Question: please help i rate fast. please follow instruction on rounding . thank you What was the change in Global's book value of equity from 2015

please help i rate fast. please follow instruction on rounding . thank you

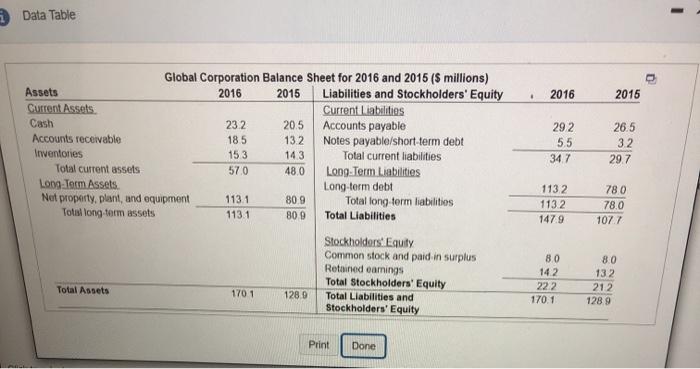

please help i rate fast. please follow instruction on rounding . thank you What was the change in Global's book value of equity from 2015 to 2016 according to Table 21 ? Does this imply that the market price of Global's shares increased in 20167 Explain What was the change in Global's book value of equity from 2015 to 2018? Global's book wahus, of equity changed by $milion from 2015 to 2016 (Round to one decimal place) Does this triply that the market price of Global's shares increased in 2010? Explain (Select all the choices that apply) DA An increase in book value does not necessary ndicate an increase in Global's share price B. There are many events that may affect Globus tuturo protability, and hence is share piloo that do not show up on the balance sheet C. The market value of a stock does not depend on the historical cost of the firm's assets, but on ovestors' expectation of the firm's future performance D. An increase in book value necessarily indicates an increase in Global's Share pace. The book value of the equity does not go up unless the share price goes up Data Table 2016 2016 2015 Global Corporation Balance Sheet for 2016 and 2015 (5 millions) Assets 2015 Liabilities and Stockholders' Equity Current Assets Current Liabilities Cash 232 20.5 Accounts payable Accounts receivable 185 132 Notes payable/short term debt Inventories 153 143 Total current liabilities Total current assets 570 480 Long Term Liabilities Long Term Assets Long-term debt Net property, plant, and equipment 113.1 80 9 Total long term habilities Total long term assets 1131 80 9 Total Liabilities 292 5.5 347 26.5 32 29.7 113 2 1132 1479 780 78.0 1077 80 Stockholders' Equity Common stock and paid in surplus Retained earings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 80 132 212 1289 142 222 170.1 Total Assets 1701 1289 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts