Question: please help i posted it 2 times o question Problem 7-19 Credit policy decision with changing variables (L07-4) Fast Turnstiles Co, is evaluating the extension

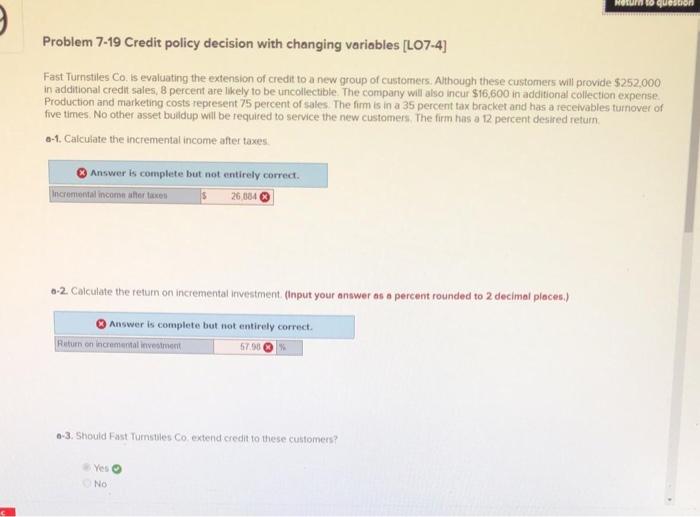

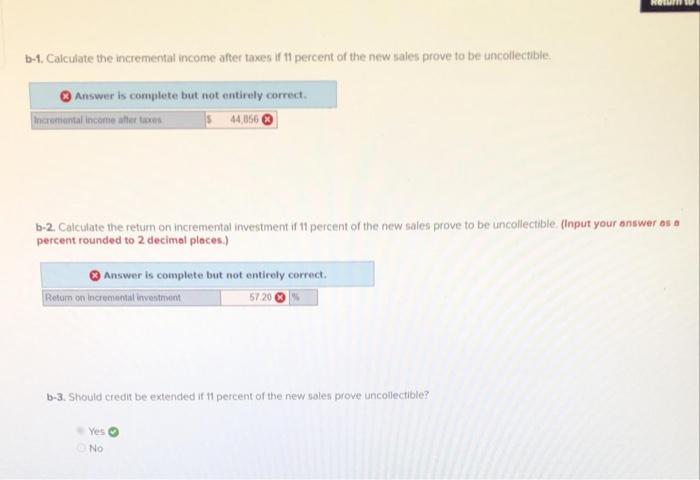

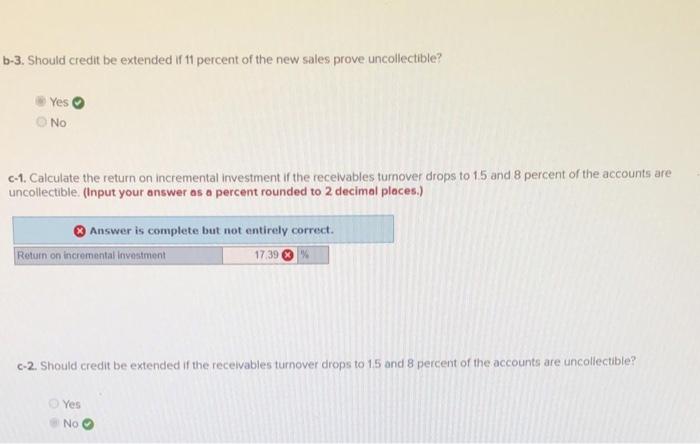

o question Problem 7-19 Credit policy decision with changing variables (L07-4) Fast Turnstiles Co, is evaluating the extension of credit to a new group of customers. Although these customers will provide $252.000 in additional credit sales, 8 percent are likely to be uncollectible. The company will also incur $16,600 in additional collection expense Production and marketing costs represent 75 percent of sales. The firm is in a 35 percent tax bracket and has a receivables turnover of five times. No other asset buldup will be required to service the new customers. The firm has a 12 percent desired return 6-1. Calculate the incremental income after taxes Answer is complete but not entirely correct. incremental income after taxes 26.0043 1-2. Calculate the return on incremental investment. (Input your answer as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. Return on incremental investment 57.00 0-3. Should Fast Turnstiles Co. extend credit to these customers? Yes NO b-1. Calculate the incremental income after taxes i 11 percent of the new sales prove to be uncollectible Answer is complete but not entirely correct Incremental income the times s 44,056 b-2. Calculate the return on incremental investment if 11 percent of the new sales prove to be uncollectible (Input your answer os percent rounded to 2 decimal places.) Answer is complete but not entirely correct Return on incrementat inventment 5720 b-3. Should credit be extended if 11 percent of the new sales prove uncollectible? Yes No b-3. Should credit be extended if 11 percent of the new sales prove uncollectible? Yes No C-1. Calculate the return on incremental investment if the receivables turnover drops to 15 and 8 percent of the accounts are uncollectible. (Input your answer as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. Return on incremental investment 1739 c-2. Should credit be extended if the receivables turnover drops to 15 and 8 percent of the accounts are uncollectible? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts