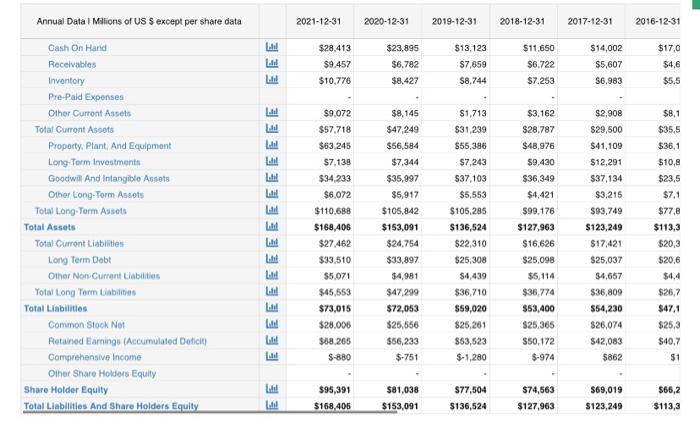

Question: Please help! I only need the reformulation from year 2017 to 2021 please! Annual Data Millions of US $ except per share data 2021-12-31 2020-12-31

Annual Data Millions of US $ except per share data 2021-12-31 2020-12-31 2019-12-31 2018-12-31 2017-12-31 2016-12-31 EEE $28,413 $9.457 $10,776 $23,895 $6,782 $8,427 $13.123 $7,659 $8,744 $11.650 $6.722 $7.253 $14,002 $5,607 56.983 $17,0 $4,6 $5,5 Cash On Hand Receivables Inventory Pre-Paid Expenses Other Curront Assets Total Current Assots Property. Plant And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Long Term Debt Other Non-Current Liabilities Total Long Term Liabilities Total Liabilities Common Stock Not Retained Earning (Accumulated Dedict Comprehensive Income Other Share Holders Equity Share Holder Equity Total Liabilitlos And Share Holders Equity EEEEEEEEEE $9.072 $57.718 $63,245 $7,138 $34,233 $6,072 $110.688 $168.406 $27.462 $33,510 $5.071 $45,553 $73,015 $28.000 $08.265 $-880 $8,145 $47,249 $56,584 $7,344 $35,997 $5,917 $105,842 $153,091 $24.754 $33,897 $4,981 $47.299 $72,053 $25,556 $56,233 $-751 $1,713 $31,239 $55,386 $7,243 $37,103 $5,553 $105,285 $136,524 $22,310 $25,308 S4,439 $36.710 $59,020 $25.261 $53,523 $-1,280 $3,162 $28,787 $48,976 $9.430 $36,349 $4,421 $99,176 $127,963 $16.626 $25.098 $5,114 $36.774 $53,400 $25,365 $50,172 $-974 $2,908 $29,500 $41,109 $12,291 $37,134 $3,215 $93,749 $123,249 $17,421 $25,037 34,657 $36,809 $54,230 $26,074 $42,083 $862 $8,1 $35,5 $36,1 $10,8 $23,5 $7.1 $77,8 $113,3 $20,3 $20,6 $4,4 $26.7 $47,1 $25,3 $40,7 $1 LA EEEEE $95,391 $168.406 $81,038 $153,091 $77,504 $136,524 $74,563 $127,963 $69,019 $123,249 566,2 $113,3 Part (2): Accounting and Financial Analysis Reformulate Financial Statements Apply financial ratios and relationships with commentaries. Make a recommendation regrading which company has a better financial profile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts