Question: Please help. I really need help. I always give thumb up (b) John has just taken a $1 million housing loan at 3% nominal annual

Please help. I really need help.  I always give thumb up

I always give thumb up

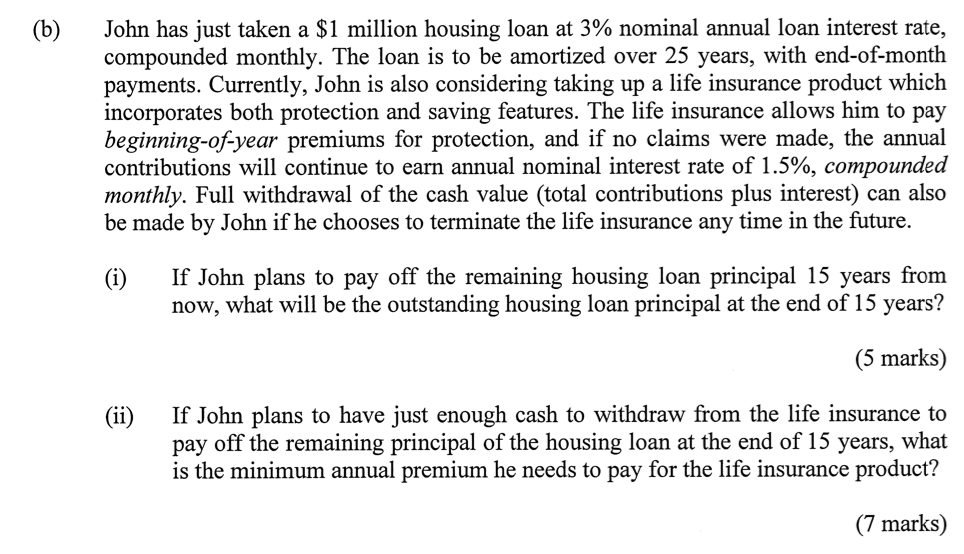

(b) John has just taken a $1 million housing loan at 3% nominal annual loan interest rate, compounded monthly. The loan is to be amortized over 25 years, with end-of-month payments. Currently, John is also considering taking up a life insurance product which incorporates both protection and saving features. The life insurance allows him to pay beginning-of-year premiums for protection, and if no claims were made, the annual contributions will continue to earn annual nominal interest rate of 1.5%, compounded monthly. Full withdrawal of the cash value (total contributions plus interest) can also be made by John if he chooses to terminate the life insurance any time in the future. (i) If John plans to pay off the remaining housing loan principal 15 years from now, what will be the outstanding housing loan principal at the end of 15 years? (5 marks) (ii) If John plans to have just enough cash to withdraw from the life insurance to pay off the remaining principal of the housing loan at the end of 15 years, what is the minimum annual premium he needs to pay for the life insurance product? (7 marks) (b) John has just taken a $1 million housing loan at 3% nominal annual loan interest rate, compounded monthly. The loan is to be amortized over 25 years, with end-of-month payments. Currently, John is also considering taking up a life insurance product which incorporates both protection and saving features. The life insurance allows him to pay beginning-of-year premiums for protection, and if no claims were made, the annual contributions will continue to earn annual nominal interest rate of 1.5%, compounded monthly. Full withdrawal of the cash value (total contributions plus interest) can also be made by John if he chooses to terminate the life insurance any time in the future. (i) If John plans to pay off the remaining housing loan principal 15 years from now, what will be the outstanding housing loan principal at the end of 15 years? (5 marks) (ii) If John plans to have just enough cash to withdraw from the life insurance to pay off the remaining principal of the housing loan at the end of 15 years, what is the minimum annual premium he needs to pay for the life insurance product? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts